Bearish Signs Point to 1.08 in EURUSD As It Fails to Reclaim 1.10

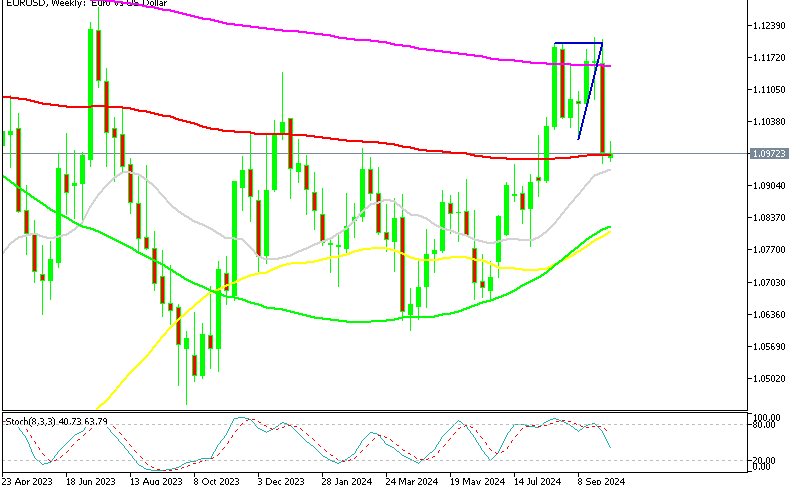

Earlier this week, the EURUSD showed signs of recovery, approaching the 1.10 level, but buyers failed to sustain the push above this resistance. Following a sharp decline last week, where the pair fell below 1.10 and lost over 2 cents, the EUR/USD now faces a key resistance zone. On the weekly chart, the price is rebounding off the 100 SMA at 1.0970. If this support breaks, it could signal a shift away from the bullish trend, potentially targeting 1.08.

EUR/USD Chart Weekly – Sticking to the 100 SMA

In June and July, the pair experienced a strong upward movement, climbing from below 1.07 to 1.12. However, buyers couldn’t sustain this rally, and the pair began to retrace as it met with significant resistance. As a result, the 1.10 level has re-emerged as a key resistance point.

US Dollar Strengthening Across the Board as FED Rate Cut Odds Fall

The recent strength of the US dollar reflects changing expectations about Federal Reserve policy. Chair Jerome Powell’s less dovish tone, combined with strong US labor market data—particularly the Non-Farm Employment Change, which surged to 254,000 in September—has prompted traders to adjust their expectations. Now, markets are anticipating a 25 basis point rate cut instead of 50 basis points, which has contributed to the USD’s current momentum.

ECB’s Dovish Outlook

In contrast, the European Central Bank (ECB) has taken a more dovish stance, limiting support for the Euro. As the Eurozone economy remains sluggish and inflation continues to decline, the outlook for the EUR remains uncertain. Today, various ECB members spoke, reinforcing the perception of a cautious policy stance going forward.

German Economy GDP Revisions by German Ministry of Economy

- GDP: Now expected to shrink by 0.2% in 2024, compared to the previous forecast of a 0.3% growth. Growth is projected to pick up modestly in 2025 at 1.1% and reach 1.6% by 2026.

- Inflation: Forecast to decrease from 2.2% in 2024 to 2.0% in 2025, and further to 1.9% in 2026.

- Exports: Expected to decline by 0.1% in 2024, following a 0.3% contraction last year.

These weaker-than-expected figures suggest limited economic momentum, which could influence the European Central Bank’s approach to maintaining restrictive rates. Lower inflation forecasts and a fragile export outlook may increase pressure for more accommodative policies to support growth.