Gold Outlook: XAU Support at $2,560 Holds as Fed Meeting Looms

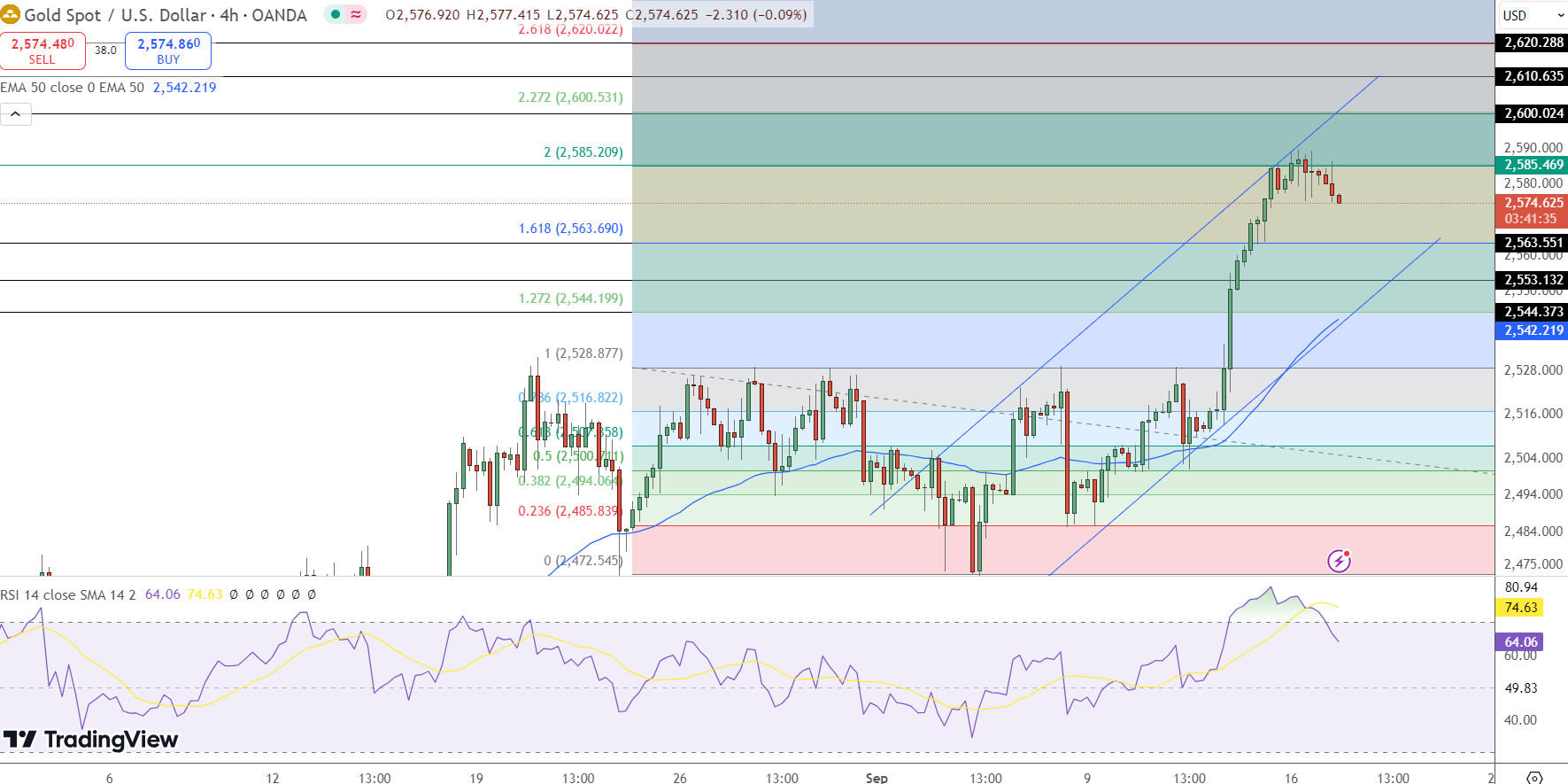

Gold (XAU/USD) is trading lower during the Asian session, hovering around $2,574.62, down 0.22% after a three-day rally to a fresh record high.

The decline is largely attributed to traders repositioning ahead of the Federal Open Market Committee (FOMC) meeting, set to start later today.

This shift has allowed the U.S. Dollar (USD) to recover slightly from its year-to-date lows, adding pressure on the precious metal. However, expectations of a more aggressive rate cut by the Federal Reserve continue to support gold, keeping potential losses in check.

#Gold Market Outlook – September 17

Market Update:

– Gold opened strong at 2583.7

– Peak price reached: 2584.4 (prior to news)Key Levels:

– Resistance Zone: 2590-2595-2600

– If this zone holds, gold may retreat to 2580-2575-2570#xauusd pic.twitter.com/Q27NEyHxz4— XAU-Trader (@Pham_XAUUSD) September 17, 2024

Fed Rate Cut Speculation and Global Factors Boost Gold

Market anticipation of a 50 basis point rate cut by the Fed on Wednesday is key to gold’s recent price action. According to the CME FedWatch Tool, there’s now over a 60% chance the Fed will reduce rates by 50 bps, based on weaker U.S. inflation data.

Lower bond yields have also driven demand for gold, with the 2-year Treasury yield at its lowest since September 2022, and the 10-year yield at its weakest since June 2023.

Further bolstering gold is ongoing uncertainty surrounding U.S. politics and concerns over a slowdown in China’s economy, which continues to miss growth targets.

Additionally, geopolitical tensions in the Middle East are elevating gold’s appeal as a safe-haven asset.

Technical Outlook for Gold: Support and Resistance Levels

Gold is showing signs of consolidation as it approaches important technical levels. Immediate support is found at $2,563.55, with the next key support at $2,533.13. A break below these levels could lead to further downside.

However, if gold holds these support points, bullish momentum may resume.

Gold hovers near record high on prospects of bigger Fed rate cut

Gold prices remained stable on Tuesday, staying close to the record highs reached in the previous session. This stability comes as markets look forward to the start of a U.S. easing cycle, with speculation pic.twitter.com/bxitgwUtYY

— Chris Wealth Management Pvt Ltd (@chriswealthman1) September 17, 2024

The pivot point at $2,585.47 is the main resistance level. Should gold breach this point, it could push toward $2,600.02 and potentially $2,610.64. The RSI at 64 indicates that gold is nearing overbought conditions, signaling a possible short-term pullback.

The 50-day Exponential Moving Average (EMA) at $2,542.22 continues to provide a key support level for the broader uptrend.

Key Events to Watch This Week

- Tuesday, Sep 17: U.S. Core Retail Sales (forecast 0.2%) and Retail Sales (forecast -0.2%) could impact USD strength, influencing gold prices.

- Wednesday, Sep 18: The Fed will announce its Federal Funds Rate decision, which is expected to remain at 5.50%, but any dovish signals could support gold.

- Thursday, Sep 19: U.S. Unemployment Claims (forecast 230K) will provide further insight into the state of the economy and its influence on gold demand.

Conclusion

Gold’s performance this week will be closely tied to the outcome of the FOMC meeting and the Fed’s economic projections. A more aggressive rate cut could push gold higher, but any signs of hawkishness may trigger a pullback.