Forex Signals Brief Sept 20: BOJ Meeting, UK, Canada Retail Sales

After the initial shock of the Fed’s unexpected 50 basis point rate cut, market sentiment shifted dramatically within 24 hours. Equities opened strong and maintained momentum as investors embraced a risk-on mood. However, the forex market responded more cautiously. The Fed’s dovish stance reduced concerns about a recession but increased worries over a higher terminal rate or potential inflation, impacting long-term bond yields.

The US dollar experienced a volatile day, spiking after stronger-than-expected data from initial unemployment claims and the Philadelphia Fed manufacturing index. However, gains were limited as the broader market digested the Fed’s position. In the UK, the British pound had its own challenge navigating the Bank of England’s unexpectedly hawkish policy decision.

The GBP surged to a yearly high following the announcement but struggled to sustain momentum, dropping to 1.3225 before USD weakness helped lift it back to 1.3280 later in the day. Despite the volatility, the market ultimately settled, with the FX landscape defined by a delicate balance between economic data and central bank actions. The combination of strong U.S. data and monetary policy uncertainties left both the dollar and pound in a state of flux, as traders gauged the future trajectory of rates and inflation.

Today’s Market Expectations

Today’s forex spotlight is on the Bank of Japan (BoJ) meeting, where interest rates are expected to stay unchanged at 0.25%. Market participants will closely follow the press conference for any clues on when the BoJ might consider a future rate hike. BoJ officials have hinted at the possibility of interest rate increases as they aim to return to a more neutral monetary policy stance. However, concerns over market instability suggest the central bank is likely to hold off until the Federal Reserve makes more progress in its easing cycle before tightening further.

Meanwhile, the People’s Bank of China (PBoC) is also expected to keep its one-year and five-year Loan Prime Rates (LPR) steady at 3.35% and 3.85%, respectively. With weak economic data and lingering deflationary risks, there’s mounting pressure on Chinese policymakers to accelerate monetary easing and lower real interest rates from their current elevated levels to support growth. On top of that, we have the retail sales from Canada and the UK which are expected to remain stable.

Yesterday the volatility continued as a post-FOMC reaction, with the USD jumping 1 cent initially, only to reverse the gains later and end up lower. The largest move came during the Asian session, which got many traders on the wrong foot. We had two losing traders early, but made up during the day, ending up with five winning forex signals in the end.

Gold Touches $2,600 After the FOMC and Falls $50

Gold has been on an upward trajectory, briefly touching $2,600 yesterday after the FED’s 50 basis point rate cut. While there was a $50 drop following the announcement, strong buying pressure reemerged overnight, driving prices close to another record high. Despite positive US Unemployment Claims indicating stable employment (and thus reducing recession fears), which gave the USD a modest boost and pushed gold back below $2,570, key moving averages have provided support. In particular, the 100 SMA (green) helped stabilize prices after yesterday’s decline, and gold is once again showing upward momentum, with expectations for another record high as demand for safe-haven assets remains strong.

XAU/USD – Daily chart

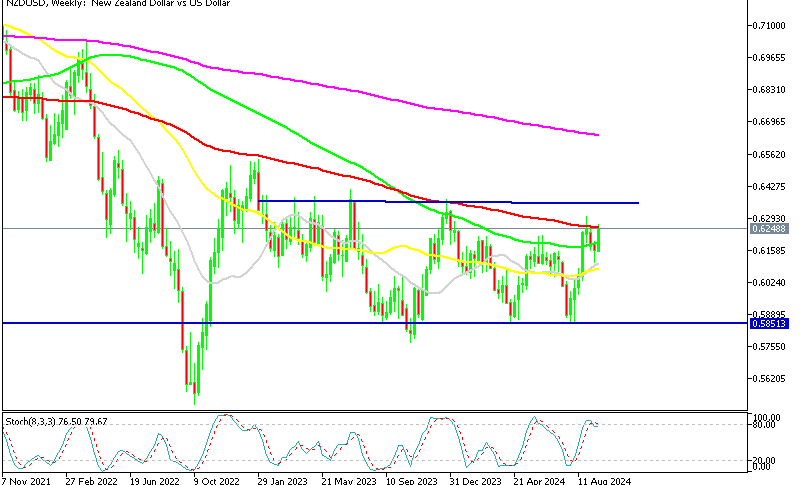

NZD/USD Retest the 100 Weekly SMA

The NZD/USD pair has remained in a consistent downtrend, with the weekly chart highlighting key moving averages acting as critical resistance points. The 100 Simple Moving Average (SMA), shown in red, has proven to be particularly significant. After a large bounce in August and another rally this week, the pair is once again testing this level. Despite gaining a cent earlier in the week, the NZD/USD gave back those gains following the FED meeting, only to see buyers return as optimism improved due to expectations of a “soft landing” for the US economy. This renewed risk sentiment pushed the price back above 0.62, but resistance around the 0.6250-60 zone (the level of the 100-week SMA) has prevented further upward movement.

NZD/USD – Weekly Chart

Cryptocurrency Update

Bitcoin Keeps Banging at the 100 SMA

Bitcoin, which surged from over $20,000 in October 2023 to more than $70,000 by April 2024, has been in a steady decline since. Lower highs and lows have been the norm, driven by fears of a US recession that triggered a global sell-off in early August, pushing the cryptocurrency below $50,000. The 50-day SMA has provided crucial support during this downturn, with buyers stepping in to curb losses. However, Bitcoin has struggled to overcome resistance at old support levels and remains unable to break above $60,000. After attempting to revisit this area yesterday, buyers were once again stalled at the 100 SMA.

BTC/USD – Daily chart

MAs Hold As Support in Ethereum

Similarly, Ethereum has been in a downtrend since March, falling from $3,830 to under $3,000 by June. While there was a brief rebound above the 50-day moving average, severe selling pressure soon followed, driving the price below $2,200. Despite this, Ethereum found strong support at that level and recently bounced off the 100-week SMA, forming a bullish candlestick pattern. This suggests increased buying activity and the potential for a reversal of the current bearish trend in Ethereum.

ETH/USD – Weekly chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |