Despite Putin rejecting a unified BRICS currency, most analysts are expecting it at some point, which might be another reason for the surge in Gold prices. The reasoning is that it should be backed by Gold to a certain level, which should increase the demand from the central banks of participating countries, most notable Russia, China and India, which means that Gold demand will increase further.

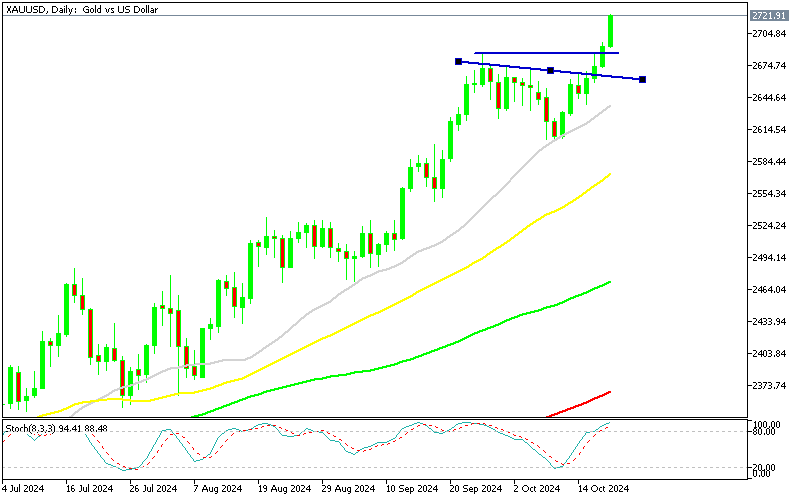

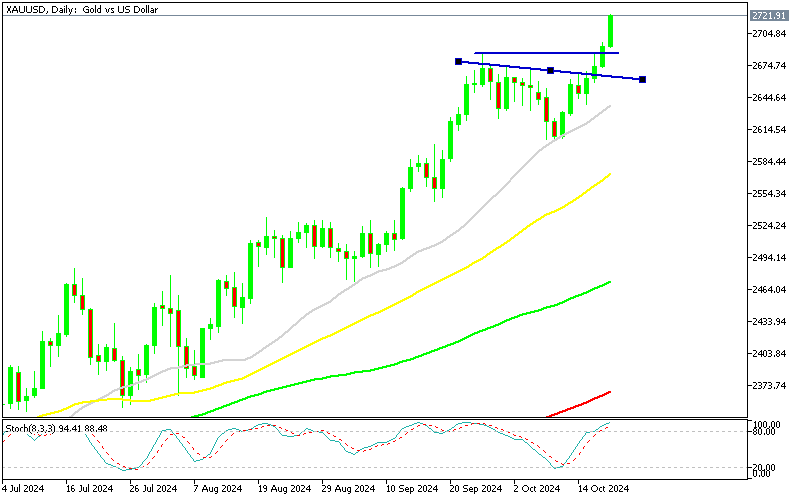

Gold Daily Chart – Accelerating the Bullish Momentum

Gold continues to display strong bullish momentum, reaching a new record high above $2,720, surpassing September’s peak of $2,685. The elevated global tensions and central banks’ monetary easing have driven investment into safe havens like gold and silver, which are significantly benefiting from this shift. Geopolitical risks and economic downturns in the Eurozone and China have also supported rising gold prices.

Central Banks and Gold Demand

One key factor behind gold’s strength is the sustained demand from central banks, particularly the People’s Bank of China, which has been purchasing gold in large quantities over the past few years. This demand is expected to continue as speculation rises around the development of a BRICS currency, which could further increase the appeal of gold as a hedge against global economic uncertainties.

Global Geopolitical Drivers

Political unrest, such as the ongoing Middle East tensions, and the unpredictability of the upcoming U.S. presidential election between Donald Trump and Kamala Harris, are pushing investors to seek the safety of gold. The continued market volatility, driven by these geopolitical threats, reinforces gold’s role as a safe-haven asset.

The BRICS Currency and Gold

There is growing anticipation ahead of the 16th BRICS conference in Kazan, which could mark a turning point in global finance. The conference may announce the formation of a BRICS currency, which aims to create a unified payment system for its member states. Although the development of a physical BRICS currency is still premature, the creation of a notional currency to challenge the U.S. dollar’s dominance could have far-reaching implications for the global financial system.

Long-Term Gold Outlook

With BRICS central banks increasing their gold reserves, it is clear that gold will play a significant role in the development of this new currency system. While the launch of a BRICS currency is still in the early stages, the potential long-term impact on global markets and currencies should be considered when trading gold on longer-term charts. Russian President Vladimir Putin has stated that while a BRICS currency is not imminent, it is something to watch closely in the future.

Gold Live Chart

GOLD