Forex Signals Brief October 22: BOE, FED and ECB Speech Today

Yesterday, with no major economic reports to focus on, attention shifted to rising yields, which continued to push the USD higher. The 10-year yield climbed 12 basis points, reaching 4.19%. Before the Fed’s 50 basis point rate cut in September, the yield had dropped to a low of 3.605%. Since then, it has risen by 59 basis points. The USD/JPY surged by 2 cents, nearing 151, while the EUR/USD edged closer to last week’s low of 1.0809.

In the US session, Fed member Lorie Logan stressed the need for flexibility in monetary policy, pointing out that rate decisions will depend on changing economic conditions. She expects gradual rate cuts, barring any surprises. Minneapolis Fed President Kashkari also noted that rate cuts would likely be small at first but could accelerate if labor market conditions worsen.

The US stock market was mostly negative, marking the first pause after six consecutive weeks of gains. The Dow experienced the biggest decline, while the Nasdaq posted a small rise. Nvidia, up 4%, hit a new all-time high, helping the S&P close in between.

Today’s Market Expectations

Today the economic calendar is light as well, so the focus will be on central bank speakers, with the bank of England chairman Andrew Bailey taking the stage first at the Bloomberg Global Regulatory Forum, in New York. GBP/USD broke below 1.30 again yesterdy and his rhetoric might give this pair another push lower.

In the US session we have a number of FED speakers, most notably FOMC Member Harker appearance at the Annual Fintech Conference hosted by the Federal Reserve Bank of Philadelphia, which come after yesterday’s balance comments from other FOMC members. The ECB President Christine Lagarde is o participate in a panel discussion titled “The Future of Cross-Border Payments: Faster Safer Together – Safe and Inclusive Fast Payments Across Borders” at the Annual Meetings of the International Monetary Fund and the World Bank Group, in Washington DC where she will hold a speech as well.

Yesterday most markets were slow coming from the weekend and with a light economic calendar, so we only had two closed forex signals, one losing and one winning trade. Both trades closed when the USD jumped higher at the start of the US session, then it quietened down once again.

Gold marches Higher Toward $3,000

After FOMC member Logan’s measured remarks, indicating that the Federal Reserve would adopt a cautious approach to rate cuts, gold reversed sharply, dropping by over $20. Despite a rise to a record high of $2,740.56 on Thursday, gold fell below the 20 SMA later in the day. Sellers faced support at the 50 SMA (yellow) on the H1 chart, which led to a price rebound later in the evening.

XAU/USD – H1 Chart

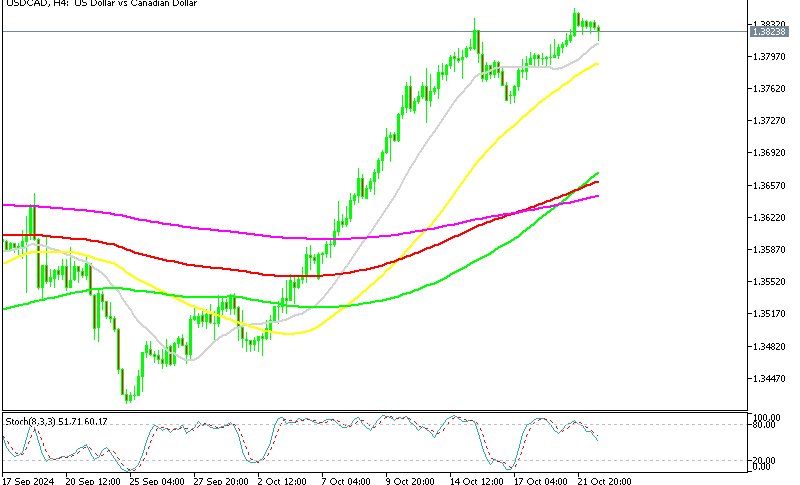

GBP/USD Returns Below 1.30

The GBP/USD pair has seen a sharp decline, losing about 4 cents in October after a reversal above 1.34, partly driven by disappointing UK CPI inflation data for September. Last week, the pair broke below the key 1.30 mark. While it briefly surged back above 1.30, resistance at the 50 SMA (yellow) proved too strong, and the pair fell below this level again.

GBP/USD – H4 Chart

Cryptocurrency Update

Bitcoin Rejected Below $70K Again

Bitcoin has also been under pressure since April, declining from near $70,000 to under $50,000 by August. Following a brief rally beyond $60,000 after the Federal Reserve’s rate cut in September, Bitcoin has been rising again, reaching $68,000 this week. After dipping below $66,000, buyers returned, pushing the price back above $69,000. However, resistance at $70,000 remains strong, and another rejection caused Bitcoin to fall by $2,500 yesterday.

BTC/USD – Daily chart

Ethereum Returns to the the 100 Daily SMA

Ethereum has experienced similar buying pressure in October, increasing to $2,700 but it was struggling to break through the 100-day SMA’s (green) overhead resistance around that level. While consolidating around $2,600, broader economic concerns have prevented a clear rise above key resistance levels and yesterday we saw a reversal lower.

ETH/USD – Daily chart