The Australian dollar is Australia’s national currency. It is also known as the Aussie dollar or the Aussie in the international currency market. It is worth mentioning that the Australian dollar replaced the Australian pound in 1966. In 2016, the currency had been in circulation for 50 years. The Australian dollar (Aussie) is the official currency in Australia and several independent countries and regions in the South Pacific, such as Papua New Guinea, Christmas Island, the Cocos Islands and Nauru, Tuvalu, and Norfolk Island.

Another interesting fact is that the Australian dollar became a free-floating currency in 1983. However, the reason for its popularity among traders could be associated with multiple factors related to geology, geography and government policy. Specifically, Australia is one of the world’s richest countries in terms of natural resources, including metals, coal, diamonds, meat and wool.

What is the AUD/USD (Australian Dollar/US Dollar)?

The AUD/USD stands for the Australian dollar versus the US dollar as a currency pair, which shows the investors how much of one currency is needed to buy one unit of another currency. Hence the Australian (Aussie) is considered the base currency, and the US Dollar (greenback) is regarded as the quote currency or the denomination in which the price quote is given. Moreover, Trading the AUD/USD currency pair is also known as trading the “Aussie.” However, the value of the AUD/USD currency pair is quoted as 1 Australian dollar per quoted number of US dollars. For example, if the pair is trading at 0.75, it means that it takes 0.75 US dollars to purchase 1 Australian dollar.

Major Factors that Influence the AUD/USD Currency Pair

The AUD/USD currency pair is usually affected by factors that affect the value of the Australian dollar and the US dollar, in relation to each other and other currencies. For example, geographical factors include the production of commodities (coal, iron ore, copper) in Australia. Apart from this, political factors such as China’s business environment (a major customer for Australian commodities) and interest rate also impact the Australian dollar exchange rate.

However, the AUD moves versus other currencies, depending on economic data releases, the country’s gross domestic product (GDP), retail sales, industrial production, inflation and trade balances. Besides the above-mentioned factors, natural disasters, elections, and government policy also play a role in moving AUD prices.

Current AUD/USD Price: $

Historical Data Tables:

AUD/USD Historical Price Data

| Date | Price | Open | High | Low | Change % |

|---|

Monthly Change

| Date | Price | Open | High | Low | Change % |

|---|

Factors that Impact the AUD/USD Prices:

As we have already mentioned, the AUD/USD currency pair is affected by factors that determine the value of the Australian dollar and the US dollar in relation to one another and other currencies. Therefore, the Reserve Bank of Australia (RBA) and the Federal Reserve (Fed) will affect the value of these currencies compared to each other.

Interest Rate Differentials:

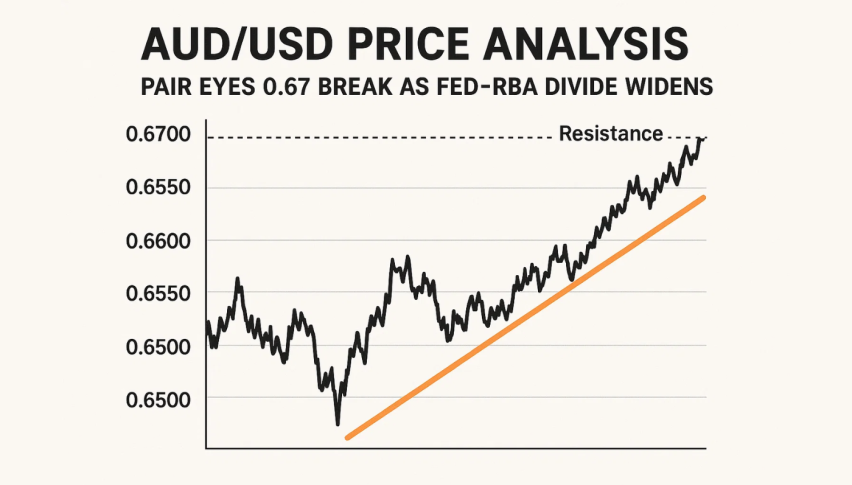

The major driver behind the movement of the currency pair could be the interest rate differential. Like other currencies, the interest rate differential between the Reserve Bank of Australia (RBA) and the Federal Reserve (Fed) will affect the value of these currencies compared to one another. However, the interest rate differential is the corresponding benefit an investor gains, from investing in one country’s assets over the other. For example, if interest rates in Australia are 1.50%, but they are higher in the US, at 2.40%, then an investor can get a great return by buying US assets. This tends to undermine the AUD’s value if investors sell AUDs and purchase US dollars, in order to invest in US assets.

Apart from this, the AUD currency also benefits from Australia’s typically conservative monetary policy. For example, the Reserve Bank of Australia did not introduce economic stimulus to the same level that the US, the European Central Bank and the Bank of Japan delivered during the Great Recession. This, in turn, raised interest rates in Australia relative to other countries, which tends to underpin the AUD currency.

Commodity Prices:

Since the Australian economy is the biggest exporter of iron ore and coal, the movement of the currency is largely reliant on commodity prices. During the commodity slowdown of 2015, oil prices hit the lowest prices in the decade, and both iron ore and coal prices collapsed. As a result, the Australian dollar weakened sharply. It dropped by more than 15 percent against the US dollar and nearly hit parity against the New Zealand dollar – a level not seen since the 1970s. The oil prices affect iron ore prices, because the latter usually include shipping costs, so there is also a link between the Australian dollar and the oil price.

Apart from this, the Australian dollar is influenced by oil and commodity prices and affected by conditions in the Japanese economy. The reason could be associated with the “carry trade”. While the Australian dollar was firm, due to the demand for the country’s commodity exports, the Japanese yen tended to be softer because of poor economic performance. Furthermore, the Interest rates in Japan were very low, while interest rates in Australia were higher. So, traders tend to sell Japanese yen, preferring to invest in higher-yielding Australian dollars. This demand for Australian dollars drove the currency even higher.

Sentiment and speculation

The sentiment and speculation can strongly impact the AUD currency, as the Aussie is arguably the most popular growth and risk proxy in global financial markets. However, the Aussie currency is usually used as a barometer and trading device, to benefit from short-term changes in sentiment towards global economic growth and market risk tone. Some of this is tied to the fundamental fact that being a ‘commodity currency’, the Australian economy is highly exposed to changes in global economic activity. Therefore, when there is an upbeat sentiment in the market, the AUD currency quite often tends to climb, while if pessimism prevails, the AUD tends to be undermined.

Economic Data:

The economic data, such as US average earnings, US ADP, US CPI, US Payrolls and Chinese Industrial Production, greatly influence the AUD/USD currency pair. This data is important for understanding the stock market, especially the direction of the AUD/USD pair. Across the pond, the sentiment surrounding the AUD currency is also affected by the country’s gross domestic product (GDP), retail sales, industrial production, inflation and trade balances. Natural disasters, elections and government policy also have a major influence on the Aussie.

Government credit ratings:

The Australian government’s credit rating also influences the sentiment surrounding the AUD currency. This is because Australia’s credit rating affects the risk profile of its debt, which tends to influence what it will cost the government to pay off on its debts. However, a bad credit rating makes buying a country’s debt riskier and less attractive, which reduces the overall demand for its currency.