usd-chf

Strong Swiss Retail Sales and Dovish SNB Can’t Help USDCHF

Skerdian Meta•Monday, September 2, 2024•2 min read

Amidst the recent financial market turbulence, traditional safe-haven assets have demonstrated significant strength. USDCHF has dropped over 8 cents, while both the Japanese yen and gold have seen even greater gains. Despite a positive risk sentiment reflected in the stock market, the Swiss franc (CHF) has also exhibited its typical safe-haven appeal.

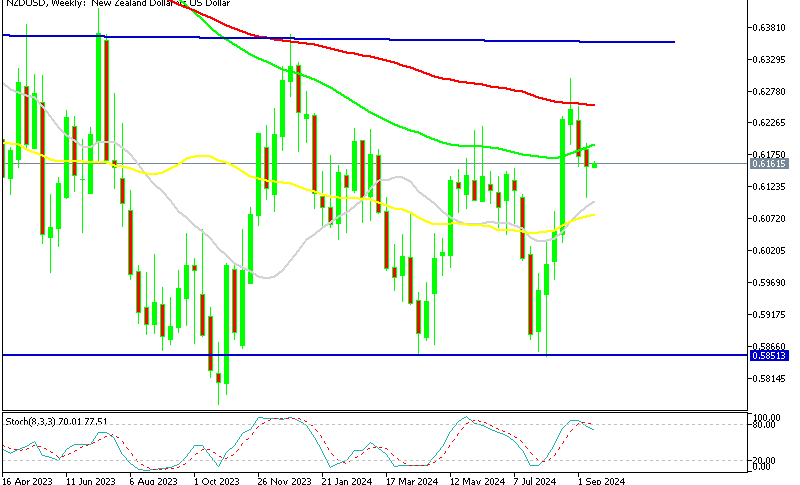

USD/CHF experienced a notable rise during the first four months of 2024, climbing nearly 8 cents as the Swiss franc weakened following two consecutive interest rate cuts by the Swiss National Bank (SNB). However, since May, the pair has been in a downtrend, driven by market sentiment that the SNB has limited room for further rate cuts. This decline accelerated in July and early August, wiping out all the gains made earlier in the year, with the pair hitting 0.84 last week.

USD/CHF Chart Weekly – Heading for 2023 Lows

The appreciation of the CHF is a concern for the SNB, as it impacts the Swiss economy, particularly reflected in retail sales figures, which have mostly been negative for the past year. Last week, SNB Chairman Thomas Jordan spoke at an event in Riehen, highlighting the challenges posed by the strong Swiss franc to the Swiss economy. It is clear that the central bank is not pleased with the current exchange rate. This situation warrants attention, as the SNB might consider intervention to weaken the CHF in the future, although immediate action seems unlikely at this point.

SNB’s Commitment to Price Stability

- Jordan affirmed the SNB’s commitment to maintaining price stability, targeting an inflation rate of 0-2%, which has been achieved for over a year.

- Early response to inflationary pressures helped the SNB control price rises, enabling two interest rate cuts this year.

- Interest rates remain the primary tool for the SNB, but currency market interventions are also possible.

- Markets currently anticipate a 70% chance of a 25 basis point rate cut at the next SNB meeting on September 26.

USD/CHF Live Chart

USD/CHF

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

3 hours ago

Save

Save

4 hours ago

Save

Save

10 hours ago

Save

Save