- Home /

- Live Rates /

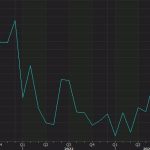

- GBP/AUD

<% signal.analyst %>

<% signal.analyst %>

<% signal.analyst %>

<% signal.analyst %>

Last Updated: Jan 08, 2026 09:25:47 AM (GMT)

GBP/AUD: The current market price is 2.01194, reflecting a 0.01% increase from the previous close.

Support and Resistance Levels Support levels are 2.00886, 2.00903, and 2.00919, with resistance levels at 2.01547, 2.01547, and 2.01707. The pivot point is 2.01194.

Indicators RSI is at 60.58, suggesting a neutral position. The ATR is 0.00222, indicating volatility. The Parabolic SAR shows a rising trend, supporting bullish sentiment.

Market Sentiment The market is bullish as the price is above the pivot point of 2.01194, supported by a strong RSI and ATR. ---

GBP/AUD Signals & Technical Analysis

Market Sentiment

Trend Indicators

Oscillators

Moving Averages

Pivot

About the GBP/AUD (British pound sterling and Australian dollar)

Breaking Down ‘GBP/AUD’

The pound sterling (symbol: £; ISO code: GBP), commonly known as the pound and less commonly referred to as sterling is the official currency of the United Kingdom At different times, the pound sterling was commodity money or bank notes backed by silver or gold,but it is currently Fiat money, backed only by the use of as little as possible in the areas where it is taken. The pound sterling is the world's most old money used in a country still in use and which has been in unbroken stretch use since its start. The Australian dollar is known as a commodity currency due to the role of Australia in global gold production and export. Aussie exhibits a long-term positive correlation with the value of gold. The British Pound vs. the Australian Dollar. Due to its relatively larger interest rates and its relationship to global ownership markets, the Australian Dollar is often referred to as a risk currency. Mining, which is Australia’s largest economic sector, has been negatively affected by a slowdown in the global commodity supercycle and a decline in China’s growth.Currency Correlations

Correlation is merely a mutual relationship or connection between two or more things. Positive correlation – The positive relationship merely is when pairs move in tandem with each other. In the forex world, the GBP/CAD, GBP/SGD, and GBP/NOK currency pairs are positively correlated Negative correlation – In contrast, a negative relationship is when forex pairs move in the opposite direction, For example, EUR/GBP, AUD/NZD, and AUD/SGD The euro is one of the most important alternatives to the U.S. dollar among fiat currencies (the EUR/USD currency exchange rate is one if the most often traded pairs in the world). This is why there is often a positive link between the euro and gold: both assets are negatively correlated with the greenback. However, the relationship is far from being a perfect correlation, as one can see in the chart below. This is because gold is not merely an alternative against the U.S. dollar, but also against the current monetary system based on fiat currencies. Therefore, in some cases the euro and the dollar both lose (or gain) ground against gold. Economic Events: The movement in the Great British Pound and Australian dollar economic events determine the exchange rates. Top of the line economic events includes GDP, Employment Change, Industrial Production, and Consumer Price Index. Better than forecast data increases the demand for related currency and impacts the value of either the Great British Pound or the Australian dollar, causing fluctuations in the GBP/AUD exchange rate.Major Economic Events

Gross Domestic Product – the gross domestic product is the central measure of economic growth in the region. Employment Change – The Sterling is also sensitive to changes in employment, as slacks in the labor market causes a drop in Inflation rates. Consumer Price Index – Since one of the goals of the BOP is to maintain price stability, they keep an eye on inflation indicators such as the CPI. If the annual CPI deviates from the central Industrial Production – This measures a change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities. Political Events - Another critical factor is the political aspect. Instability, as seen in the Brexit referendum, can entirely change the direction of the currencies. So, stay up-to-date on the latest political and economic news.What Determines the GBP/AUD Exchange Rate?

Several factors can impact the GBP/AUD rate valuation, including: BOE & RBA Monetary Policies: The Bank of England and Reserve Bank of Australia control the supply of money in the market, to keep the economy on track. A dovish policy, which is also known as expansionary policy, from either of the central banks, weakens the related currency. In contrast, a hawkish monetary policy (contractionary policy) strengthens the currencyGBP/AUD Specifications

The GBP/AUD is traded in amounts denominated in the US Dollar. Standard lot Size: 100,000 Mini lot size: 10,000 One pip in decimals 0.0001 Pip Value: $7.02The GBP/AUD trading pair can be a good option for traders who are looking to move capital between the British Pound and the Australian Dollar. Both currencies are majorly traded, which means they have sufficient liquidity in the market and tight spreads so you can enter and exit trades quickly. Additionally, since both currencies tend to move independently of each other, they offer great opportunities for arbitrage trading strategies. However, given their relatively high volatility, it’s important to ensure that your stop losses and take profits are wide enough to handle sudden spikes or falls in price.

The pair of GBP/AUD is currently experiencing an overall bullish trend. This means that the British Pound is appreciating against the Australian Dollar, and a trader may therefore expect to purchase more Australian Dollars in exchange for each Pound. Long-term trends are typically determined by macroeconomic factors such as economic growth, interest rate differences, and geopolitical developments. Consequently, it may be wise to monitor recent news related to these matters in order to forecast any potential changes in the price of GBP/AUD.

The exchange rate between the British Pound (GBP) and the Australian Dollar (AUD) can vary quite widely. In general, however, one GBP is currently worth more than one AUD, indicating that the Pound is stronger than the Aussie Dollar. As of this writing, one GBP equals 1.86 AUD. Depending on market conditions and other factors, this exchange rate can change at any time.

The GBP/AUD exchange rate is affected by a variety of factors. These include supply and demand for the two currencies, economic health, political stability in both countries, central bank monetary policy decisions, and interest rates. Geopolitical events can also affect the rate fluctuations between these two currencies. In addition, changes in commodity prices (such as oil) as well as news concerning Brexit can also have an impact on the GBP/AUD exchange rate. Generally speaking, when the British economy is doing well then this usually has a positive effect on the GBP value against other currencies such as AUD.

Indicator Alert

Warning: Several indicator values are missing for this timeframe. Please choose another timeframe to continue.

Sidebar rates

- <% signal.pair %>