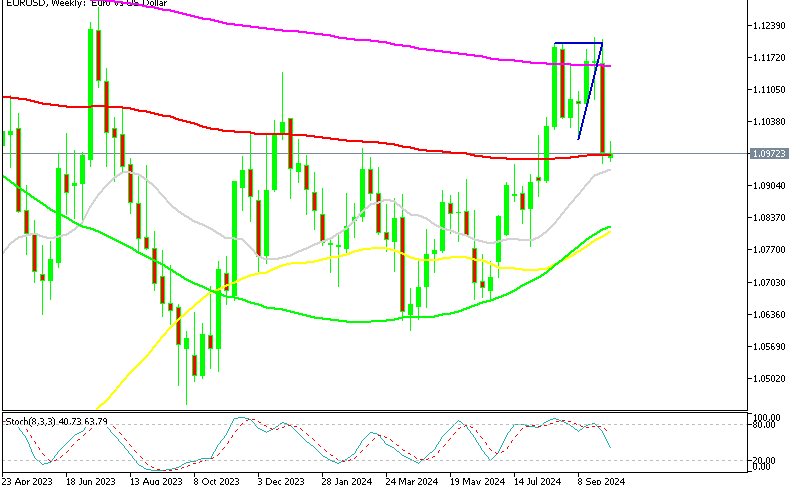

FOMC Minutes Don’t Support a 50 bps Cut, USD Continues Higher

The FED started the policy easing cycle with a 50 bps rate cut in the last meeting which sent the USD lower, but they’re not looking for more such cuts soon, instead they want to keep it steady. FOMC members didn’t seem particularly worried about the US economy and employment, so they didn’t support another 50 bps rate cut in the November meeting.

The USD had been on a 2 month decline ahead of the FOMC meeting, and it took another dive after the rate cut, as markets were expecting another 50 bps cut in November. However the odds of such a move diminished as the employment data showed resilience last week, while Chairman Powell and a number of FOMC speakers have pushed back on such an idea, although not explicitly.

FOMC Minutes from the 50 bps Rate Cut FED Meeting

- A “substantial majority” supported a 50 basis point rate cut.

- The committee has “greater confidence” that inflation is sustainably moving toward the 2% target.

- Risks to employment and inflation goals are now seen as “roughly in balance.”

- Economic activity is expanding at a “solid pace”; job gains have slowed, but unemployment remains low.

- Inflation has made “further progress,” though it remains “somewhat elevated.”

- Most participants view risks to the inflation outlook as balanced.

- Some members would have preferred a smaller 25 basis point cut, given elevated inflation and solid economic growth.

- Governor Bowman dissented, favoring a 25 basis point cut due to core inflation still being above target.

- Members anticipate gradually moving to a more neutral policy stance if data aligns with expectations.

- The committee will “carefully assess” incoming data for additional potential rate adjustments.

Attendees noted that recent inflation data matched reports from business contacts, indicating weakening pricing power and customers becoming more demanding about discounts. Many participants pointed out that the unexpectedly high inflation numbers from Q1 appeared to be a temporary setback, as the second and third quarters of 2024 showed inflation moving closer to the 2% target. A number of participants also expected real GDP to grow at a pace close to its trend rate over the next few years.

FED Members See Stable US Labour Market

Several participants mentioned that assessing labor market changes had been complex. Factors like increased immigration, adjustments to payroll data, and possible changes in productivity growth rates made evaluations challenging. Many noted that the latest inflation figures reflected a broader trend reported by companies about declining pricing power. During this meeting, most members supported a 25 basis point rate cut, and they appeared unconcerned about any near-term economic slowdown.

However, most observed an increase in downside risks to employment. The majority felt that recent inflation data aligned with a gradual return toward the 2% goal, showing more confidence in this steady trend. Nearly all participants agreed that the statement should reflect their increased confidence about inflation approaching the target. Overall, the vast majority backed reducing the federal funds rate range by 50 basis points, to 4.75% to 5%, reflecting a consensus that inflation risks had eased while downside risks to employment had grown.