Nvidia Corp. Earnings Report: Will Nvidia Continue to Prove Itself as an Inflation Hedge Tool?

Nvidia Corp., the American multinational technology behemoth, is set to release its earnings report for the fiscal quarter ending April 2024 on May 22nd, after market close. As the third most valuable company in the world, with a market cap exceeding $2.2 trillion, Nvidia specializes in designing and manufacturing computer graphics processors, chipsets, and related multimedia software. Many regard Nvidia as “an inflation hedge tool comparable to gold.” This article explores whether Nvidia can live up to this expectation through its upcoming earnings results.

Nvidia’s Impressive Revenue Growth

In the latest reported quarter, Nvidia’s revenue reached $22.1 billion, marking a 22% increase from Q3 2024 and an impressive 265% year-over-year growth. For the fiscal year 2024, revenue surged by 126% year-over-year to $60.9 billion. Operating income also saw a significant rise, up 31% quarter-over-quarter and 983% year-over-year, reaching $13.62 billion. Nvidia’s gross margin improved by 2.0 points quarterly and 12.7 points from the previous year, standing at 76.0%.

Nvidia’s Data Center segment continues to be a major driver of growth. In the previous quarter, it recorded sales revenue of $18.4 billion, a 27% increase from the prior quarter and a staggering 409% year-over-year growth.

Other Segment Contributions

The Auto segment surpassed $1 billion in revenue last year, while software and services also achieved an annualized revenue run rate of $1 billion. The demand for Nvidia’s chips and related products remains robust, with expectations of supply constraints for next-generation products. AI technology adoption in sectors such as healthcare and financial services further boosts Nvidia’s growth prospects.

Nvidia’s Gaming segment reported $2.9 billion in sales revenue, flat from the previous quarter but up 56% year-over-year. The company has shipped over 100 million AI-ready RTX PCs and workstations. The Professional Visualization segment saw an 11% quarter-over-quarter and 105% year-over-year increase in revenue, reaching $463 million. The Automotive segment reported $281 million in revenue, an 8% quarterly increase but a 4% year-over-year decline. The Nvidia’s AI car computers are used by EV makers like Li Auto, Great Wall Motor, ZEEKR, and Xiaomi.

FY 2024 Segment Performance

Throughout FY 2024, all segments reported revenue gains compared to the previous year:

– Data Center: $47.5 billion (up 217%)

– Gaming: $10.4 billion (up 15%)

– Professional Visualization: $1.6 billion (up 1%)

– Automotive: $1.1 billion (up 21%)

Projections and Technical Analysis

According to S&P, Nvidia’s sales revenue is expected to reach $24.5 billion, up 10.7% from the previous quarter. This is over 240% year-over-year. Operating profit and net income have been projected to increase to $16.3 billion and $12.8 billion, respectively. The net margin is expected to decline to 52.45%, while the operating margin to decrease to 66.65%.

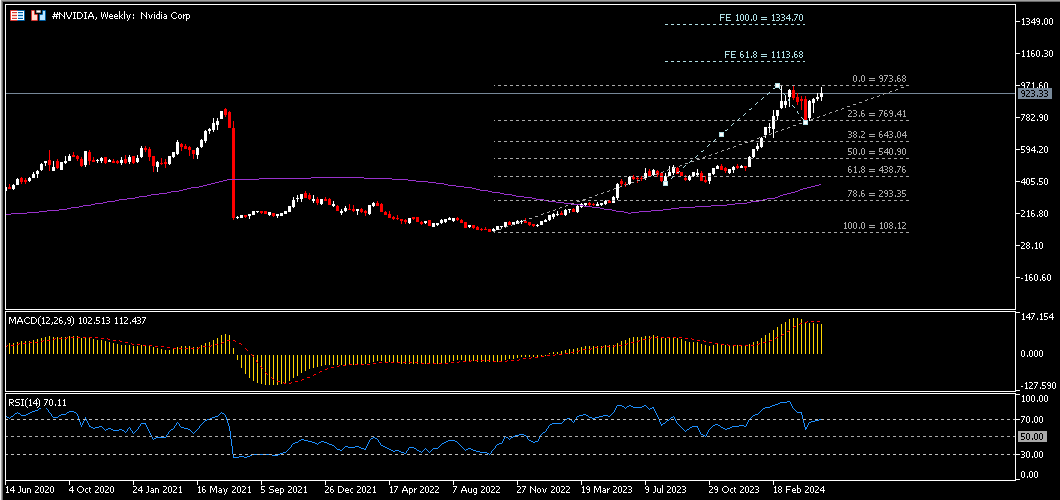

Nvidia’s EPS is estimated to hit $5.18, significantly higher than $0.82 in Q1 2024. The share price has resumed its upward trend, gaining support above $769.40. The MACD indicator remains positive. The RSI hovers around 70, indicating the potential for further gains. The all-time high at $973.68 serves as the nearest resistance level, with potential targets at $1113.70 and $1334.70 based on Fibonacci Expansion.

Conclusion

The company’s strong revenue growth, particularly in the Data Center segment, and its position as a leader in AI and graphics technology, make it a crucial player in the tech industry. Will Nvidia continue to prove itself as a reliable inflation hedge? Stay tuned for the earnings report to find out.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account