Last week the US inflation and FED speech added volatility to financial markets, this week we have the UK and Canadian CPI inflation for October, as well as the manufacturing and services PMI reports from all over the globe.

The main theme in the markets was the USD strength, continuing the bullish momentum after Donald Trump’s victory, which was reinforced by the higher CPI and PPI inflation numbers, showing an increase in October. Toward the end of the week, FED’s Jerome Powell made some less-hawkish comments, saying that they will take it slow with rate cuts, further supporting the US Dollar. Stock markets on the other hand, went through a strong retreat toward the end of the week, after Powell’s comments.

We also has some important data from the UK, with the employment report showing a 2 point jump in October, which sent the GBP lower, while GDP report was also pretty soft. The September GDP data showed a contraction, while the Q3 GDP increased by only 0.1%, weighing further on the GBP.

This Week’s Market Expectations

This week we have more inflation report, coming from Canada tomorrow and the UK on Wednesday, while on Friday, the manufacturing and services PMI reports will be released, although not much is expected to change, so the market impact will be minimal.

Upcoming Events:

- Monday:

- US NAHB Housing Market Index

- Tuesday:

- RBA Meeting Minutes

- Canada CPI

- US Housing Starts and Building Permits

- Wednesday:

- PBoC Loan Prime Rate (LPR)

- UK CPI

- Eurozone Wage Growth

- Thursday:

- Canada PPI

- US Jobless Claims

- Friday:

- Flash PMIs: Australia, Japan, EU, UK, US

- Japan CPI

- UK Retail Sales

- Canada Retail Sales

Last week we remained long on the USD as the Trump trade continued and the USD kept making gains. That proved to be a good trading strategy and we ended with an 80%-20% win/loss ratio, after opening 35 trades and ending the week with 28 winning forex signals and 7 losing ones.

Gold Decline Stalls at the 100 Daily SMA

Since November 2022, gold prices have risen by more than 50% from a low of $1,600, maintaining an upward trend throughout 2024. However, recent weeks have seen a pullback, with Monday’s dip to $2,610 hinting at a potential bearish reversal. This reversal became more apparent after gold failed to hold above $2,700 following the U.S. election. A further break below $2,600 could signal additional downside risk. Despite the broader bullish momentum, gold has fallen below its 50-day simple moving average, indicating growing downward pressure, however sellers will have to break the 100 daily SMA.

XAU/USD – Daily Chart

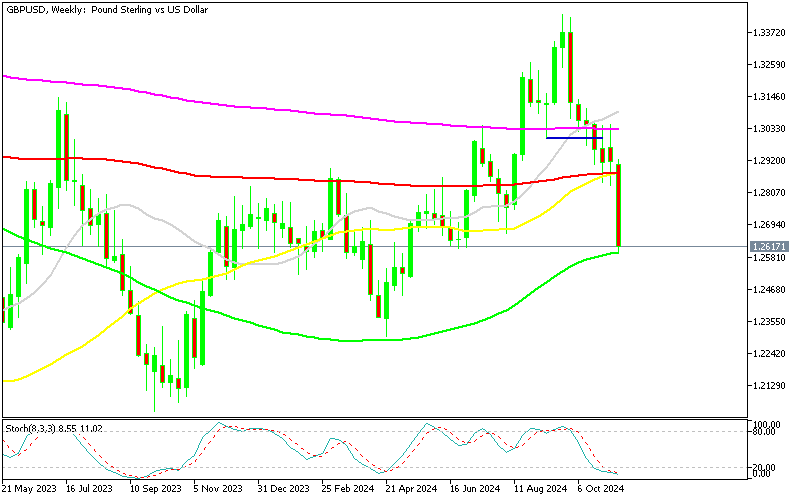

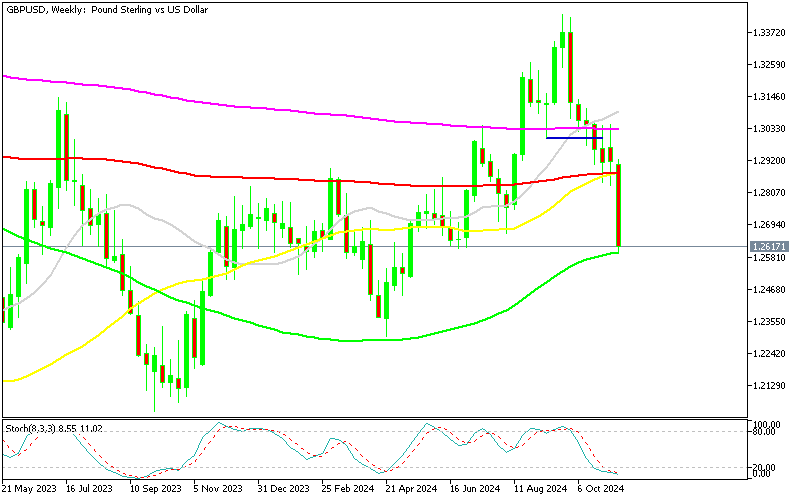

GBP/USD Tests 1.26

The GBP/USD pair faced significant downward pressure last week, breaking below 1.26 as the 100-week SMA failed to hold as support. This drop was triggered by hawkish comments from the Federal Reserve and weaker-than-expected UK economic data. Earlier in the year, the pair had climbed above 1.34, but renewed U.S. dollar strength reversed those gains, leading to a steep October decline of 6 cents. The 100-day Smooth Moving Average (red) initially offered stability during the early part of November, but mounting economic concerns have since intensified the bearish outlook. Recent UK data revealed a rise in unemployment and a contraction in September’s monthly GDP by -0.1%, further straining the pair’s performance.

GBP/USD – Daily Chart

Cryptocurrency Update

Bitcoin Retreats Below $90K Again

In the cryptocurrency market, Bitcoin and Ethereum have shown dynamic movements. Bitcoin experienced a sharp decline during the summer, dropping from over $70,000 to just over $50,000. It rebounded strongly after the election, climbing to $93,500 on Wednesday and nearing the $100,000 mark. However, a slight pullback followed, with Bitcoin falling below $90,000 yesterday.

BTC/USD – Daily chart

Ethereum Retreats but Holds Above $3,000

Ethereum also regained bullish momentum after dipping below $2,500. It broke above its 50-day simple moving average, reaching $3,450 before a modest retreat. Despite their susceptibility to market corrections, both Bitcoin and Ethereum exhibit signs of increasing investor confidence.

ETH/USD – Daily chart