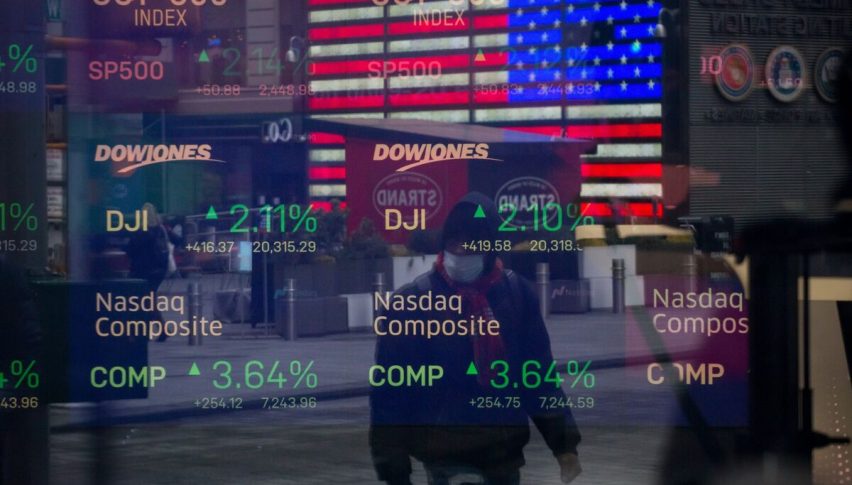

Stock Market Off to Bad Start This Week

The top stock market indices closed high on Friday, and the expectation was that they would open high for Monday, but investors demonstrated mostly bearish sentiment as the market opened.

The Dow Jones has lost 340 points so far today- a drop of 0.79% from Friday. The S&P 500 is down 0.28% today too, even though both of these indices were positive for six straight weeks. The streak has ended, though, and only the Nasdaq Composite is positive right now, with a negligible gain of 0.05%.

The 10-year Treasury yield climbed, and the stock market is in decline ahead of major earnings reports this week. We could see a major rally later on this week thanks to incoming quarterly reports from Tesla (TLSA), Coca-Cola (KO), American Airlines (AAL), General Motors (GM) and others. This could be one of the most packed weeks for earnings reports so far, and it could mean a major turnaround for a somewhat subdued market.

Many of these reports are expected to be at least mildly positive, which could result in a bullish market very soon. Investors should pay close attention to the major reports that are coming out this week and consider investing in some of these stocks before they shoot up.

Market Factors to Know about

Later today, there will be talks from FOMC members, and these could shift the market, especially as anticipation and fear are high for the proposed interest rate cuts for next month.

Nvidia (NVDA) will likely continue to move the tech market and the Nasdaq Composite with its high earnings. The AI company hit an intraday record today. Apple (AAPL) could also end the day high if its current trend continues.

Oil prices were up by 2% today and have been heavily affected by the recent stimulus package that is being sent to Chinese citizens at the moment.

The latest news from the Middle East is that Israel has apologized for a missile strike that killed three Lebanese soldiers. Israeli officials say they are not battling Lebanon and were attempting to target a vehicle operated by Hezbollah forces. The area is still a tinder box that could continue to go off and hurt market performance.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |