EURUSD made a bearish break on Friday, falling below the 2023 low and opening the way for parity, as the slowdown in the Eurozone economy escalates.

EUR/USD was already bearish toward the end of the week, breaking breaking below 1.05 on Thursday, and after the disappointing manufacturing and services reports, the euro dropped by 1.5 cents, weighed down by disappointing PMI data from Germany and France. This weak economic performance aligns with the European Central Bank’s recent shift in focus toward supporting the economy, reinforcing the possibility of a more aggressive policy adjustment.

EUR/USD Chart Monthly – November Still has to Close Below 1.0450

The EUR/USD pair fell to a two-year low, breaking below the October 2023 low of 1.0448. With a confirmed weekly breach of the 1.0500 level, the likelihood of a steeper decline has increased. However, a sustained move lower will hinge on whether the pair closes below 1.0448 by the end of November.

Money market pricing suggests a 35% probability that the European Central Bank (ECB) will cut interest rates by 50 basis points at its December meeting. This marks a significant increase from the less than 20% likelihood seen before the release of disappointing PMI data from France and Germany. Meanwhile, €STR futures reflect a slightly higher 44% chance of such a rate reduction.

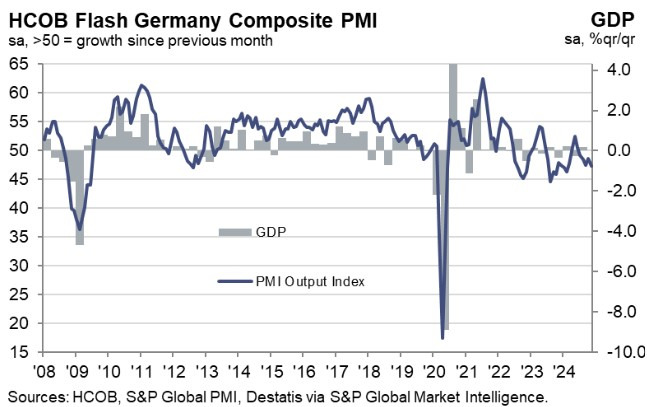

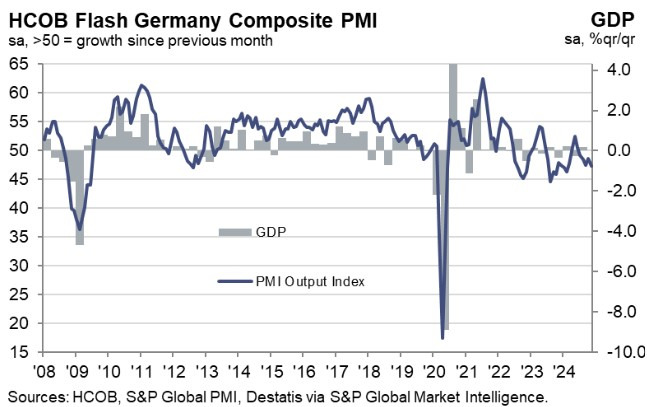

German November Flash Services and Manufacturing by HCOB for November

-

Manufacturing PMI:

- 43.2 (vs 43.0 expected; prior 43.0).

- 5-month high.

-

Services PMI:

- 49.4 (vs 51.6 expected; prior 51.6).

- 9-month low.

-

Composite PMI:

- 47.3 (vs 48.6 expected; prior 48.6).

- 9-month low.

-

Manufacturing Output Index:

Eurozone November Flash PMI (HCOB):

-

Services PMI:

- 49.2 (vs 51.6 expected; prior 51.6).

-

Manufacturing PMI:

- 45.2 (vs 46.0 expected; prior 46.0).

-

Composite PMI:

- 48.1 (vs 50.0 expected; prior 50.0).

The latest data paints a troubling picture. Until recently, Germany’s service sector had offset the steep decline in manufacturing, but that support is fading. Activity in the services sector plummeted to a 10-month low, driving a sharp overall downturn. Manufacturing conditions also worsened, with production contracting significantly.

Eurozone November Flash Services and Manufacturing Released by HCOB – 22 November 2024

- Eurozone November flash services PMI 49.2 vs 51.6 expected

- Prior 51.6

- Manufacturing PMI 45.2 vs 46.0 expected

- Prior 46.0

- Composite PMI 48.1 vs 50.0 expected

- Prior 50.0

While peripheral Eurozone countries are performing better, France and Germany—key economic players—are now the primary sources of weakness. After months of modest growth, the Eurozone’s services sector is faltering alongside its deepening industrial recession. Political instability exacerbates the challenges, with Germany heading toward early elections and France’s government in a precarious state. For the first time since January, the services sector experienced a sharp contraction, undermining hopes that lower inflation and rising wages would boost consumption and demand. A recovery seems distant, with no immediate signs of improvement in sight.

EUR/USD Live Chart

EUR/USD