WTI Crude Oil Dips Below $77 Amidst China’s Real Estate Crisis and Global Central Bank Policies

West Texas Intermediate (WTI) crude oil witnessed a significant decline of over 1.50% on Monday. This downtrend was primarily influenced by

West Texas Intermediate (WTI) crude oil witnessed a significant decline of over 1.50% on Monday. This downtrend was primarily influenced by the inability to overcome a crucial technical resistance level.

Additionally, the oil market is currently contending with demand concerns, largely attributed to the ongoing real estate crisis in China.

Despite escalating tensions in the Middle East, the anticipation of the US Federal Reserve’s decision is playing a pivotal role in strengthening the US Dollar, further impacting oil prices.

The oil market’s struggle to breach a key resistance level is further exacerbated by worsening conditions in China’s real estate sector.

A notable development in this context is the liquidation of China Evergrande Group, ordered by a Hong Kong court. This situation, as reported by Reuters, poses a significant challenge to market stability, overshadowing the geopolitical risk premiums related to the Middle East.

In another noteworthy development, oil prices remained unresponsive to an attack on a Russian oil facility on Monday, specifically targeting the Slavneft-YANOS refinery in Yaroslavl. This non-reaction underscores the market’s focus on broader economic factors over isolated geopolitical events.

Furthermore, the global financial landscape, marked by the restrictiveness of central banks, continues to exert pressure on oil prices. This week, significant attention is on the Federal Reserve (Fed) and the Bank of England (BoE), with expectations leaning towards maintaining the current interest rates.

US Dollar Index on a Rise; Weakens WTI Demand

The Fed’s policy, in particular, is instrumental in supporting the US Dollar (USD), as evidenced by the 0.15% rise in the US Dollar Index (DXY) to 103.61, impacting US Dollar-denominated assets like crude oil.

Market participants are now shifting their focus to the upcoming American Petroleum Institute (API) stockpiles report in the US, followed by the US Energy Information Administration (EIA) data.

According to a Reuters poll, there is an anticipation of a reduction in US crude oil and distillates stockpiles, while gasoline inventories are projected to rise.

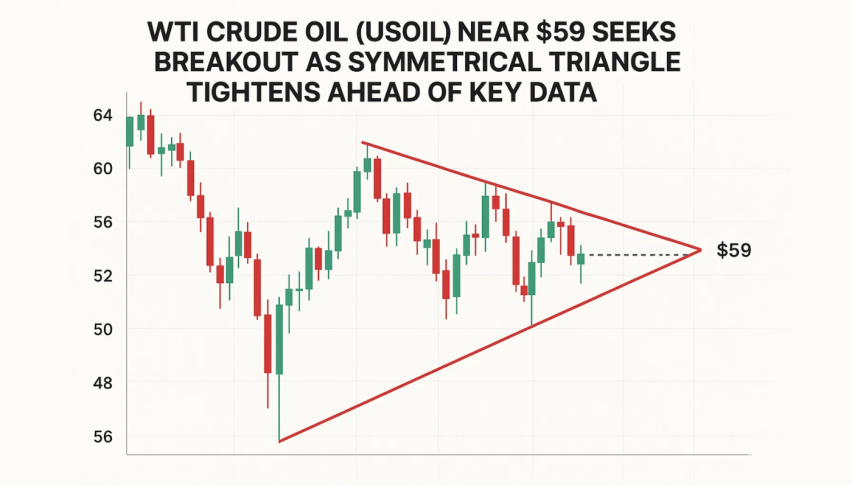

WTI Crude Oil Technical Outlook

The technical outlook for WTI Crude Oil on January 29 presents a nuanced picture. Technical analysis highlights key levels on the 4-hour chart, with a pivot point at $76.35 and immediate resistance at $79.21.

The Relative Strength Index (RSI) reads at 69, suggesting market sentiment, while the 50-Day Exponential Moving Average (EMA) at $74.71 offers additional insight.

Chart patterns indicate significant resistance near the $79.20 level, highlighted by a double top pattern. This pattern suggests potential bearish momentum, with a likelihood of the price moving towards the next support area around $76.35.

In summary, the short-term trend for WTI Crude Oil appears bearish, particularly below the $79.20 resistance level. A trend reversal would necessitate breaking through this resistance. The presence of the double top pattern warrants caution for a potential downward movement towards the $76.35 support.

Traders and investors are advised to closely monitor these critical levels for informed decision-making in the forthcoming period.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account