UK Retail Sales Jump, GBPUSD Tests 50 Daily SMA Below 1.31

GBPUSD made a strong bearish reversal last week, losing nearly 4 cents, as USD buyers returned, but the decline stalled at the 50 daily SMA. The strong NFP employment report removed the threat of another 50 bps rate cut by the FED in November, while the BOE has turned increasingly dovish, as BOE governor Bailey’s comments suggested last week, which have turned the GBP bearish even against the Euro.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC | USD 100 | Visit Broker |

| 🥈 |  | Read Review | FSCA, FSC, ASIC, CySEC, DFSA | USD 5 | Visit Broker |

| 🥉 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker |

| 5 |  | Read Review | ASIC, FCA, CySEC, SCB | USD 100 | Visit Broker |

| 6 |  | Read Review | FCA, FSCA, FSC, CMA | USD 200 | Visit Broker |

| 7 |  | Read Review | BVI FSC | USD 1 | Visit Broker |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker |

Since June, GBP/USD has shown strong resilience, maintaining a bullish trend as long as it stays above the 1.30 level. In late September, the pair rose above 1.34 as markets began pricing in a possible 50 basis point rate cut by the Fed at the November meeting, prompting a sell-off in the USD. However, early last week, hawkish remarks from Fed Chair Powell reversed the USD’s decline, initiating a pullback in GBP/USD. Bank of England Governor Andrew Bailey’s comments added further pressure, pushing the pair lower.

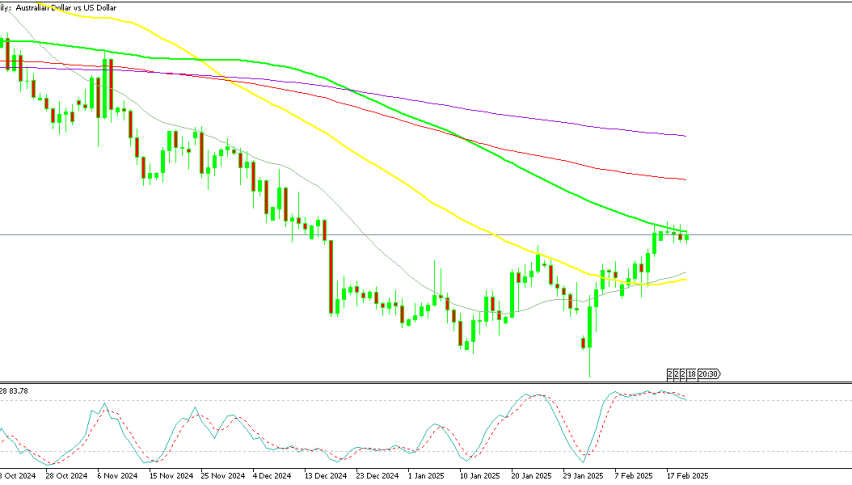

GBP/USD Chart Daily – Stochastic is Already Oversold

Friday’s robust Non-Farm Payrolls (NFP) report, which saw the U.S. unemployment rate dip to 4.1%, strengthened the dollar further, and GBP/USD fell sharply. The decline halted around the 50 SMA (yellow) on the daily chart, which is now acting as a support level. While a doji candlestick formed at the 50 SMA—often a signal of potential bullish reversal—the following day’s bearish candlestick signaled hesitation.

Outlook and Key Support Levels

To confirm a potential trend reversal to the downside, GBP/USD will need to decisively break below the 50 SMA. If this support holds, the pair might continue to show resilience. However, failure to maintain this level could signal the start of a more sustained bearish trend for GBP/USD. Earlier today we had the BRC Retail Sales Monitor report

- BRC Retail Sales Monitor (YoY):

- September: Increased by 1.7% year-on-year, beating the expected 0.8% and last month’s 0.8% growth.

- Total Retail Sales (MoM):

- Up by 2.0% compared to September of the previous year, surpassing the 12-month average growth rate of 1.1%.

- Food Sales:

- Grew by 3.1% year-on-year over the three months leading to September, indicating steady demand in the food sector.

- Non-Food Sales (MoM):

- Declined by 0.3%, an improvement from August’s -1.2%, suggesting a slight recovery in non-food spending.

These figures show robust growth in overall retail sales, especially for food, with a modest improvement in non-food sales, reflecting consumer resilience in the UK market.