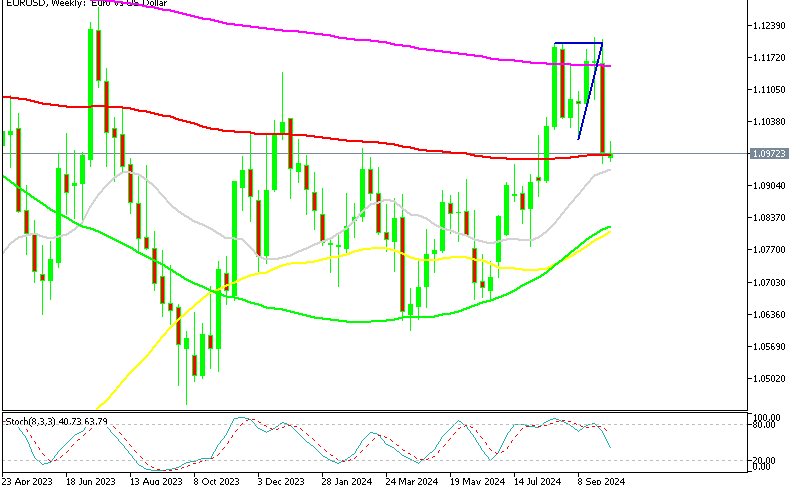

USD Grinds Higher As FED Members Keep Rejecting 50 bps Cut

One of the main reasons for the USD decline in the last two months was expectations of a fast rate cut cycle by the FED, but after the 50 bps cut in the last meeting, Powell signaled a steady pace of monetary easing and other FOMC members keep confirming this. As a result, the USD has shifted from bearish to bullish in the last two weeks.

Now markets are leaning more toward a 25 basis points rate cut by the FED in the November meeting, which is also hurting risk currencies, amplifying the USD uptrend, with AUD/USD falling below 0.70. Today we already had a couple of FED speakers who continued to keep this sort of agenda, sending USD climbing higher again.

Comments from the Dallas Fed President Logan

The Dallas Fed President was speaking a while ago and emphasized that the Federal Reserve should avoid cutting rates too quickly, as inflation remains a concern. She suggests that a “more gradual” approach to rate reductions would be more suitable, given the upside risks to inflation. She believes there is still a significant chance that inflation will stay above the Fed’s target, and taking a slower path with rate cuts would allow the Fed to evaluate how restrictive the current monetary policy stance might be.

A gradual easing of policy also helps the Fed “best balance” its concerns over the labor market. By taking a less restrictive approach, the Fed can avoid unnecessarily cooling the labor market, which, while it has softened, remains relatively healthy. Both inflation and labor market conditions are described as being “within striking distance” of the Fed’s objectives.

Logan cautions that while the labor market has cooled, there is a risk of it weakening too much, which could hurt economic recovery without necessarily bringing inflation down to the 2% target. Additionally, unexpected economic expansion and consumer overspending could increase inflation risks. Despite her cautious stance, Logan isn’t suggesting a complete halt to rate cuts. Instead, she advocates for a measured approach that allows for ongoing adjustments as the economic situation evolves, however these comments lean more toward the bullish side for the USD.

Comments form Boston Fed President Susan Collins

- Additional rate cuts are likely, with future decisions guided by data.

- September Fed forecasts indicated 50 basis points of cuts through year-end.

- Collins is increasingly confident inflation is on a lasting downward trajectory.

- Core inflation is moderating but remains elevated.

- Fed aims to maintain a healthy labor market, which continues to show solid job growth and low unemployment.

- Collins highlights that the labor market is balanced and in a strong position.

- The economy shows strength and resilience but is more susceptible to adverse shocks.

- Wage growth is robust but not a primary driver of inflation.

- Collins believes restrictive monetary policy has helped ease inflation.

- The Fed continues to focus on both price stability and employment mandates.

- She expects inflation to reach the 2% target by late next year.

- Elevated prices remain challenging for many consumers.

- Collins notes that the economic outlook has become more optimistic overall.