BOC Macklem Evasive on Rate Cuts, USDCAD Heads to 1.34

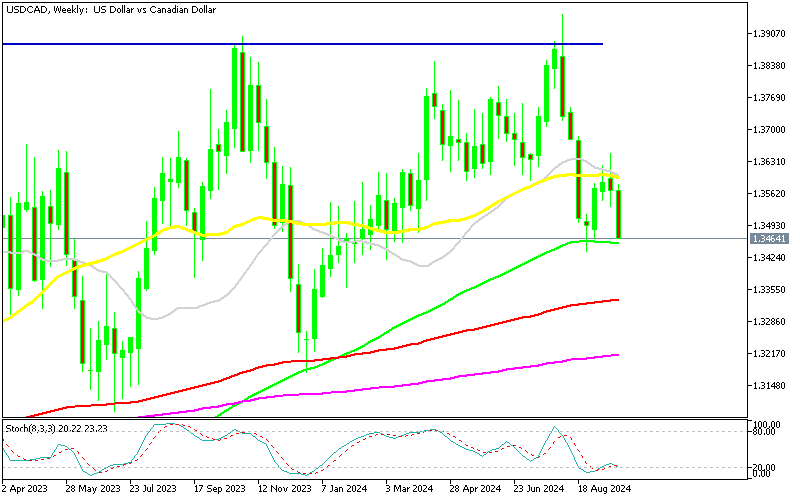

USDCAD has been trading in a 2-cent range since the last week of August, with the USD doing most of the work. Moving averages have been acting as support and resistance on the weekly chart, with the 100 SMA being under threat now, which will open the door for 1.34 if it breaks.

In early September, the Canadian dollar (CAD) lost ground, trailing other commodity currencies. The USD/CAD pair climbed nearly 2 cents from its August lows, reaching 1.3648. Economic concerns have weighed on the CAD, especially as the Bank of Canada (BoC) has shifted to a more dovish stance and already lowered interest rates. However, the U.S. Federal Reserve’s 50 basis point rate cut had a larger impact, pushing USD/CAD lower.

USD/CAD Chart Weekly – The 200 SMA Has Been Broken

On the weekly chart, the 50 SMA (yellow) acted as resistance, and following a doji candlestick, the pair reversed bearish, dropping towards the 100 weekly SMA (green), which provided support in both August and November of last year. If this moving average breaks, the pair could move towards the 1.34 level. Additionally, Bank of Canada Chairman Tiff Macklem gave a speech today, which could offer further insight into the BoC’s monetary policy direction.

Bank of Canada (BoC) Governor Tiff Macklem Key Points:

- Policy Rate Outlook: Macklem signaled that further cuts to the BoC’s policy rate are likely, but emphasized that the timing and pace of these cuts will depend on incoming data and their implications for future inflation.

- Inflation and Economic Goals: He noted that the BoC is pleased to see inflation at 2%, which aligns with the bank’s target. However, the focus now is on maintaining that level, particularly as core inflation remains slightly above the 2% mark.

- Economic Indicators: Macklem emphasized the importance of closely monitoring consumer spending, business hiring, and investment trends. These factors will play a critical role in determining future economic health and guiding monetary policy.

- Borrower Concerns: He raised concerns about the rising share of borrowers who, despite not having a mortgage, are carrying high credit card balances—specifically, those with balances at 90% or more of their credit limit. This group, which consists largely of renters, has seen a notable increase in financial stress.

- Digital Currency and Payment Systems: The BoC is scaling back its work on a retail central bank digital currency (CBDC) and is now focusing more on broader research related to payment systems and policy development in this area.

- Growth and Labor Market: Macklem expressed a desire to see growth rise above 2%, and hinted that any further adjustments in the labor market might lead to higher unemployment.

The USD/CAD pair continues to slide following Bank of Canada (BoC) Governor Macklem’s dovish remarks. The price is approaching the August low of 1.3436, which could open the door for a further drop toward this year’s lows, just above 1.34. The Canadian dollar (CAD) has strengthened as a result of Macklem’s comments, particularly his indication of future rate cuts and the BoC’s commitment to maintaining inflation near its 2% target. With the USD/CAD trading at new lows, the CAD is gaining momentum, reflecting market confidence in Canada’s economic outlook compared to the US dollar.

USD/CAD Live Chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |