Top 100 Forex Brokers

The Top 100 Forex Brokers revealed. We have explored and tested the top 100 Forex brokers to identify the 10 best.

In this in-depth guide you’ll learn:

✅What constitutes a top Forex broker

✅Who the best Forex brokers are

✅The top 10 Forex brokers in the industry

and much, MUCH more!

Top 100 Forex Brokers – a Comparison

| 🔍Broker | 🚀Open an Account | ⌛Regulation | 💵Minimum Deposit | 🔢Trust Score |

| 🥇AvaTrade | 👉 Click Here | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA, KNF, IIROC | USD100 | 93% |

| 🥈Exness | 👉 Click Here | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA, CMA | Depends on regional deposit conditions | 97% |

| 🥉JustMarkets | 👉 Click Here | FSA, CySEC, FSCA, FSC | USD10 | 90% |

| 🏆XM | 👉 Click Here | FSCA, IFSC, ASIC, CySEC, DFSA, FCA | USD5 | 90% |

| 🥇HFM | 👉 Click Here | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA | USD0 | 85% |

| 🥈BDSwiss | 👉 Click Here | CySEC, FSCA, FSC | USD10 | 90% |

| 🥉Pepperstone | 👉 Click Here | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB | AUS200 | 95% |

| 🏆FBS | 👉 Click Here | IFSC, CySEC, ASIC, FSCA | USD90 | 80% |

| 🥇Octa | 👉 Click Here | CySEC, SVG FSA, FSCA | USD25 | 79% |

| 🥈FP Markets | 👉 Click Here | ASIC, CySEC, FSCA, FSA, FSC | AUS100 | 87% |

| 🥉Ally Invest | 👉 Click Here | SEC, FINRA | USD0 | 90% |

| 🏆Admirals | 👉 Click Here | FCA, ASIC, CySEC, JSC, FSCA, FSA, CMA | USD1 | 88% |

| 🥇ATC Brokers | 👉 Click Here | FCA | USD2000 | 80% |

| 🥈Axi | 👉 Click Here | ASIC, DFSA, FCA | USD0 | 85% |

| 🥉Accent Forex | 👉 Click Here | VFSC | USD50 | 60% |

| 🏆Axiory | 👉 Click Here | MFSC, IFSC, FCA | USD10 | 65% |

| 🥇Activ Trades | 👉 Click Here | SCB, FCA, CSSF | USD0 | 70% |

| 🥈AMarkets | 👉 Click Here | IFC | USD100 | 55% |

| 🥉Alpari | 👉 Click Here | FSC | USD100 | 65% |

| 🏆Blackwell Global | 👉 Click Here | FCA | USD500 | 75% |

| 🥇BlackBull Markets | 👉 Click Here | FMA, FSA | USD50 | 60% |

| 🥈City Index | 👉 Click Here | MAS | USD150 | 60% |

| 🥉CM Trading | 👉 Click Here | FSA, FSCA | USD100 | 70% |

| 🏆CMC Markets | 👉 Click Here | FCA, ASIC | USD10 | 80% |

| 🥇Colmex Pro | 👉 Click Here | CySEC | USD500 | 80% |

| 🥈Dukascopy | 👉 Click Here | FINMA | USD100 | 80% |

| 🥉Deriv | 👉 Click Here | FSA, MFSA, VFSC | USD5 | 65% |

| 🏆Exclusive Markets | 👉 Click Here | FSA | USD0 | 55% |

| 🥇eToro | 👉 Click Here | CySEC, FCA | USD50 | 85% |

| 🥈EasyMarkets | 👉 Click Here | CySEC, ASIC, FSA | USD100 | 90% |

| 🥉Equiti | 👉 Click Here | FCA, CMA, JSC | USD500 | 70% |

| 🏆EightCap | 👉 Click Here | ASIC, FCA | USD100 | 85% |

| 🥇FinecoBank | 👉 Click Here | CRR | USD0 | 60% |

| 🥈FxPro | 👉 Click Here | FCA, CySEC, SCB | USD100 | 85% |

| 🥉Finq.com | 👉 Click Here | FINRA | USD100 | 85% |

| 🏆FirstTrade Securities | 👉 Click Here | SEC, FINRA | USD0 | 90% |

| 🥇FXCM | 👉 Click Here | FCA, FSCA | USD50 | 90% |

| 🥈FXTM | 👉 Click Here | CySEC, FSCA | USD10 | 85% |

| 🥉FXPrimus | 👉 Click Here | CySEC, FSCA | USD100 | 90% |

| 🏆FXOpen | 👉 Click Here | ASIC | USD10 | 80% |

| 🥇FXGT | 👉 Click Here | SFSA, FSCA | USD5 | 70% |

| 🥈Forex4You | 👉 Click Here | FSC | USD0 | 60% |

| 🥉FXGrow | 👉 Click Here | CySEC | USD100 | 70% |

| 🏆Forex.ee | 👉 Click Here | MEAE | USD50 | 55% |

| 🥇FreshForex | 👉 Click Here | CRFIN | USD10 | 75% |

| 🥈FreeTrade | 👉 Click Here | FCA | USD0 | 80% |

| 🥉FXDD | 👉 Click Here | NFA, CFTC | USD10 | 85% |

| 🏆FXChoice | 👉 Click Here | FSC | USD10 | 70% |

| 🥇FXGlory | 👉 Click Here | N/A | USD1 | 50% |

| 🥈GO Markets | 👉 Click Here | ASIC, CySEC | USD200 | 80% |

| 🥉GoldFX | 👉 Click Here | LFSA | USD10 | 55% |

| 🏆HYCM | 👉 Click Here | FCA | USD100 | 80% |

| 🥇Hirose Financial | 👉 Click Here | FCA | USD50 | 80% |

| 🥈IC Markets | 👉 Click Here | ASIC, CYSEC | USD200 | 90% |

| 🥉ICM Capital | 👉 Click Here | FCA | USD200 | 80% |

| 🏆IG Group | 👉 Click Here | FCA, CFTC, ASIC | USD0 | 95% |

| 🥇Interactive Brokers | 👉 Click Here | FCA, ASIC | USD0 | 95% |

| 🥈InstaForex | 👉 Click Here | CySEC, FSC | USD1 | 75% |

| 🥉IQ Option | 👉 Click Here | N/A | USD10 | 55% |

| 🏆IFX | 👉 Click Here | FSCA | USD100 | 65% |

| 🥇IForex | 👉 Click Here | FSCA | USD100 | 65% |

| 🥈IFC Markets | 👉 Click Here | CySEC, BVI FSC | USD1 | 75% |

| 🥉JP Markets | 👉 Click Here | FSCA | USD30 | 70% |

| 🏆JustForex | 👉 Click Here | FSA, CySEC | USD1 | 75% |

| 🥇Khwezi Trade | 👉 Click Here | FSCA | USD50 | 75% |

| 🥈Key to Markets | 👉 Click Here | FCA | USD100 | 80% |

| 🥉KVB Prime | 👉 Click Here | FCA | USD10 | 80% |

| 🏆LiteForex | 👉 Click Here | CIF | USD50 | 60% |

| 🥇Libertex | 👉 Click Here | N/A | USD10 | 55% |

| 🥈LQDFX | 👉 Click Here | N/A | USD20 | 55% |

| 🥉LCG Trader | 👉 Click Here | SCB | USD0 | 60% |

| 🏆Markets.com | 👉 Click Here | CySEC, ASIC, FCA | USD100 | 85% |

| 🥇Moneta Markets | 👉 Click Here | CIMA | USD200 | 60% |

| 🥈MultiBank Exchange | 👉 Click Here | ASIC, VFSC | USD50 | 80% |

| 🥉NordFX | 👉 Click Here | VFSC | USD10 | 60% |

| 🏆Naga | 👉 Click Here | CySEC, FCA | USD50 | 85% |

| 🥇Oanda | 👉 Click Here | FCA, CFTC, ASIC | USD0 | 90% |

| 🥈Pocket Option | 👉 Click Here | N/A | USD0 | 60% |

| 🥉Plus500 | 👉 Click Here | CySEC, FCA, FSA | USD100 | 95% |

| 🏆Prime XTB | 👉 Click Here | N/A | USD0 | 55% |

| 🥇PhillipCapital | 👉 Click Here | FINRA | USD5000 | 80% |

| 🥈RoboForex | 👉 Click Here | IFSC | USD10 | 75% |

| 🥉ROInvesting | 👉 Click Here | CySEC | USD100 | 85% |

| 🏆Saxo Bank | 👉 Click Here | MiFID | USD10 000 | 95% |

| 🥇SamTrade | 👉 Click Here | FCA, FINTRAC | USD10 | 75% |

| 🥈Skilling | 👉 Click Here | N/A | USD100 | 60% |

| 🥉TradeNation | 👉 Click Here | FSCA, SCB | USD0 | 75% |

| 🏆TD Ameritrade | 👉 Click Here | SEC, NFA | USD2000 | 95% |

| 🥇Tickmill | 👉 Click Here | CySEC, FCA, FSA | USD100 | 80% |

| 🥈TMGM | 👉 Click Here | ASIC, VFSC, FMA | USD100 | 65% |

| 🥉TioMarkets | 👉 Click Here | FCA, CySEC | USD500 | 80% |

| 🏆TradeStation | 👉 Click Here | FINRA | USD0 | 80% |

| 🥇Trade360 | 👉 Click Here | CySEC | USD250 | 75% |

| 🥈Trade.com | 👉 Click Here | N/A | USD100 | 55% |

| 🥉TeraFX | 👉 Click Here | FCA | USD100 | 70% |

| 🏆TFI Markets | 👉 Click Here | CySEC | USD1 | 75% |

| 🥇TradersWay | 👉 Click Here | N/A | USD10 | 55% |

| 🥈Vantage Markets | 👉 Click Here | VFSC | USD200 | 55% |

| 🥉XTB | 👉 Click Here | FCA, CySEC | USD0 | 95% |

| 🏆Windsor Brokers | 👉 Click Here | CySEC | USD100 | 80% |

10 Best Forex Brokers (2024)

- AvaTrade – Overall, The Best Forex Broker

- HFM – Best Commodities Broker

- Exness – specializing in CFD Trading

- JustMarkets – Excellent Safety and Security Measures

- XM – Best User-Friendly Trading Platforms

- BDSwiss – Excellent Educational Resources

- Pepperstone – Wide Range of Financial Instruments

- FBS – Flexible Leverage Options

- Octa – Excellent MT4 and MT5 platforms

- FP Markets – Exceptional Customer Support

What are the top 100 Forex brokers?

In the vast and dynamic world of Forex trading, selecting the right broker is paramount. A top-ranking Forex broker epitomizes reliability, transparency, competitive spreads, robust trading platforms, exemplary customer service, and regulatory compliance.

This article delves into the criteria defining the top 100 Forex brokers, guiding traders toward informed decisions.

AvaTrade

Overview

AvaTrade is a leading online brokerage platform offering a comprehensive range of financial instruments for trading, including Forex, commodities, cryptocurrencies, stocks, indices, and more.

Founded in 2006, AvaTrade has established itself as a trusted and innovative broker, providing traders with access to powerful trading platforms, advanced charting tools, educational resources, and dedicated customer support.

With multiple regulatory licenses across various jurisdictions, including the Central Bank of Ireland, the Financial Services Commission of the British Virgin Islands, and the Australian Securities and Investments Commission, AvaTrade prioritizes security and transparency for its clients.

Known for its user-friendly interface and competitive trading conditions, AvaTrade caters to both novice and experienced traders worldwide.

| 🔍Feature | ℹ️ Information |

| ⌛Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA |

| 📱Social Media Platforms | Instagram YouTube |

| 🗂️Trading Accounts | Retail Account, Professional Account |

| 📊Trading Platforms | AvaTradeGO AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 💵Minimum Deposit | $100 |

| 🛢️Trading Assets | Forex Stocks Commodities Cryptocurrencies Treasuries Bonds Indices Exchange-Traded Funds (ETFs) Options Contracts for Difference (CFDs) Precious Metals |

| ➡️USD-based Account? | ✅ Yes |

| 💵USD Deposits Allowed? | ✅ Yes |

| 🎁Bonuses for traders? | ✅ Yes |

| ⬇️Minimum spread | From 0.0 pips |

| 🗂️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons AvaTrade

| ✅ Pros | ❌ Cons |

| AvaTrade provides a diverse range of trading assets, such as FX pairings, equities, commodities, indices, and cryptocurrencies. | Some users have experienced greater spreads than other brokers, which may affect trading expenses, particularly for frequent traders. |

| AvaTrade offers social trading through its integration with ZuluTrade, allowing users to follow and copy the techniques of successful traders. | AvaTrade's research and analysis capabilities may be seen as inadequate in comparison to other platforms, preventing some traders from conducting in-depth market study. |

| The platform includes unique capabilities such as AvaProtect for advanced charting and technical analysis, AvaSocial for social trading activities, and AvaTradeGo for mobile trading convenience. | The platform's complex features and tools may be daunting for inexperienced traders, necessitating a learning curve to properly utilise. |

| AvaTrade is authorised by several respected institutions, including the Central Bank of Ireland and the Financial Services Commission of the British Virgin Islands, offering a secure and trustworthy trading environment for clients. | While AvaTrade provides customer support, the quality and responsiveness of their service can vary, potentially frustrating some clients. |

| AvaTrade provides a variety of educational services, including webinars, tutorials, and market analysis, to help traders enhance their skills and expertise. | There have been occasional reports of delays or issues in the withdrawal process with AvaTrade, which may be problematic for users who require immediate access to their assets. |

Trust Score

AvaTrade has a high trust score of 96%

HFM

Overview

HFM is a globally recognized online forex and commodities broker, renowned for its client-centric approach and cutting-edge trading technology.

Established in 2010, HFM offers a wide range of trading instruments, including forex pairs, commodities, indices, shares, and cryptocurrencies, catering to both retail and institutional clients.

With headquarters in Cyprus and regulated by multiple regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Authority (FSA) in Seychelles, HFM prioritizes client security and regulatory compliance.

The broker provides clients with access to a variety of trading platforms, including MetaTrader 4 and MetaTrader 5, along with educational resources, market analysis, and responsive customer support. HFM’s commitment to transparency, competitive pricing, and innovative trading solutions has made it a preferred choice for traders worldwide.

| 🔍Feature | ℹ️ Information |

| ⌛Regulation | FSCA, CySEC, DFSA, FSA, FCA, FSC, CMA |

| 📱Social Media Platforms | Facebook Telegram YouTube |

| 🗂️Trading Accounts | Micro Account, Premium Account, HFcopy Account, Zero Spread Account, Auto Account |

| 📊Trading Platform | MetaTrader 4 and MetaTrader 5 |

| 💵Minimum Deposit | No minimum deposit requirement |

| 🛢️Trading Assets | Forex, Precious Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, Bonds, Stocks DMA, ETFs |

| ➡️USD-based Account? | ✅ Yes |

| 💵USD Deposits Allowed? | ✅ Yes |

| 🎁Bonuses for traders? | ✅ Yes |

| ⬇️Minimum spread | From 0.0 pips |

| 🗂️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons HFM

| ✅ Pros | ❌ Cons |

| HFM advantages traders by protecting against negative balances and offering a maximum leverage of 1:2000. | The MT4 and MT5 platforms include a lot of functionality, so rookie traders may need to put in a lot of work during the setup process. |

| HFM traders benefit from minimal commissions and no pip spread. | HFM traders benefit from minimal commissions and no pip spread. |

Trust Score

HFM has a trust score of 85%

Exness

Overview

Exness is a prominent online brokerage firm specializing in forex and CFD trading. Founded in 2008, Exness has established itself as a global leader in the financial markets, serving clients in over 180 countries.

The company offers a wide range of trading instruments, including forex currency pairs, commodities, indices, cryptocurrencies, and more, through its user-friendly trading platforms, including MetaTrader 4 and MetaTrader 5.

Exness is known for its commitment to transparency, reliability, and client satisfaction, evidenced by its strict adherence to regulatory standards and its membership with reputable regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

With competitive trading conditions, fast execution speeds, and responsive customer support, Exness strives to provide traders with a seamless and rewarding trading experience.

| 🔍Feature | ℹ️ Information |

| ⌛Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 📱Social Media Platforms | Instagram YouTube |

| 🗂️Trading Accounts | Standard Account Standard Cent Account Raw Spread Account Zero Account Pro Account |

| 📊Trading Platforms | MetaTrader 4 MetaTrader 5 Exness Terminal Exness Trade app |

| 💵Minimum Deposit | Based on the chosen regional deposit method |

| 🛢️Trading Assets | Forex Metals Crypto Energies Indices Stocks |

| ➡️USD-based Account? | ✅ Yes |

| 💵USD Deposits Allowed? | ✅ Yes |

| 🎁Bonuses for traders? | None |

| ⬇️Minimum spread | From 0.0 pips |

| 🗂️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons Exness

| ✅ Pros | ❌ Cons |

| Any trader can adjust their leverage according to their risk tolerance and trading style. | Any trader can modify their leverage based on their risk tolerance and trading strategy. |

| Before participating in the real market, traders can set up a trial account to gain expertise with virtual funds. | Before entering the actual market, traders can open a account to get experience with virtual funds. |

| Exness has gained recognition for its effort to publishing all spreads, fees, and trading conditions. | Exness has received acclaim for its efforts to publish all spreads, fees, and trading conditions. |

| Exness has no fees for deposits or withdrawals | Exness has no fees for deposits or withdrawals. |

| Local deposit and withdrawal options are available. | Local deposit and withdrawal options are available. |

| Exness provides MetaTrader users with trading automation tools, including Expert Advisors (EAs) tailored exclusively for Taiwanese customers. | Exness provides MetaTrader users with trading automation tools, such as Expert Advisors (EAs) designed specifically for Taiwanese customers. |

| A number of platforms and account types enable traders to trade in a wide range of marketplaces. | Traders can trade on a variety of platforms and account kinds. |

| Exness provides its customers with a comprehensive range of assets, including commodities, indexes, cryptocurrencies, and FX pairs. | Exness offers its customers a wide selection of assets, including commodities, indexes, cryptocurrencies, and FX pairs. |

| The Exness mobile app gives consumers access to all of the company's trading tools. | The Exness mobile app allows customers access to all of the company's trading tools. Exness effectively serves a global audience with a bilingual website and prompt customer support. |

| Exness effectively serves a global audience through its bilingual website and rapid customer service. | The system's functionality and infrastructure are regularly updated. |

| The system's functionality and infrastructure are frequently updated. | The platform's capacity to limit financial losses and recuperate investments is one of its risk management features. |

Trust Score

Exness has a trust score of 97%

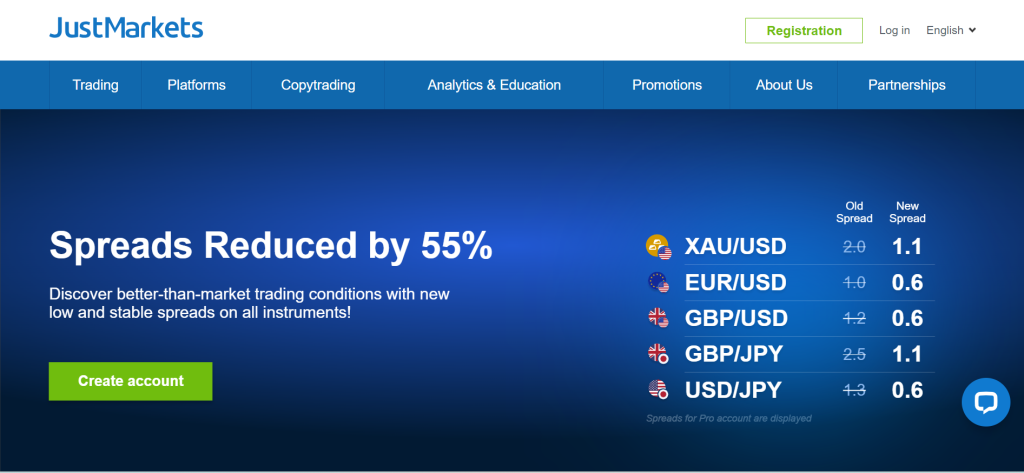

JustMarkets

Overview

JustMarkets is a respected Forex broker known for its attractive trading conditions and dedication to customer protection.This broker provides a high leverage ratio of up to 1:500, allowing traders to amplify their positions and potentially maximise earnings, but this also increases risk.

They prioritises security and has strict safeguards in place to protect client accounts and sensitive information.

These safeguards include advanced encryption technology, secure payment processing, and rigorous adherence to regulatory guidelines.

Furthermore, JustMarkets offers traders a variety of specialised trading features and tools to improve their trading experience.

These may include advanced charting tools, technical indicators, risk management features, and algorithmic trading capabilities to meet traders’ different demands and preferences.

Overall, JustMarkets provides a dependable and feature-rich brokerage platform with high leverage, strong security measures, and comprehensive trading tools, making it a popular choice among Forex traders.

| 🔍Feature | ℹ️ Information |

| ⌛Regulation | CySEC, FSCA, FSA, FSC |

| 📱Social Media Platforms | Facebook YouTube |

| 🗂️Trading Accounts | MT4 Standard Cent Account MT4 Standard Account MT4 Pro Account MT4 Raw Spread Account MT5 Standard Account MT5 Pro Account MT5 Raw Spread Account |

| 💵Minimum Deposit | USD10 |

| 🛢️Trading Assets | Indices Energies Forex Metals Cryptocurrencies Shares Futures |

| ⬇️Minimum spread | From 0.0 pips |

| 🗂️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| 🌟PAMM Accounts | ✅ Yes |

| 🎁Bonuses and Promotions for traders | ✅ Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons JustMarkets

| ✅ Pros | ❌ Cons |

| Because of its minimal minimum deposit, JustMarkets is an accessible platform for traders of all financial levels. | When compared to other brokerages, JustMarkets provides a more limited selection of tradable assets. |

| The platform's competitive spreads may enable customers to lower their trading costs. | The JustMarkets demo account is terminated after thirty days. |

Trust Score

JustMarkets has a trust score of 90%

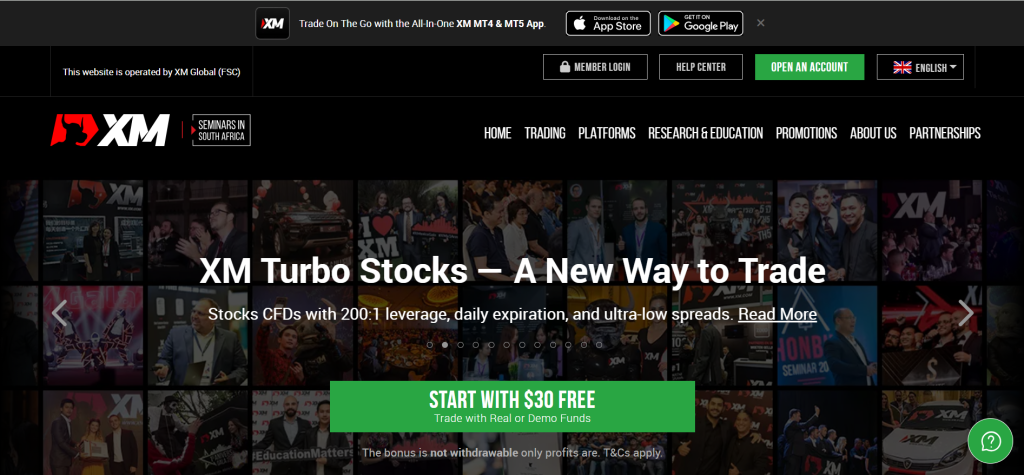

XM

Overview

XM is a well-established online brokerage firm that provides a wide range of trading services for forex, commodities, indices, stocks, metals, energies, and cryptocurrencies. Founded in 2009, XM has grown into a globally recognized brand, serving clients in over 196 countries.

The company offers clients access to competitive trading conditions, including tight spreads, flexible leverage, and fast execution, through its user-friendly trading platforms, such as MetaTrader 4 and MetaTrader 5.

Known for its commitment to integrity, reliability, and innovation, XM continues to enhance its services and expand its global presence, aiming to provide clients with a seamless and rewarding trading experience.

| 🔍Feature | ℹ️ Information |

| ⌛Regulation | FSCA, IFSC, ASIC, CySEC, DFSA |

| 📱Social Media Platforms | Facebook YouTube |

| 🗂️Trading Accounts | Micro Account, Standard Account, XM Ultra-Low Account, Shares Account |

| 📊Trading Platform | MetaTrader 4, MetaTrader 5, XM Mobile App |

| 💵Minimum Deposit | $5 |

| 🛢️Trading Assets | Forex, Cryptocurrencies, Stock CFDs, Commodities, Equity Indices, Precious Metals, Energies, Shares, |

| ➡️USD-based Account? | ✅ Yes |

| 💵USD Deposits Allowed? | ✅ Yes |

| 🎁Bonuses for traders? | ✅ Yes |

| ⬇️Minimum spread | From 0.0 pips |

| 🗂️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons XM

| ✅ Pros | ❌ Cons |

| XM offers its clients a wide range of trading opportunities and global markets. | In comparison to other brokerages, XM offers a rather small selection of cryptocurrencies. This restriction may limit traders' ability to acquire a variety of bitcoin assets. |

| XM provides a cent account, which enables traders, particularly those new to the market, to start trading with lesser assets while successfully lowering risk. | If traders leave their accounts idle for an extended period of time, they may face inactivity fees. |

| The competitive margins offered by XM's platform reduce transaction costs while potentially increasing trader profitability. | XM uses changeable spreads, which may appear higher to traders during periods of increased market volatility. |

| XM offers a variety of instructional options, including seminars and webinars, to help traders expand their knowledge. | In comparison to specific competitors in the market, XM does not always provide appealing fixed deposit alternatives. This may limit traders seeking further incentives. |

| XM's bilingual customer service encourages effective communication. | Many traders are perplexed by XM's pricing structure, which is account category specific and may mislead some customers. |

| XM allows its users to create extensive trading portfolios by offering a diverse range of financial assets such as Forex, commodities, indices, and cryptocurrencies. | The regulatory environment and XM's power to impose leverage restrictions may have an impact on traders who prioritise higher leverage ratios. |

Trust Score

XM has a high trust score of 90%

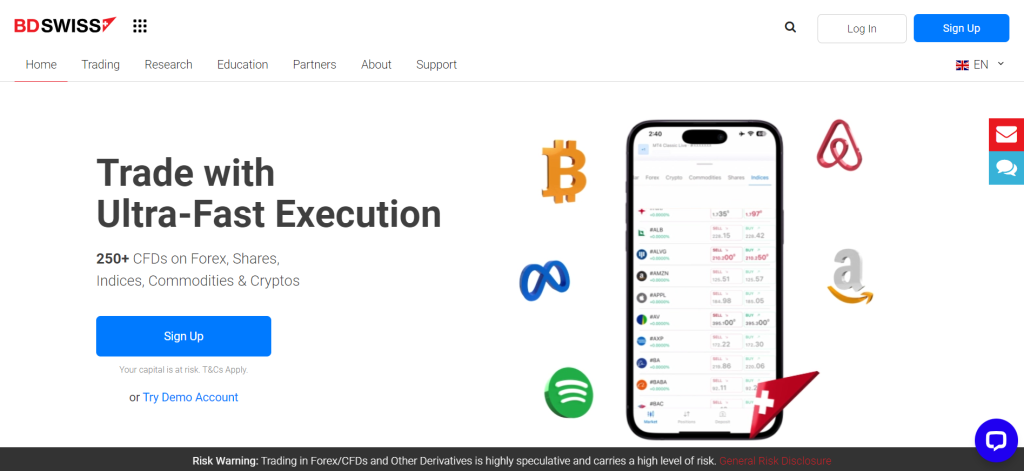

BDSwiss

Overview

BDSwiss is a prominent online brokerage firm offering trading services in forex, contracts for difference (CFDs), stocks, indices, commodities, and cryptocurrencies. Founded in 2012, BDSwiss has grown into a respected brand in the financial industry, serving clients globally.

The company provides traders with access to a range of trading instruments through its user-friendly platforms, including MetaTrader 4 and its proprietary platform, BDSwiss WebTrader. BDSwiss emphasizes transparency, competitive pricing, and robust security measures to ensure a safe trading environment for its clients.

BDSwiss offers various account types to cater to the diverse needs of traders, along with educational resources, market analysis, and dedicated customer support. With a focus on innovation and client satisfaction, BDSwiss continues to evolve, aiming to provide traders with a seamless and rewarding trading experience.

| 🔍Feature | ℹ️ Information |

| ⌛Regulation | FSCA, FSA, AMF, BAFIN, GFSC, CySEC, MAS, ASIC, FINMA, FSC |

| 📱Social Media Platforms | Facebook YouTube |

| 🗂️Trading Accounts | Cent, Classic, VIP, Zero Spread |

| 📊Trading Platform | MetaTrader 4 MetaTrader 5 MT4 Vs. MT5 BDSwiss Mobile app BDSwiss WebTrader |

| 💵Minimum Deposit | $10 |

| 🛢️Trading Assets | Forex Commodities Shares Indices Cryptocurrencies |

| ➡️USD-based Account? | ✅ Yes |

| 💵USD Deposits Allowed? | ✅ Yes |

| 🎁Bonuses for traders? | ✅ Yes |

| ⬇️Minimum spread | From 0.0 pips |

| 🗂️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons BDSwiss

| ✅ Pros | ❌ Cons |

| BDSwiss offers a variety of teaching products, like as webinars, tutorials, and market research, to help traders develop their skills and make more educated decisions. | While BDSwiss offers the popular MetaTrader 4 platform, some traders may prefer other solutions for trading. |

| BDSwiss provides competitive spreads and minimal trading expenses to clients, making trading more cost-effective. | BDSwiss may charge withdrawal fees for certain payment methods, reducing traders' overall profits. |

| BDSwiss offers access to a wide range of assets, such as FX pairs, stocks, indexes, commodities, and cryptocurrencies. | BDSwiss may restrict service availability in some regions, limiting access for particular traders. |

Trust Score

BDSwiss has a high trust score of 90%

Pepperstone

Overview

Pepperstone is a globally renowned online brokerage firm specializing in forex and CFD trading. Established in 2010, Pepperstone has earned a reputation for its transparency, reliability, and technological innovation.

The company offers traders access to a wide range of financial instruments. Including forex currency pairs, commodities, indices, cryptocurrencies, and shares.

Pepperstone provides clients with advanced trading platforms. Including MetaTrader 4, MetaTrader 5, and cTrader, known for their intuitive interfaces and powerful trading tools.

The broker offers competitive pricing, tight spreads, fast execution speeds, and flexible leverage options, catering to both retail and institutional clients.

| 🔍Feature | ℹ️ Information |

| ⌛Regulation | ASIC, BaFin, CMA, CySEC, DFSA, FCA and SCB |

| 📱Social Media Platforms | LinkedIn YouTube |

| 🗂️Trading Accounts | Standard Account Razor Account Professional Account Demo Account Islamic Account |

| 📊Trading Platforms | MetaTrader 4 MetaTrader 5 cTrader TradingView Myfxbook Duplitrade |

| 💵Minimum Deposit in OMR | OMR 50.33 or AU$200 |

| 🛢️Trading Assets | Forex Indices Shares Commodities Cryptocurrencies Futures Options |

| ➡️USD-based Account? | ✅ Yes |

| 💵USD Deposits Allowed? | ✅ Yes |

| 🎁Bonuses for traders? | None |

| ⬇️Minimum spread | From 0.0 pips |

| 🗂️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons Pepperstone

| ✅ Pros | ❌ Cons |

| Pepperstone has among of the lowest spreads. | While Pepperstone provides a wide selection of FX pairings and CFDs, other markets, such as equities and cryptocurrencies, may see less activity. |

| Pepperstone offers sophisticated trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader. | Customers have occasionally complained delays or issues reaching Pepperstone's customer support representatives, especially during peak trading hours. |

| By charging low transaction fees, the broker allows traders to dramatically lower their trading costs. | Certain traders in specific areas may be unable to utilise Pepperstone due to regulatory limits, limiting their ability to reach some potential customers. |

| Pepperstone's trading technology closes deals quickly, which reduces slippage and increases trade efficiency. | Pepperstone's spreads are competitive in general, but they may widen in volatile markets, increasing trading costs. |

| Pepperstone provides a number of educational offerings, including as webinars, market analysis, and tutorials, to help traders stay informed and improve their skills. | Traders may regard Pepperstone's research services to be less comprehensive than those of other brokers, despite the fact that Pepperstone offers some market analysis tools. |

Trust Score

Pepperstone has a high trust score of 92%

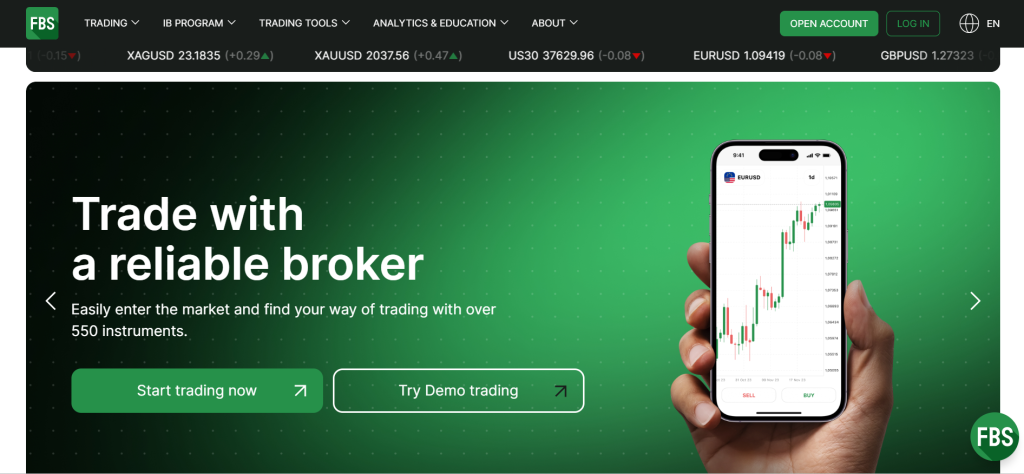

FBS

Overview

FBS is a well-established online brokerage firm offering forex and CFD trading services to clients worldwide. Founded in 2009, FBS has grown into a reputable brand known for its commitment to customer satisfaction, innovative trading solutions, and competitive trading conditions.

The company provides traders with access to a diverse range of financial instruments, including forex currency pairs, commodities, indices, stocks, and cryptocurrencies, through its user-friendly trading platforms such as MetaTrader 4 and MetaTrader 5.

FBS offers flexible leverage options, tight spreads, and fast execution speeds to accommodate the varying needs and preferences of traders.

| 🔍Feature | ℹ️ Information |

| ⌛Regulation | IFSC, CySEC, ASIC, FSCA |

| 📱Social Media Platforms | LinkedIn YouTube |

| 🗂️Trading Accounts | Single retail trading account |

| 📊Trading Platforms | MetaTrader 4 MetaTrader 5 FBS Trader App |

| 💵Minimum Deposit | $5 |

| 🛢️Trading Assets | Forex Precious Metals Indices Energies Stocks Cryptocurrencies |

| ➡️USD-based Account? | ✅ Yes |

| 💵USD Deposits Allowed? | ✅ Yes |

| 🎁Bonuses for traders? | ✅ Yes |

| ⬇️Minimum spread | From 0.0 pips |

| 🗂️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons FBS

| ✅ Pros | ❌ Cons |

| FBS provides a number of bonuses and special deals. | FBS presently has only one retail account, down from the prior amount of accounts. |

| FBS provides monthly market updates and analysis. | Withdrawal fees may apply depending on the payment method chosen. |

| Opening an account requires only a small deposit. | When closing transactions, a market maker may encounter a conflict of interest. |

| The trading platform allows automated trading strategies. | Not every country may offer all FBS services and incentives |

| Traders can use local payment methods to deposit and withdraw money. | FBS stopped offering CopyTrade in September. A high leverage ratio can be profitable, but it also raises the risk of large losses, particularly for rookie traders. |

| The demo account is available for 45 days. | Floating spreads can widen in reaction to considerable market volatility or economic shocks. |

| The MetaTrader platforms provide traders with tools and settings that allow them to customise their trading experience | For newcomers, the diversity of services and complicated platforms might be intimidating. Compared to its competitors, FBS provides fewer comprehensive research tools and insights. |

Trust Score

FBS has a trust score of 75%

Octa

Overview

Octa is a reputable online brokerage firm specializing in forex and CFD trading services. Established in 2011, Octa has gained recognition for its commitment to providing traders with competitive trading conditions, advanced technology, and exceptional customer support.

The company offers traders access to a wide range of financial instruments, including forex currency pairs, commodities, indices, and cryptocurrencies, through its user-friendly trading platforms such as MetaTrader 4 and MetaTrader 5.

Octa provides clients with tight spreads, fast execution speeds, and flexible leverage options to enhance their trading experience.

| 🔍Feature | ℹ️ Information |

| ⌛Regulation | Financial Services Authority in Saint Vincent and the Grenadines (SVG FSA), and Cyprus Securities and Exchange Commission (CySEC) |

| 📱Social Media Platforms | Facebook YouTube Telegram |

| 🗂️Trading Accounts | MetaTrader 4 Habitual Trader Account, MetaTrader 5 Smart Trader Account |

| 📊Trading Platform | MetaTrader 4, MetaTrader 5, cTrader |

| 💵Minimum Deposit | $5 |

| 🛢️Trading Assets | Forex Currency Pairs, Index ECNs, Commodities, Cryptocurrencies |

| ➡️USD-based Account? | ✅ Yes |

| 💵USD Deposits Allowed? | ✅ Yes |

| 🎁Bonuses for traders? | ✅ Yes |

| ⬇️Minimum spread | From 0.6 pips |

| 🗂️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons Octa

| ✅ Pros | ❌ Cons |

| Octa provides some of the best spreads in the FX trading market. | Octa has tier 2 regulation, which not considered the most secure licensing available |

Trust Score

Octa has a trust score of 79%

FP Markets

Overview

FP Markets is a distinguished online brokerage firm offering a wide range of trading services across various financial markets.

Established in 2005, FP Markets has garnered a strong reputation for its commitment to providing traders with competitive pricing, innovative trading platforms, and exceptional customer support.

The company offers access to a diverse array of financial instruments, including forex currency pairs, commodities, indices, stocks, and cryptocurrencies, catering to both retail and institutional clients.

Traders can execute trades through FP Markets’ advanced trading platforms, including MetaTrader 4, MetaTrader 5, and the IRESS platform, known for their reliability, speed, and comprehensive trading tools.

| 🔍Feature | ℹ️ Information |

| ⌛Regulation | ASIC, CySEC, FSCA, FSA, FSC |

| 📱Social Media Platforms | LinkedIn YouTube |

| 🗂️Trading Accounts | MT4/5 Standard Account, an MT4/5 Raw Account, an MT4/5 Islamic Standard Account, and an MT 4/5 Islamic Raw Account |

| 📊Trading Platforms | MetaTrader 4 MetaTrader 5 IRESS cTrader FP Markets App |

| 💵Minimum Deposit | $100 |

| 🛢️Trading Assets | Forex Shares Metals Commodities Indices Cryptocurrencies Bonds ETFs |

| ➡️USD-based Account? | ✅ Yes |

| 💵USD Deposits Allowed? | ✅ Yes |

| 🎁Bonuses for traders? | None |

| 💵Minimum spread | From 0.0 pips |

| 🗂️Demo Account | ✅ Yes |

| ☪️Islamic Account | ✅ Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons FP Markets

| ✅ Pros | ❌ Cons |

| FP Markets' cutting-edge technology infrastructure assists traders. | Because of FP Markets' global focus, there may be limited support for all local payment choices. |

| Traders can benefit from the extended customer care provided by a professional and devoted crew. | Even if FP Markets offers a wide range of products, some traders may be interested in niche or local markets that they do not cover. |

| Traders can trade with a broker who is regulated by a number of international agencies, including the FSA, FSC, ASIC, FSCA, and CySEC. | FP Markets imposes withdrawal fees for a wide range of payment options. |

Trust Score

FP Markets has a high trust score of 87%

In Conclusion

Overall, the selection of a Forex broker is a critical decision for traders. With factors such as reliability, regulatory compliance, trading conditions, and customer support playing pivotal roles. Exploring the top 100 Forex brokers provides invaluable insights, guiding traders towards reputable and trustworthy partners for their trading journey.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy. The forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all South African investors.

Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

Faq

Begin by assessing your trading preferences, such as preferred trading instruments, desired leverage, and trading platform preferences. Then, research and compare brokers based on factors like regulation, trading costs, available assets, and customer service.

Look for brokers regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Commodity Futures Trading Commission (CFTC) in the United States.

Trading fees and spreads vary among brokers. Generally, top Forex brokers offer competitive spreads and transparent fee structures. It’s essential to review each broker’s fee schedule to understand the costs involved in trading, including spreads, commissions, overnight financing fees, and withdrawal/deposit fees.

Yes, leading Forex brokers prioritize security and implement robust measures to protect client funds and personal data. These measures may include encryption protocols, segregated client accounts, and adherence to strict regulatory standards.

Top Forex brokers typically offer a choice of reliable trading platforms like MetaTrader 4, MetaTrader 5, or proprietary platforms tailored to their clients’ needs. They also provide responsive customer support through various channels and offer a range of educational resources, including tutorials, webinars, and market analysis, to assist traders in enhancing their skills and knowledge.