EURUSD Knocking on 1.08 Again As ECB Comments Weigh

EURUSD fell to 1.0810 last week after the dovish ECB rate cut but bounced as the USD retreated. However, sellers are back now, retesting last week’s low as USD buyers have returned, being helped by higher US Treasury yields, while the Euro continues to be weighed down by dovish ECB rhetoric.

Markets are now expecting a more cautious approach from the Federal Reserve, while worsening economic conditions in the Eurozone have deepened the negative sentiment toward riskier currencies like the euro. The EUR/USD has already dropped 4 cents in October, and the outlook remains pessimistic.

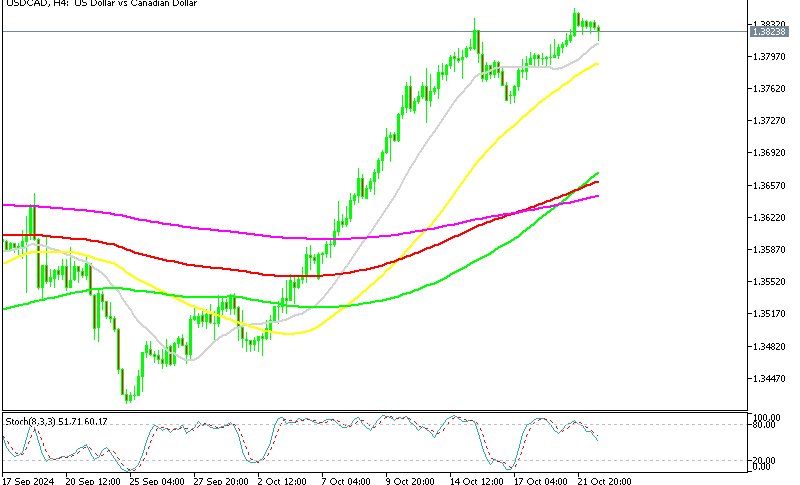

EU/USD Chart H4 – The 20 SMA Keeping the Trend Bearish

The recent European Central Bank (ECB) meeting was interpreted as dovish, with markets expecting further rate cuts of 25 basis points in both November and December, contributing to the euro’s decline. Today, both the euro and the pound are struggling, though the recent drop in the EUR/USD exchange rate has been largely driven by dollar strength. However, in today’s market, the dollar’s dominance is not the primary cause of the euro’s continued weakness.

Comments from the ECB President on Bloomberg

- No conclusion yet that the inflation target is fully achieved.

- “Not unhappy” with the current inflation trends.

- Optimistic inflation could return to target sooner than forecasted.

- Recent inflation data is somewhat reassuring.

- Confident inflation target will be reached sustainably by 2025, but uncertain about exact timing.

- Sharp focus required on services inflation.

- European consumers spend less than Americans.

- The pace of rate cuts will be decided later.

- Declined to speculate on a 50 bps rate cut scenario.

- Uncertain about the “neutral” rate.

ECB Member Holzmann’s remarks:

- The rate cut was appropriate, with more expected to follow.

- Inflation may be declining faster than anticipated.

Their comments show that the ECB remains cautiously optimistic about reaching its inflation target by 2025, though uncertainty persists regarding the timeline and necessary rate adjustments. Both ECB President and member Holzmann acknowledge recent positive inflation trends, but emphasize the need for continued vigilance, particularly in evaluating services inflation.

The European consumer’s lower spending, compared to the US, adds complexity to their approach. While rate cuts are likely, the timing and magnitude will depend on evolving economic conditions, with no clear stance yet on where the neutral rate lies.

EUR/USD Live Chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |