USDJPY Analysis – The PCE Price Index and Bank of Japan!

- The US PCE Core Price Index reads as per previous expectations, 0.4%, the highest since May 2023.

- The US Dollar Index declined after the release of the PCE Core Price Index and now trades below the day’s open price.

- Bond Yields drop from 4.3170 to 4.272 (10-Year Bond Yield) and the US Stock market returns to gains.

- The bank of Japan gives its first clear signal that the Board of Representatives are discussing ways of moving away from negative interest rates.

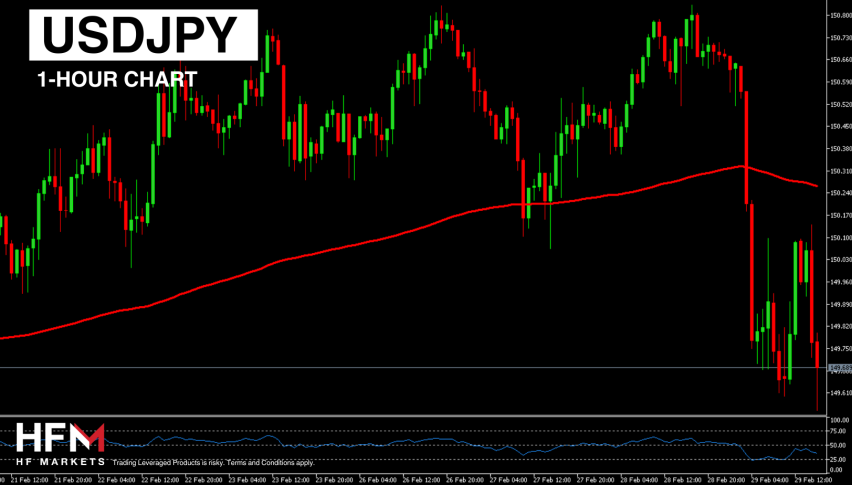

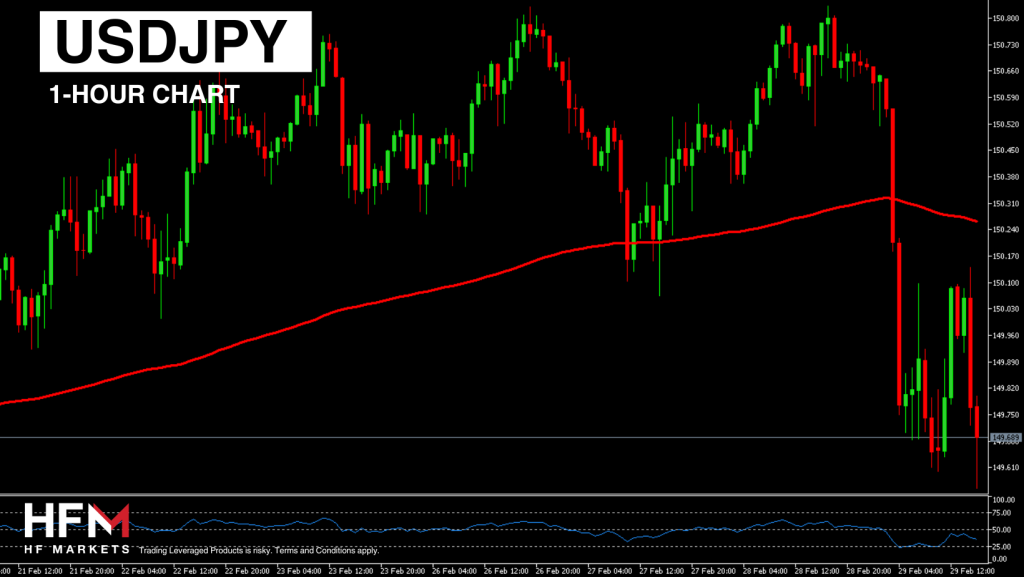

USDJPY

The USDJPY is currently witnessing the clearest price movement amongst the major currency pair category. This is due to conflicting signals from Europe and investors taking advantage of the current Dollar weakness and a hawkish Bank of Japan. The Euro is currently declining against most currencies as the German Consumer Price Inflation fell short. Simultaneously, the US Dollar is declining due to failing to beat the PCE Price Index expectations. As a result, the EURUSD is more difficult to grasp. The USDJPY on the other hand includes a declining currency and a bullish currency.

The Yen’s strengths lie in its status as a safe haven and its ability to mitigate risks away from the Dollar. Investors also observe that its current valuation is relatively low compared to other alternatives. As a result, economists are assessing whether investors will consider purchasing the Yen for the long term, especially as the Bank of Japan may soon move away from negative interest rates. Investors should also take into consideration the fact that a weaker Dollar tends to support the Yen across the Board.

Mr. Takata, a key member of the Bank of Japan’s Board, emphasized the need for a flexible response, including considering how to transition away from the current highly accommodative monetary policy. While this suggests that the Bank of Japan is not likely to abruptly raise interest rates, Mr. Takata’s comments provide the first clear indication that the regulator intends to initiate rate hikes in 2024, aiming to move away from negative rates.

Consequently, the Japanese Yen strengthened against all currencies this morning, and Japan’s 2-Year Bond Yield reached its highest level since 2011, now trading at 0.185%. Higher bond yields can also bolster the currency and attract global interest in Japan’s Financial Service Market. Furthermore, the Yen received additional support from this morning’s economic data, with Japan’s Retail Sales figure surpassing expectations at 2.3% and the Core CPI remaining at 2.6%, both higher than anticipated.

Lastly, the US Dollar has since come under pressure from the Release of the PCE Price Index. However, investors still should take into consideration that the index read relatively high, even if not higher than expected. According to economists, a reading of 0.4% is not likely to persuade the Fed to cut interest rates any time soon, unless the economy starts to contract or lose momentum.

Technical analysis currently continues to indicate the USDJPY to move in favor of the Yen as it did this morning. The price trades below trend lines, the 75-bar EMA, regression channels and in the “sell” zone of most oscillators such as the RSI.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account