GBPUSD Returns to 1.30 After Failed Jump on UK Retail Sales

GBP/USD broke below the major 1.30 level earlier this week after the softer UK CPI inflation for September, but the break hasn’t been clear as the price kept returning above it several times. Today the Retail Sales number was expected to show a 0.4% decline in September, which would send the price below this level.

The GBP/USD pair has dropped roughly 4 cents so far in October, following a sharp reversal above 1.34. This signals a shift from a bullish to bearish trend, after gaining about 8 cents in August and September. Despite this, the UK economy has started to show positive signs—most notably, the UK employment survey reported a lower unemployment rate of 4.0% in September, alongside stronger-than-expected job data for August.

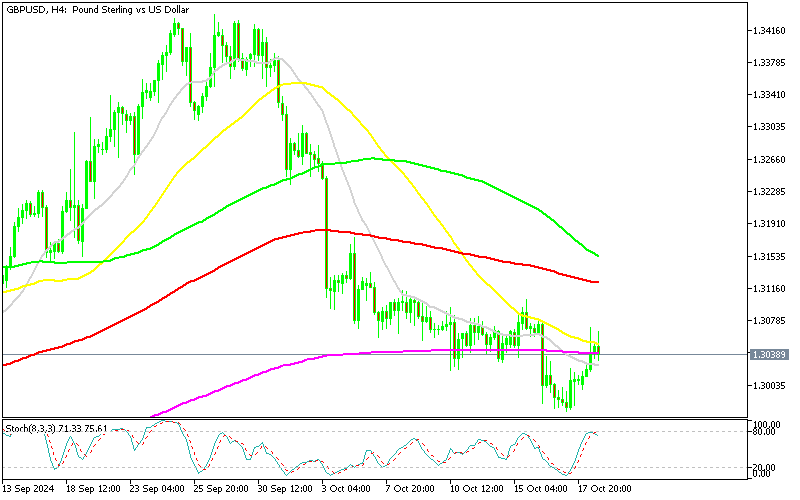

GBP/USD Chart H4 – The 50 SMA Has Turned into Resistance

As a result, there has been some hesitation around the 1.30 level. Looking at the H4 chart, the GBP/USD pair briefly dipped below 1.30 on after Wednesday’s UK CPI report, but quickly rebounded above it yesterday. That sort for price action shows that buyers are stepping in around these levels, which could point to a potential resurgence. However, for sellers to strengthen their bearish stance, they will look for a decisive break below this level, pushing toward the key trendline.

Today buyers had a go, sending the price to 1.3070 after the positive UK retail sales for September, but they failed to hold above the 50 SMA (yellow) and this pair is forming a bearish reversal chart pattern now. UK retail sales in September outperformed expectations, with both monthly and yearly figures showing stronger-than-anticipated growth. Sales excluding autos and fuel also showed resilience, indicating that consumer spending remained robust despite broader economic concerns. The upward trend from August suggests solid momentum in the retail sector heading into the final quarter of the year.

UK Retail Sales Report for September from ONS – 18 October 2024

UK Retail Sales Report for September (ONS – 18 October 2024)

- Retail Sales (MoM):

- Increased by +0.3%, beating expectations of -0.3%.

- Previous month (August) retail sales were stronger at +1.0%.

- Retail Sales (YoY):

- Rose by +3.9%, outperforming the expected +3.2%.

- Previous figure was revised down to +2.3% from the prior +2.5%.

- Retail Sales (Excluding Autos and Fuel, MoM):

- Gained +0.3%, again better than the -0.3% expected.

- Prior month’s increase was +1.1%.

- Retail Sales (Excluding Autos and Fuel, YoY):

- Jumped by +4.0%, exceeding the +3.2% forecast.

- Previous figure was revised down to +2.2% from +2.3%.

Breaking down the data, the main drivers of the increase in consumer activity were department store sales, which rose by 1.9%, and non-food store sales, up by 5.5%. The latter was primarily fueled by strong sales of computers and telecoms equipment—perhaps driven by the release of the iPhone 16.

On the downside, grocery store sales were the only significant detractor, falling by 1.9% month-on-month. Retailers attributed this decline to consumers cutting back on premium food purchases and the impact of unexpectedly poor weather. The Bank of England will be relieved to observe that UK retail sales have remained stable for another month.

GBP/USD Live Chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |