Gold and the CHF have been bearish for about a week, as USD buyers returned, but today the USD dipped lower after the soft JOLTS job openings numbers for July, which showed that the weakening trend continues for the US labour market. We were short on Gold and the CHF since yesterday, making some nice profit and today’s traders were going in the right direction, but they missed the take profit (TP) targets by just a couple of mere pips, when the reversal took place.

Gold Chart H1 – Highs Keep Getting Lower

Gold’s Support and Resistance Dynamics

Gold fell to a low of $2,070 yesterday, a significant support and resistance zone, and it retested that area today. The price rallied for the second time, driven primarily by escalating geopolitical tensions in the Middle East and growing expectations of a 50 basis point rate cut by the Federal Reserve after disappointing employment data. Despite this, a stronger US dollar continues to limit gold’s upward movement, keeping it below key resistance levels.

Gold Trading Strategy and Market Reaction

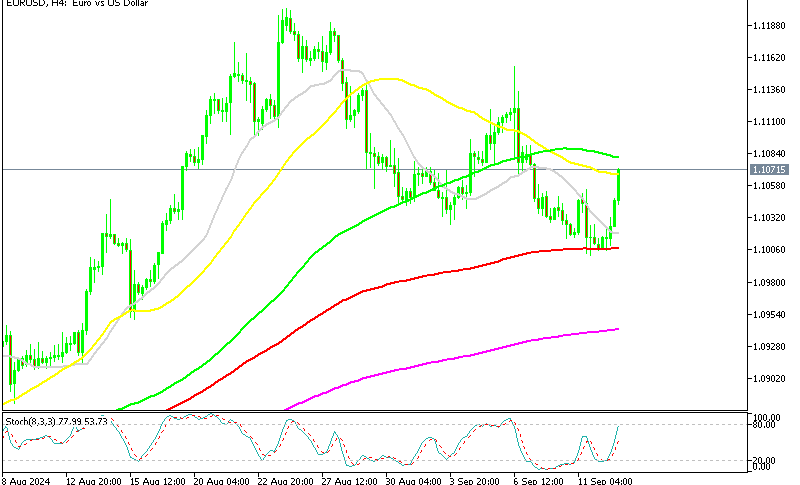

We initiated a sell trade at the 50 SMA (yellow) on the H4 chart, expecting a continuation of the bearish trend that has persisted since last week. The trade was on track until a jump above the 50 SMA, triggered by soft US employment figures, disrupted our plan. However, the rally has encountered resistance at the 100 SMA (red), where the price is now reversing lower. We are maintaining our sell position as the pattern of lower highs suggests that the short-term trend remains bearish.

USD/CHF Chart H4 – The 50 SMA Is Acting As Support

USD/CHF Rebound and Outlook

USD/CHF dropped over 6 cents to 0.84 in the past two months, but it rebounded above 0.85 late last week after a sharp bullish reversal that pushed the pair more than 1 cent higher. The return of USD buyers has significantly contributed to this positive shift since mid-last week. However, with the Federal Reserve likely to cut interest rates by 50 basis points this month, the USD is losing momentum. Following today’s JOLTS job openings data, USD/CHF fell approximately 40 pips. Despite this, the price remains above the 50 SMA (yellow) on the H4 chart, which has acted as support since USD/CHF moved above it last week. We’re holding a buy signal for USD/CHF, confident in the upward trend.

Gold Live Chart

GOLD