GBPUSD Analysis: Markets Speculate on BOE Dhingra’s Rate Cut Vote

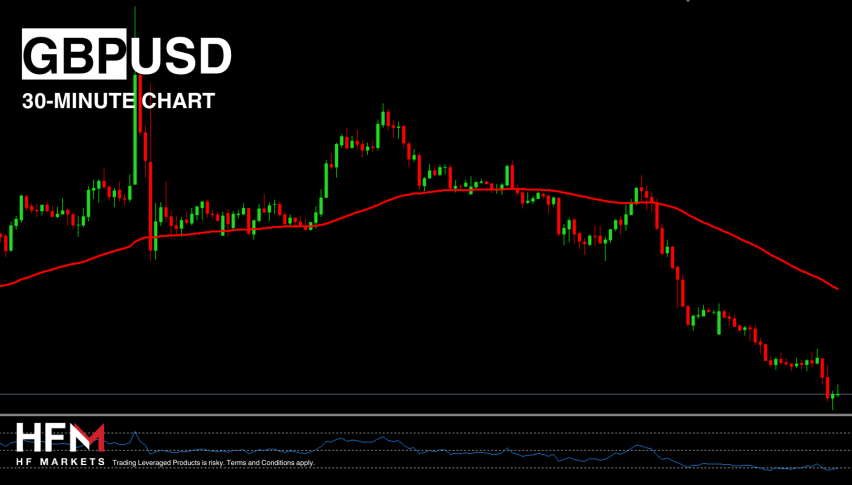

The GBPUSD has declined for the second consecutive day and maintains the sell signal initiated on Monday. It remains below the 75-Bar EMA and the 50.00 mark on the RSI, with lower highs and lower lows indicating a potential downward trend. This downward movement coincides with the Bank of England’s MPC voting on interest rates and hosting a press conference tomorrow at 11:00 GMT, followed by another at 11:30 GMT. Investors anticipate the Monetary Policy Committee to opt for a “hold,” given other central banks’ hawkish stances. However, if the MPC votes for a cut once again, it could further pressure the GBP.

The pound’s recent upward momentum was primarily driven by the S&P Global/CIPS Construction PMI, which surged from 50.2 points to 53.0 points in April, surpassing the forecast of 50.4 points. Additionally, the Halifax House Price Index rebounded by 0.1% following a 0.9% decrease in the previous month, slightly below analysts’ expectations of 0.2%. With house prices nearing stabilization, investors are anticipating interest rate cuts, which are expected to bolster the construction sector significantly. However, April data from the British Retail Consortium (BRC) revealed a 4.4% decline in retail sales, contrasting with preliminary estimates of 1.6%.

Dollar traders are focusing more on interviews and speeches by Federal Reserve representatives. The head of the Richmond Federal Reserve, Mr Barkin, said that to bring inflation lower, a serious reduction in demand is necessary, however, the current interest rate level of 5.50% is enough to bring inflation to the target of 2%. However, comments from Neel Kashkari were less promising. Mr Kashkari did accept inflation in 2023 came down faster than previous expectations, however, that inflation has stalled. Mr Kashkari advises the FOMC does not yet know if the inflation rate will decline or continue to hold at its current level. In addition to this, the lower level of inflation is due to better supply chains and not due to lower demand.

However, economists advise that even though Mr Kashkari is hawkish, a hike is a low possibility. The main question for investors is if the Fed will cut in 2024. If the Federal Reserve does not cut, institutions may price the US Dollar Index above 107.00. For the GBPUSD, the price will need to break below 1.24830 for sell signals to remain intact.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account