Oil Market Update: WTI Crude Set for Weekly Gain Amid Hurricane Impact and Middle East Tensions

WTI Crude Oil prices experienced some volatility on Friday but were on track for a second consecutive weekly gain.

Investors weighed the potential demand destruction from Hurricane Milton, which has severely impacted the U.S., against broader supply disruptions if Israel retaliates against Iranian oil facilities. The hurricane caused significant damage across Florida, leaving millions without power and raising concerns over reduced fuel consumption in the short term.

“Investors are evaluating how hurricane damage might impact the U.S. economy and fuel demand,” said Hiroyuki Kikukawa, president of NS Trading. Hurricane Milton’s aftermath may suppress fuel demand in the U.S., but supply disruptions remain a key focus as geopolitical tensions rise.

WTI Crude Oil Futures Set for 2nd Weekly Gain

• WTI crude oil futures trade around $75.5 per barrel, expected to book its second weekly gain.

• Increased risks of supply disruptions due to Israel's PM Netanyahu's security cabinet meeting.— Amit Gupta (@amit_gupta444) October 11, 2024

Middle East Tensions and Potential Oil Supply Disruptions

The Middle East remains a critical area of concern for the oil markets. Earlier this month, Iran launched over 180 missiles against Israel, escalating tensions. While Israel has not yet retaliated, Defense Minister Yoav Gallant warned of a potential “lethal and precise” strike against Iranian oil facilities if the situation escalates further. This uncertainty has kept oil prices relatively flat this week, despite the earlier spike.

Meanwhile, Gulf states are urging the U.S. to dissuade Israel from targeting Iran’s oil infrastructure. Any attack on Iran’s facilities could lead to a broader conflict, disrupting oil supplies in the region and pushing prices higher.

$INDO $EONR 10/10/2024, 09:34 AM "Could Middle East tensions push #oil prices above $100/barrel? Bernstein weighs in"#MiddleEastCrisis #Kharg island + Strait Of #Hormuz #stockstofocus with #lowfloat #DayTrading #Crudeoil #Brent #WTI #HurricaneMilton https://t.co/SByUpN3GsT

— claude (@allezlombcit) October 10, 2024

Technical Outlook: WTI Crude Oil

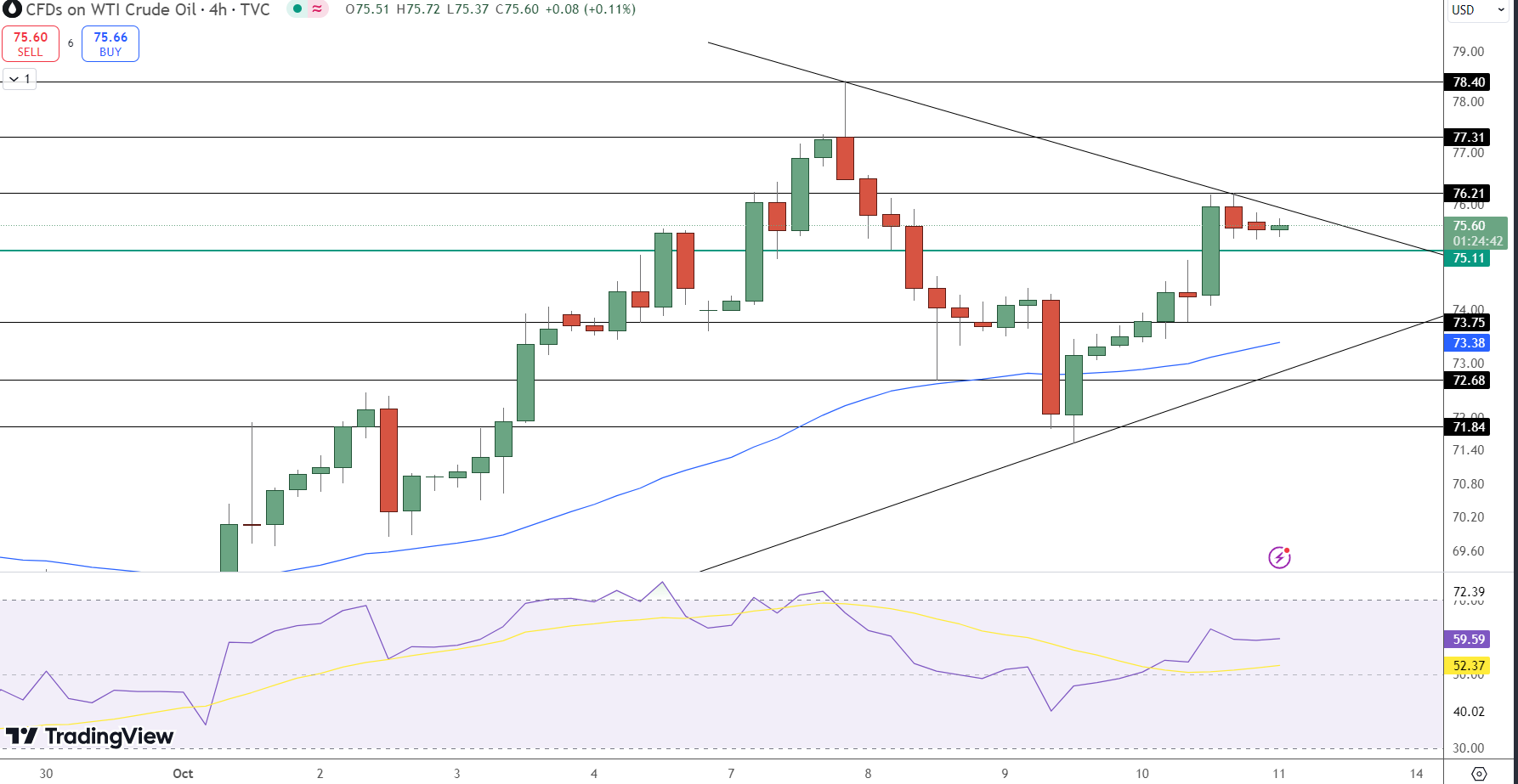

WTI Crude is currently trading at $75.60, up 0.11% for the day. The price is consolidating below the $76.20 resistance level, limited by a descending trendline on the 4-hour chart. A breakout above $76.20 could push prices towards the next resistance at $77.31 and potentially $78.40. Immediate support is seen at $75.10, with further support levels at $73.75 and $72.68.

Resistance Levels: $76.20, $77.31, $78.40.

Support Levels: $75.10, $73.75, $72.68.

RSI at 59.59: Indicates moderate bullish momentum.

The short-term outlook remains neutral to bullish above $75.10. A sustained break above $76.20 is crucial for bullish continuation, while a failure to break this level could lead to a bearish correction towards $73.75. Traders should monitor geopolitical developments closely, as any escalation in the Middle East could significantly impact oil prices.