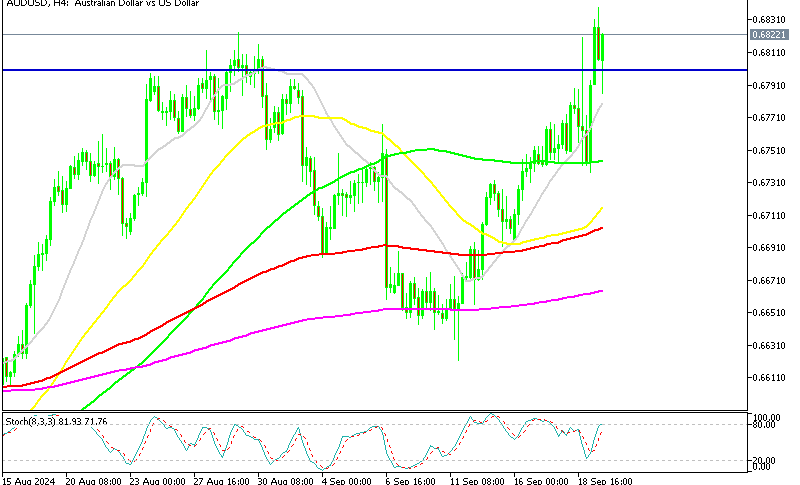

xau-usd

Gold Holds Close to $2,600, Despite Strong Unemployment Claims

Skerdian Meta•Thursday, September 19, 2024•2 min read

Gold has been surging higher and yesterday XAU touched $2,600 after the 50 bps FED rate cut. We saw a $50 retreat afterward, but it found strong bids again overnight, sending the Gold price close to the new record high, despite the positive Unemployment Claims in the US, which show that employment remains stable, so no recession risk.

That helped the USD somewhat, sending Gold dipping lower below $2,570, but moving averages held as support, with the 100 SMA (green) providing support, after the decline yesterday stopped at the Red moving average. We’re seeing a bounce in Gold prices right now, as safe havens remain in demand, so Gold buyers will likely make another record high soon.

Gold Chart H1 – MAs Holding As Support During Retreats

Initial jobless claims came in stronger than expected at 219K, compared to the 230K estimate. This marks the lowest level since the third week of May when claims were at 216K. The previous week’s initial claims were revised slightly higher from 230K to 231K, and continuing claims for the prior week were revised from 1.850 million to 1.843 million. The four-week moving average for initial claims decreased by 3,500 to 227.5K, with the prior week’s average revised up by 250 to 231.0K. Continuing claims came in lower at 1.829 million, below the 1.854 million estimate. The four-week moving average for continuing claims also fell by 6,500 to 1.844 million from the revised average of the prior week.

The Weekly US Initial Jobless Claims and Continuing Claims

- Initial jobless claims: Reported at 219K, lower than the 230K estimate, marking the smallest level since May when claims stood at 216K.

- Prior week’s claims: Revised slightly higher from 230K to 231K.

- Continuing claims: Revised for the prior week from 1.850M to 1.843M.

- 4-week moving average (initial claims): Decreased by 3,500, now at 227.5K, compared to the previous week’s revised average of 231.0K.

- The prior week’s average was revised up by 250 from 230.75K.

- Current continuing claims: Lower than expected at 1.829M, versus an estimate of 1.854M.

- 4-week moving average (continuing claims): Fell by 6,500 to 1.844M, compared to the prior week’s revised average.

Gold Live Chart

GOLD

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

3 h ago

Save

Save

4 h ago

Save

Save

9 h ago

Save

Save