Yen Falls to Levels Not Seen in Decades – Speculation of BoJ Intervention

The yen fell to 160.86 against the US dollar overnight as dollar strengths continue to punish the currency.

The yen fell to 160.86 against the US dollar overnight as dollar strengths continue to punish the currency.

The last time these levels were reached was April 1990, when the USD/JPY peaked at 160.40. Since the wave of monetary tightening started in 2022 the yen has been suffering against G7 currencies.

The BoJ has seen inflation rise at a much slower rate than the US, and only raised rates from -0.1% to 0.1% in March this year. A move that did very little to stop the decline in the yen. The interest rate differential heavily favors the US dollar carry trade.

The economic activity in Japan and the interest rate spread has pushed the yen lower by 23% in 2024 alone. The spread may be at a pivot point, the Fed is set to decrease rates by Q4 while the BoJ is getting closer to rising rates.

A tightening interest rate gap should bring the yen higher, in the meantime, speculation is rising that the BoJ will intervene in the forex market to prop up their currency. Intervention may also come from the JGB purchasing program, where the central bank can reduce its balance sheet and push up yields.

Later today we are expecting GDP Growth and Durable Goods Orders from the US. Most analysts are expecting a decline in both. With a drop in GDP Growth Q1 to 1.4% from 3.4% YoY, and a sharp drop in Durable Goods MoM to -0.1% from 0.7%.

Technical View

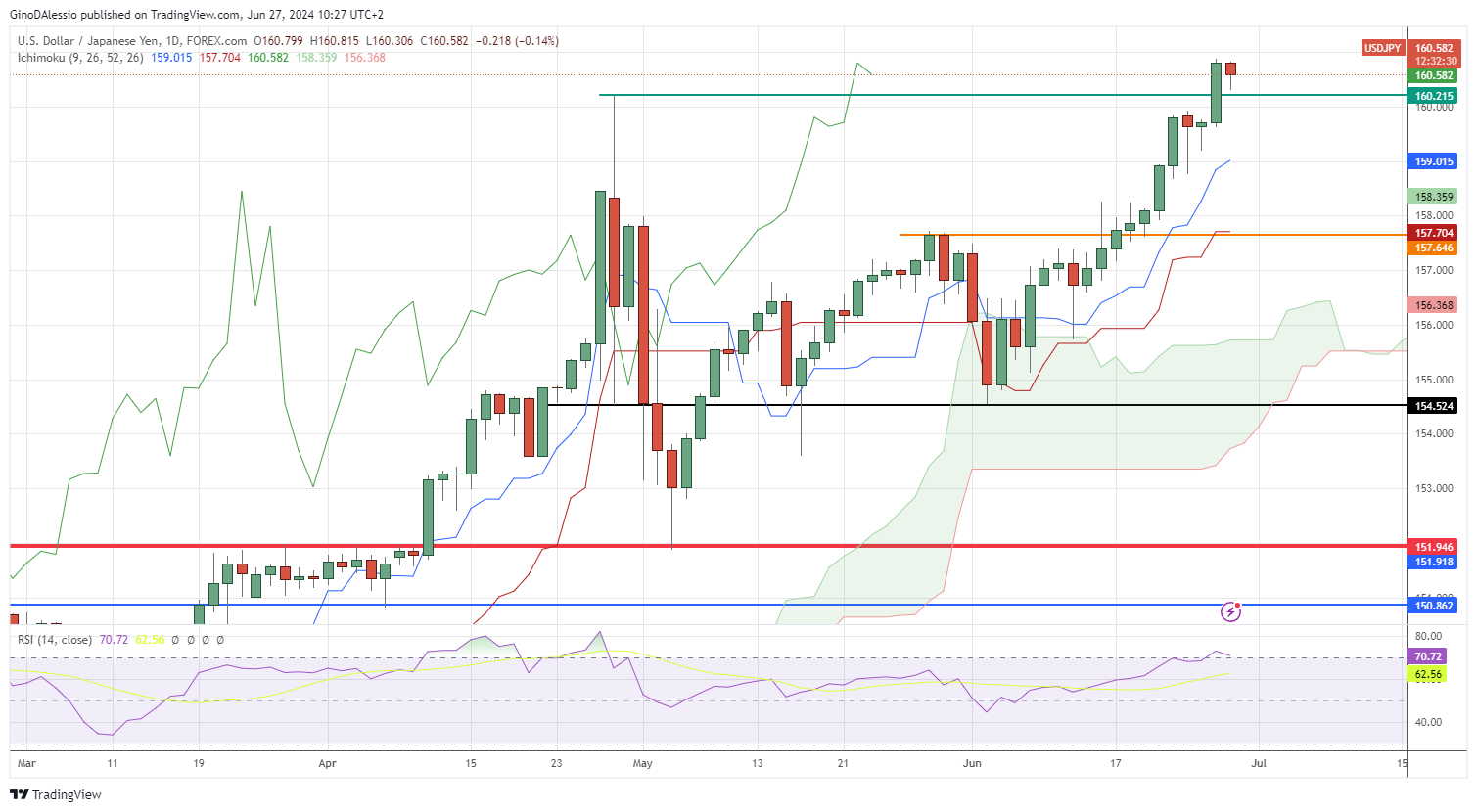

The chart below for the USD/JPY shows a market that is in a bullish trend and broken through its previous high from April 29. The RSI is over 70 indicating a strong bullish trend, however, a dip back below 70 would signal a probable retracement.

The closest support is the previous high at 160.21, should that break the following support is at 157.64 (orange line), which also coincides with the Kijun Sen (crimson line) from the Ichimoku system.

The current level is showing signs of overbought, and we must link this to statements from BoJ officials that levels of 160 could import inflation. So, it seems likely that intervention will come and, at least temporarily, give the yen some reprieve.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account