GBPUSD fell below 1.30 last week and after several attempts from buyers to bring it back above water this week, it seems like they have given up. UK manufacturing PMI indicator also showed that the activity in this sector fell in contraction in October, which further accelerated the bearish move on Friday, despite some weak US economic data.

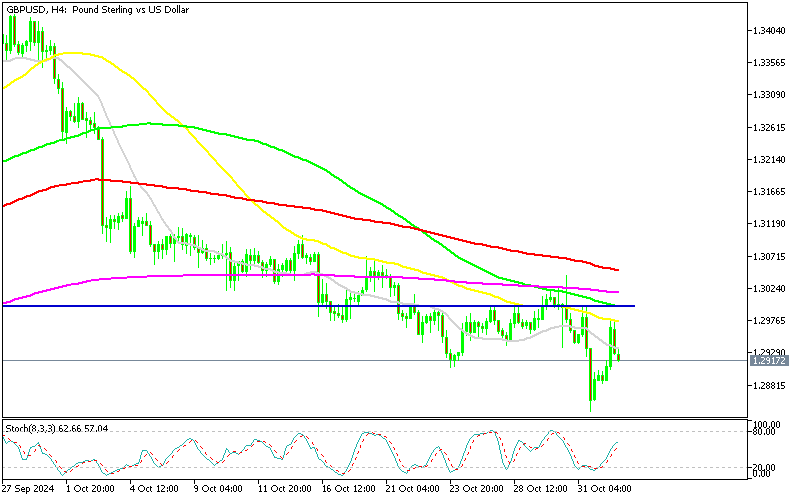

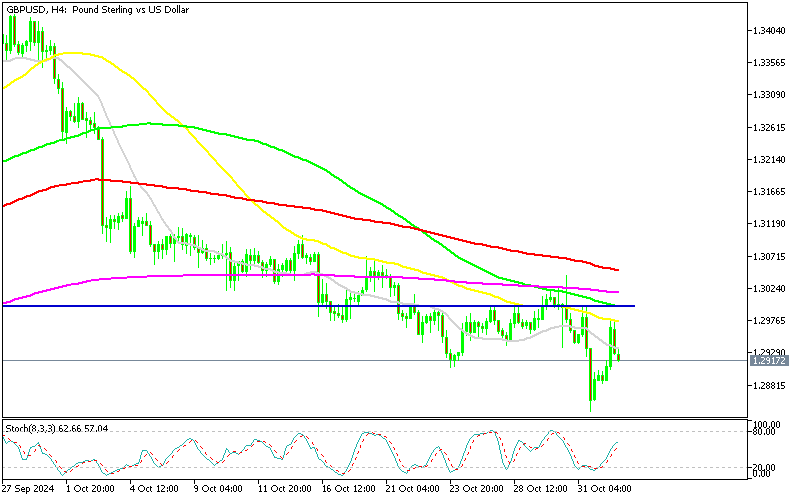

GBP/USD Chart H4 – The 50 SMA Keeps Rejecting the Price

The GBP/USD trend turned bearish this week, with the pound dropping over 5 cents to reach 1.2907 on Wednesday as economic conditions in the UK continued to weaken. The Confederation of British Industry (CBI) Realized Sales report showed a -0.6% decline in prices for October, reversing a brief rise in September, while British Retail Consortium (BRC) store prices fell by -0.8% this week, highlighting a lack of consumer confidence.

On Thursday, the GBP slid further to the 1.2840s as the UK government announced a new budget featuring a £40 billion tax hike. Among the major changes is an increase in National Insurance contributions, expected to provide substantial revenue for the Treasury. UK officials argue these tax increases are necessary to address fiscal challenges, but the heavier tax burden on consumers and businesses could further weigh on the pound.

The pair faced strong resistance at moving averages, particularly the 50 SMA on the H4 chart, which has held firm as a resistance point. This capped attempts to push GBP/USD above 1.30, leading to a bearish reversal and suggesting further downside potential as the 50 SMA continues to push highs lower, even amid temporary rebounds from recent lows.

Final reading released by S&P Global – 1 November 2024

- UK October Final Manufacturing PMI: Registered at 49.9 points, down from the preliminary estimate of 50.3 and significantly below September’s 51.5, indicating a contraction in the manufacturing sector.

- Output Growth: Growth was constrained by reduced new order intakes, reflecting weakened demand and signaling potential challenges for sustained production momentum.

- Input Price Inflation: Input price inflation eased sharply in October, marking a relief for manufacturers and suggesting that cost pressures on goods production may be stabilizing after recent highs.

Comment:

“Rob Dobson, director at S&P Global Market Intelligence, noted that UK manufacturing began the fourth quarter on uncertain footing, partly due to speculation around government policies leading up to the budget. This uncertainty seemed to create a “wait-and-see” approach to spending and investment, contributing to the first full decline in new orders since April alongside ongoing weakness in export demand.

The slowdown in orders almost brought production growth to a halt, and the overall manufacturing environment appeared subdued. The PMI dropped below the neutral 50.0 mark, and business optimism was only slightly above September’s nine-month low. On the positive side, input cost inflation eased significantly, hitting a 10-month low and marking one of the largest declines in the survey’s 33-year history. Selling price inflation also moderated, potentially giving policymakers room to promote growth if demand continues to slow. The upcoming November PMI will be closely watched for insights on how the budget impacts business conditions and confidence.”

GBP/USD Live Chart

GBP/USD