eur-usd

European and US Policies Diverge, the Euro Tests 1.05 Again

Skerdian Meta•Wednesday, November 20, 2024•2 min read

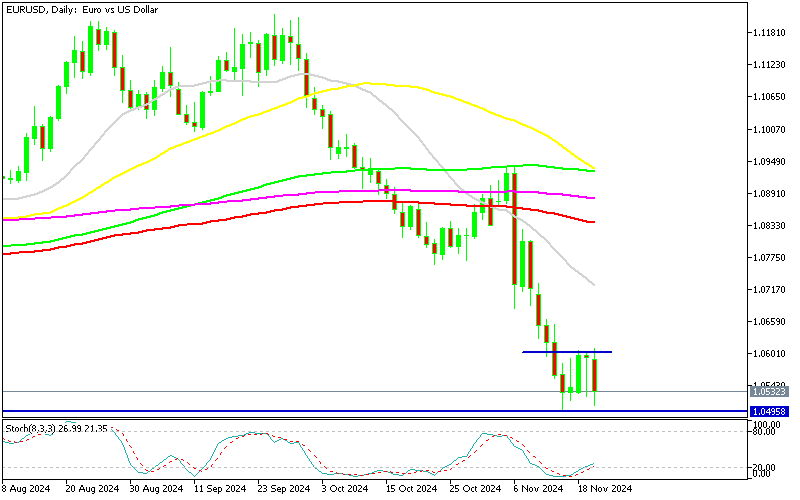

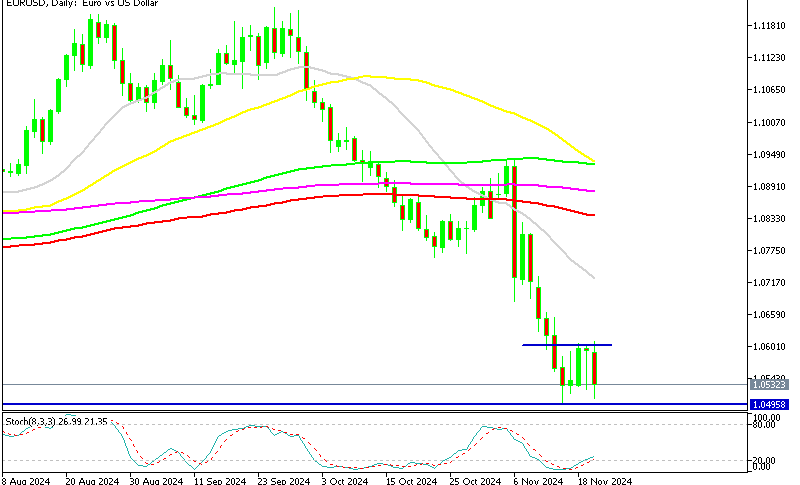

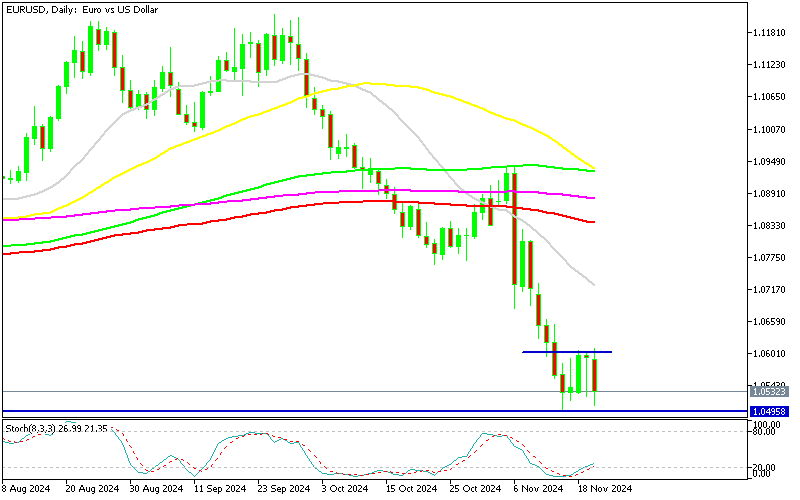

EUR/USD has been retesting the 1.05 a few ties since late last week, as it seems like we might see a bearish break take place soon, as the ECB policy turns dovish while the FED is sounding less so, with some hawkish fiscal policies to come from the new Trump administration.

The U.S. dollar has gained significant strength over the past two months, bolstered by several key factors. A cautious approach by the Federal Reserve toward rate cuts, coupled with robust economic data like today’s upbeat housing numbers, has supported the greenback. Additionally, a Republican win in the U.S. elections has added further momentum. This surge in the dollar has pushed the euro sharply lower, with EUR/USD falling 7 cents to drop below 1.05 last week, marking its weakest point since October 2023.

Euro Struggles Amid Dovish ECB Policies

The European Central Bank’s dovish outlook has kept the euro under pressure. Comments from ECB officials, such as Panetta’s mention of negative rates, underscore a cautious approach to monetary policy, which contrasts with the Federal Reserve’s stance. Attempts by EUR/USD buyers to push the pair above 1.06 this week have failed, indicating persistent bearish sentiment. The pair is once again testing the critical 1.05 support level. Should this level fail to hold, sellers are likely to target the 1.0440 zone as the next key level.

Fed’s Bowman: Key Remarks on Monetary Policy

Approach to FED Policy

- Advocates for a cautious approach to monetary policy.

- Suggests the neutral policy rate may be closer than currently estimated by policymakers.

- Personal estimate of the neutral rate is higher than pre-COVID levels.

Views on Interest Rate Decisions

- Supported the November Fed rate cut, aligning with her preference for gradual easing.

- Praised the November policy statement for preserving flexibility in future decisions.

Inflation and Price Stability

- Inflation progress appears to have stalled, raising concerns.

- Highlights greater risks to the price stability mandate despite potential labor market weakening.

- Notes a sideways trend in core PCE inflation since May, driven by housing market dynamics:

- Increased demand for affordable housing.

- Limited, inelastic housing supply.

Economic Observations

- Economy remains strong, with the labor market near full employment and inflation still elevated.

- Unemployment rate is below her estimate of full employment, but the rise this year indicates weaker hiring trends.

- Anticipates October payroll growth to align with the recent average, adjusting for factors like:

- Hurricane impacts.

- Boeing strike.

- Lower response rates in surveys.

Today Bowman’s remarks, which are bullish or at least less dovish, suggested that the Fed might be moving closer to neutral policy than policymakers currently believe. Following her remarks, US equities began to decline once more, with the NASDAQ index dropping 130 points.

EUR/USD Live Chart

EUR/USD

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

24 mins ago

Save

Save

13 h ago

Save

Save

18 h ago

Save

Save