The EUR is the official currency for 19 of the 28 member countries of the European Union (EU), including Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, Cyprus, Estonia, Latvia, Lithuania, Malta, Slovakia, and Slovenia. The EUR is also known as the euro currency, the second most traded currency globally, after the US dollar. The name “euro” was adopted in 1995, after heavy negotiations; the currency replaced the former European Currency Unit (ECU). However, the euro was initially introduced in virtual form on January 1, 1999, and it began circulating physically in 2002. It is also worth mentioning that the euro coins in general use are the 1, 2, 5, 10, 20, and 50 cent coins, as well as the 1 and 2 euro coins, and the most frequently used euro banknote denominations are the 5, 10, 20, 50 and 100 euro notes.

The CHF is the abbreviation for the Swiss Franc, which is Switzerland’s official currency. CHF stands for Confoederatio Helvetica Franc, whereby Confoederatio Helvetica is the Latin name for the Swiss Confederation. This is the only Franc still issued in European countries. The CHF is subdivided into 100 centimes. The Swiss Franc is also known as Swisse by currency market traders, and it is the seventh most traded currency in the world.

What is the EUR/CHF (Euro/Swiss Franc)?

The EUR/CHF stands for the Euro versus the Swiss Franc (EUR/CHF) currency pair, which shows how much the EUR (base currency) is worth measured against the CHF (counter currency). For example, EUR/CHF = 1.07 indicates that one Euro can buy 1.07 Swiss Franc.

The correlation between the EUR and the Swiss Franc currency pairs cannot be ignored. Thus, the correlation between the two currency pairs, EUR/USD (Euro/US Dollar) and USD/CHF (US Dollar/Swiss Franc), is defined as upwards of negative 95%. This represents an opposite relationship, which means that when the EUR/USD rallies, the USD/CHF usually sells off and vice versa.

Major Factors that Influence the EUR/CHF Currency Pair

The value of the EUR/CHF currency pair is mainly affected by geopolitical and global sentiment, like many emerging market currencies. Apart from this, one factor that affects the value of the Swiss Franc could also be the Economic data releases, such as GDP data; across the pond, the worldwide demand for Switzerland’s banking services as a secure and confidential place to hold offshore funds could also be considered as one of the key factors that affect the value of the Swiss Franc.

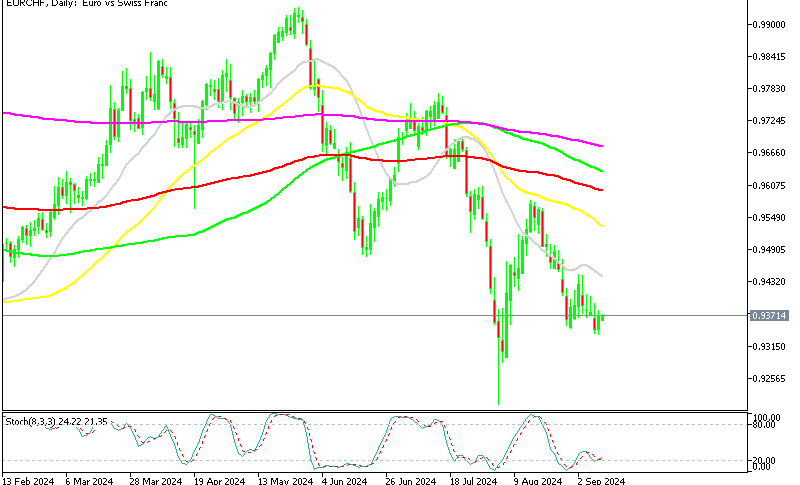

Current EUR/CHF Price: $

Historical Data Tables:

EUR/CHF Historical Price Data

| Date | Price | Open | High | Low | Change % |

|---|

Monthly Change

| Date | Price | Open | High | Low | Change % |

|---|

Factors impacting EUR/CHF Prices:

As mentioned above, the value of the EUR/CHF currency pair is primarily affected by geopolitical and global sentiment, like many emerging market currencies. Apart from this, one factor that affects the value of the Swiss Franc could also be the Economic data releases such as GDP data; across the pond, the worldwide demand for Switzerland’s banking services as a secure and confidential place to hold offshore funds could also be considered as one of the key factors that affect the value of the Swiss Franc.

Economic data releases: These include GDP data, information about industrial production and retail sales, inflation rates and trade balances. Other important details deserving of attention include employment figures, scheduled SNB meetings, and any daily reports regarding natural disasters, the political climate or any new government policy. All of these factors tend to affect the exchange rate of the Swiss Franc.

Interest Rates:

Higher interest rates in an economy tend to draw foreign investment, increasing the demand and value of the home currency. Likewise, lower interest rates tend to undermine exchange rates. By raising interest rates, the central bank can lower the demand for goods, leading to pressure on prices.

Safe-Haven Demand:

The Swiss Franc’s demand as a safe-haven considerably improves its value in the global foreign exchange markets. The demand for the currency as a safe-haven rose in the years after the 2008 financial crisis. The Swiss National Bank (SNB) had amassed approximately a half-trillion dollars in foreign currencies by 2011, which is equal to around 70% of Switzerland’s GDP.

Swiss banking services:

One factor that affects the value of the Swiss Franc could also be the worldwide demand for Switzerland’s banking services as a secure and confidential place to hold offshore funds. It is worth mentioning that the Swiss Franc could also be considered a firm alternative to the US Dollar or the Pound Sterling in times of turbulence and uncertainty, as whenever other economies show signs of deterioration, the Swiss Franc grows in popularity with speculators and traders.