aud-usd

AUDUSD Fails at Resistance as Australian GDP Slows

Skerdian Meta•Wednesday, September 4, 2024•2 min read

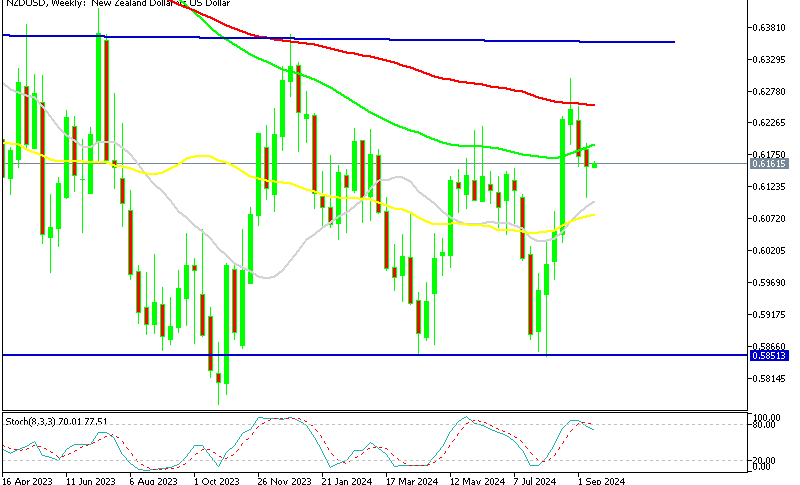

In August, the Australian dollar demonstrated notable strength, but it failed at the 0.68 resistance and now sellers have taken control of AUD. AUDUSD failed to hold the gains above that major resistance level and last week we saw a reversal lower, with the decline picking up pace yesterday, with the price falling to 0.67 lows, ahead of the Q2 GDP report from Australia.

The AUD/USD experienced a significant rally in August, climbing nearly 5 cents from a low of 0.6350 to reach a 2024 high of 0.6823. However, this bullish momentum soon faded, with USD buyers stepping in and driving the pair down by over a cent, bringing it closer to the 20-day SMA (gray) on the daily chart. Several factors are weighing on the Australian dollar.

Last week’s manufacturing PMI report pointed to a struggling Australian economy, and expectations for the second-quarter GDP were low, with forecasts predicting a decline to 1% year-on-year from 1.1% in Q1—marking the slowest growth rate since the COVID-19 shutdown in 2020.

AUD/USD Chart Daily – Buyers Failed at Resistance

In addition to domestic economic challenges, declining commodity prices, particularly iron ore, and a lackluster Chinese economy are creating a bleak outlook for the AUD. Despite the U.S. Federal Reserve preparing to cut interest rates, the Reserve Bank of Australia (RBA) has not signaled any intention to start a monetary easing policy, further complicating the AUD’s prospects.

Australian GDP Report for Q2

- Quarterly Growth: Australia’s GDP for Q2 2024 grew by 0.2% quarter-over-quarter, slightly below the expected increase of 0.3%. This follows a revised Q1 GDP growth rate of 0.2%, which was initially reported at 0.1%.

- Annual Growth: On a year-over-year basis, the GDP for Q2 2024 matched expectations at 1.0%. This marks a slight decline from the 1.1% growth recorded in Q1 2024.

- Economic Context: The modest growth figures reflect ongoing challenges in the Australian economy, with slower-than-anticipated expansion amid global economic uncertainties and domestic pressures. The revised Q1 figures provide a slight improvement but indicate that economic momentum remains subdued.

AUD/USD Live Chart

AUD/USD

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

3 hours ago

Save

Save

4 hours ago

Save

Save

10 hours ago

Save

Save