UK Services Slowdown, GBPUSD Highest Since 2022

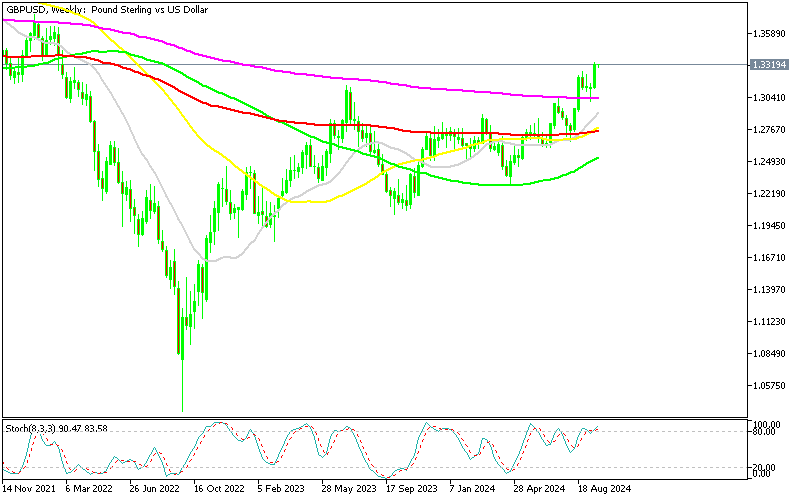

Last week, the British pound (GBP) stood out, supported by the Bank of England’s (BoE) decision to keep interest rates unchanged. By Friday, GBP/USD had reached 1.3340, marking its highest level since February 2022. The BoE’s choice to maintain its policy stance without rushing to ease rates has provided solid backing for the pound, leading to a bullish outlook against most other major currencies.

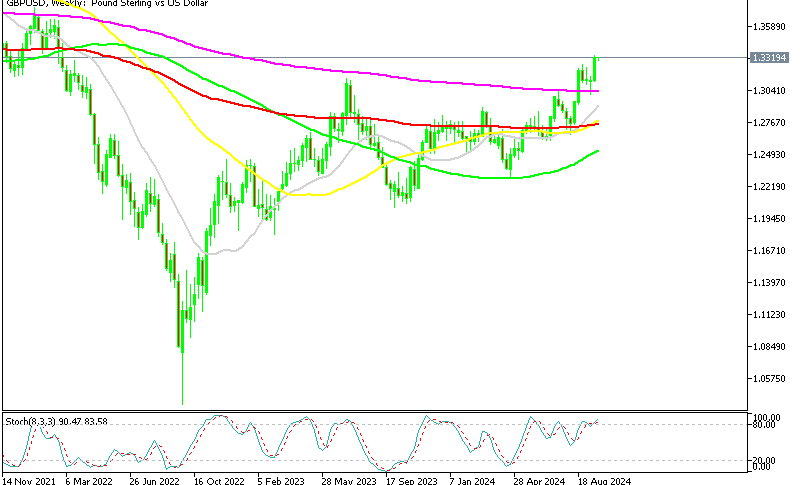

GBP/USD Chart Weekly – The 200 SMA Has Turned Into Support Now

The GBP/USD pair surged following decisions by both the BoE and the Federal Reserve, with the daily chart reflecting a strong rebound. The Bank of England’s neutral monetary policy approach signals that they are not in a hurry to lower rates, reinforcing market confidence in the pound.

With the BoE adopting a more hawkish tone and the Federal Reserve showing dovish tendencies, the GBP/USD pair is unlikely to test the 1.30 level soon. Earlier in the month, the 200-week simple moving average (SMA) flipped from resistance to support at 1.3030, highlighting the importance of holding above this key zone.

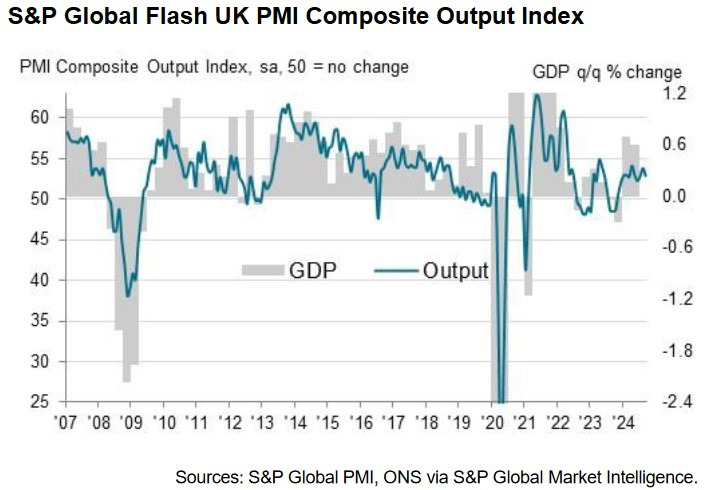

The August UK PMI data which was released earlier today, signals a general slowdown in both services and manufacturing. While both sectors remain in expansion territory, the pace of growth has significantly weakened. This deceleration points to a cooling economy, with business activity and output moderating across key sectors. The continued weakening in the manufacturing sector is particularly concerning, as it faces a three-month low, reflecting subdued demand and production pressures. These figures reinforce the need for close monitoring of the UK’s economic trajectory as the momentum continues to fade.

UK Services and Manufacturing PMI Report for August

- UK Services PMI:

- Reported at 52.8, below the expected 53.5 and previous 53.7 (August).

- Marked a two-month low, indicating a slowing pace of growth in the services sector.

- UK Manufacturing PMI:

- Came in at 51.5, lower than the forecasted 52.5 and matching the previous month’s reading of 52.5.

- Hit a three-month low, reflecting weakened momentum in the manufacturing sector.

- Composite PMI:

- Recorded at 52.9, below the expected 53.5 and previous 53.8 (August).

- Reached a two-month low, suggesting that the overall economic activity in the UK is slowing.

Key Findings:

- UK PMI Composite Output Index:

- 52.9 in September, down from 53.8 in August, a two-month low indicating a deceleration in overall output growth.

- UK Services PMI Business Activity Index:

- Dropped to 52.8 from 53.7 in August, signaling a two-month low for business activity in the services sector.

- UK Manufacturing Output Index:

- Fell to 53.5 from 54.4 in August, marking a three-month low for manufacturing output.

- UK Manufacturing PMI:

- Decreased to 51.5 from 52.5 in August, reflecting a three-month low and a slower pace of growth in the manufacturing sector.

GBP/USD Live Chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |