EURUSD Bounces As 1.10 Holds, Despite Dovish ECB

EURUSD retreated 2 cents off the August high, but Euro sellers couldn't send it below 1.10, even with a dovish ECB.

EURUSD retreated 2 cents off the August high, but Euro sellers couldn’t send the price below 1.10, even with a dovish ECB, as the Eurozone economy weakens. The price consolidated for a couple of trading sessions just above this major level and yesterday we saw a considerable bounce off this zone, indicating strong buying pressure down there.

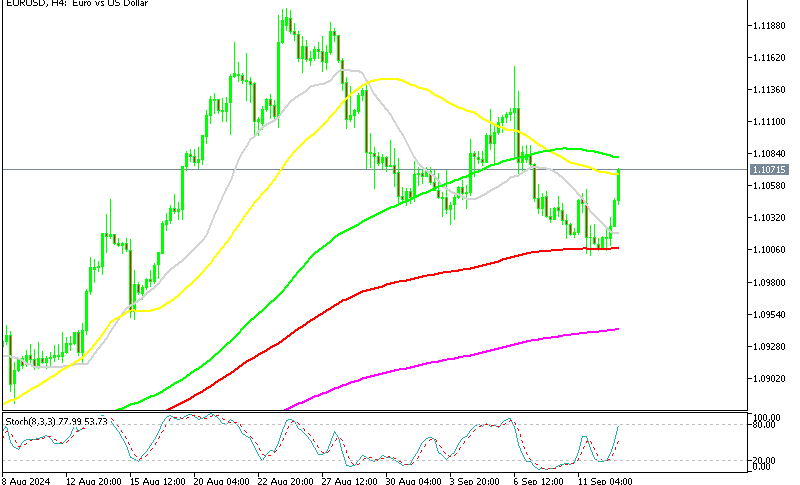

EUR/USD Chart H4 – MAs held As Support at 1.10

The EUR/USD pair showed strength last month, climbing above 1.12, but by the end of August, the price began to decline, dropping to the 1.10 level as the U.S. dollar made a mild recovery. This shift in momentum reflects growing concerns over the economic outlook in the Eurozone.

ECB Rate Cuts and Economic Outlook

Due to ongoing weakness in the Eurozone economy, the European Central Bank (ECB) was compelled to lower interest rates, cutting them by 25 basis points yesterday. Some analysts believe this marks the beginning of a more aggressive approach to monetary easing. According to Bloomberg, certain ECB officials are keeping the door open for another rate cut during the October meeting, driven by the downside risks to European Union economic growth.

Contradicting Rumors on Future ECB Rate Cuts

However, later reports from Reuters quoted additional ECB sources who stated that another rate cut in October is unlikely unless there is a significant economic downturn. Policymakers appear cautious about moving too quickly, preferring to wait for more substantial data before making further decisions.

Next Steps for ECB Policy

Despite the recent rate cut, another reduction is not expected in October. By mid-October, there will not be sufficient new data to justify such a move, and ECB officials are inclined to wait until December to review updated forecasts. To trigger another rate reduction, a marked slowdown in growth would be necessary. So, while the ECB is monitoring economic conditions closely, further rate cuts will depend on future economic data and growth trends.

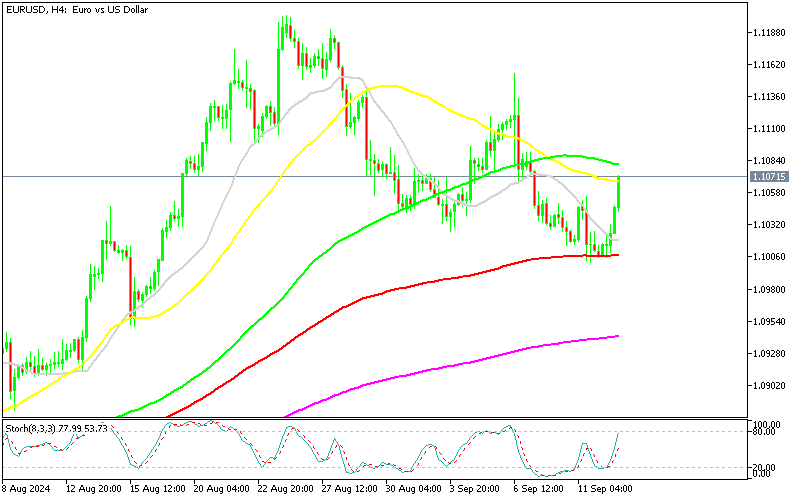

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account