Oil Prices Set for 8% Weekly Gain as Middle East Conflict Spurs Supply Disruption Concerns

Oil prices remained relatively stable on Friday but are set to end the week with approximately 8% gains. Investors are closely monitoring the potential for a wider Middle East conflict that could disrupt crude supplies against the backdrop of an amply supplied global market.

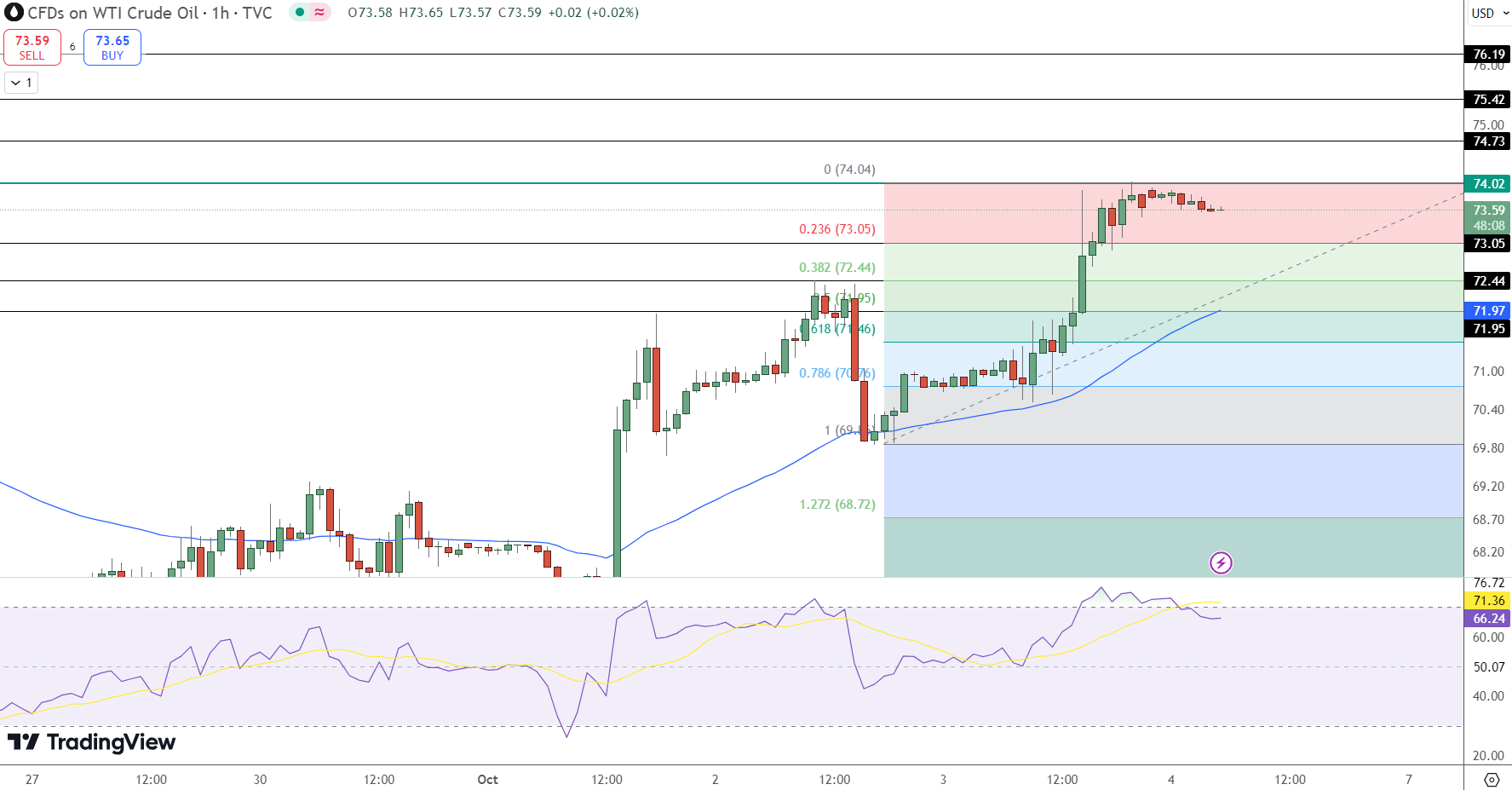

WTI Crude Oil is currently trading at $73.59 per barrel, facing resistance at $74.02. This level has been pivotal in capping the recent rally that was fueled by fears of potential supply interruptions.

The geopolitical landscape has shifted significantly this week. President Joe Biden indicated that the U.S. might support Israeli strikes on Iran’s oil facilities, which spurred a 5% rise in oil prices on Thursday. Israel’s recent airstrikes on Beirut and the ongoing conflict with Hezbollah have raised the stakes for the region, making investors cautious about potential escalation.

All major sectors closed in the red besides energy producers, which benefited from the surge in oil prices. Sanofi and Bayer fell close to 2% each to set the pace for healthcare, while Schneider and Vinvi dropped 1.5% and 2.8%, respectively, to set the pace for industrials.

— Ryan ATHI (@RYAN_ATHI) October 3, 2024

Key Market Drivers:

Weekly Performance: Both Brent and WTI are poised for weekly gains of around 8%, marking their strongest weekly performance in months.

Supply Concerns: Rising Middle East tensions and the possibility of supply disruptions are keeping traders on edge, despite current ample global supply.

Geopolitical Tensions vs. Ample Supply: An Uncertain Outlook

Despite the surge in prices, ANZ analysts caution that the impact of supply disruptions might be limited. The Middle East accounts for over one-third of the world’s oil production, but an actual disruption has yet to materialize. Israel’s potential response to Iran remains uncertain, as a direct attack on Iran’s oil infrastructure could lead to heightened geopolitical risks, complicating relationships with global partners and provoking a more aggressive response from Tehran.

Adding to the market’s complexity, Libya’s resolution of a dispute over its central bank leadership has resulted in the reopening of oilfields and export terminals, restoring its production capacity of 1.3 million barrels per day. Iran, operating under U.S. sanctions, still produces around 4.0 million barrels per day. Together, these developments add some reassurance to the market, even as geopolitical risks linger.

Key Supply Developments:

Libyan Oil Production: Resumed operations following the resolution of internal political disputes, bringing an additional 1.3 million barrels per day back to the market.

OPEC Spare Capacity: The cartel’s spare capacity is providing a safety net, reducing immediate fears of a sharp supply shortage.

🚨 Oil Market Update 🚨#WTI rises to $73.32 amid escalating Middle-East tensions. Geopolitical instability is fueling concerns over potential supply disruptions as US President #Biden discusses strikes on #Iran's oil infrastructure with Israel.

📉 #OPEC+ has capacity to offset… pic.twitter.com/Ntwvm9c2ua

— UTrada (@utrada_global) October 4, 2024

Technical Analysis: WTI Crude Oil’s Short-Term Prospects

WTI Crude Oil is trading at $73.59, showing a mild bullish bias. Immediate resistance is at $74.02, with further levels at $74.75 and $75.42. A breakout above these levels would confirm further upward momentum. However, if WTI fails to clear $74.02, it may experience a pullback to immediate support at $73.05, followed by $72.44 and $71.97. The 50-day Exponential Moving Average (EMA) at $71.97 provides additional support, reinforcing the cautiously bullish outlook.

The Relative Strength Index (RSI) is currently at 71.36, suggesting that prices are nearing overbought territory. This condition could trigger short-term profit-taking, particularly if geopolitical tensions ease over the weekend. Overall, traders should watch for a decisive breakout above $74.02 for bullish confirmation, while a decline below $73.05 may signal potential downside risks.

Technical Levels to Watch:

Resistance: $74.02, $74.75, $75.42

Support: $73.05, $72.44, $71.97

RSI Indicator: 71.36—indicates overbought conditions, signaling a possible short-term pullback.

The current balance between geopolitical risks and ample supply suggests that oil prices will remain highly sensitive to news developments. Traders should stay vigilant, as the market remains poised for potential volatility in the near term.