AUDUSD Fails at 0.68 Resistance, As China Manufacturing Slows

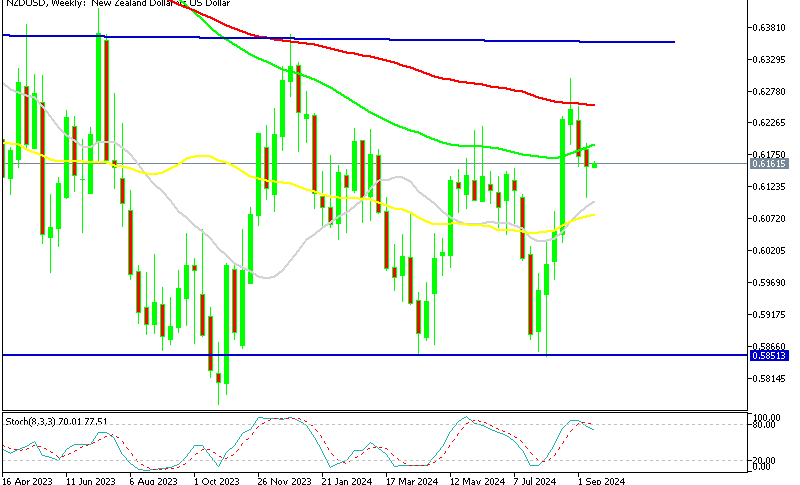

In August, the Australian dollar demonstrated notable strength, with AUDUSD rising nearly 5 cents from its low of 0.6350 early in the month to a high of 0.6823, marking the first time this year it reached such levels. This represents a significant reversal, moving from its lowest to highest point of the year within just a few weeks. However, the bullish momentum appears to be waning, as signs of buyer fatigue emerge. The price ended the week below 0.68, forming an upside-down hammer candlestick, which is a bearish reversal signal, especially following recent losses.

Additionally, the stochastic indicator shows overbought conditions on a weekly timeframe, suggesting a potential pullback. Just above August’s peak lies the 100-week SMA (red), a resistance level that has previously hindered upward movements for AUD/USD . With the price potentially reversing lower, there is a possibility of at least a 2-cent decline towards the 50-week SMA (yellow), which could act as a support level. This setup indicates that the Australian dollar may face challenges ahead, and traders should be cautious of a possible retracement in the coming weeks.

AUD/USD Chart Weekly – The Resistance at 068 Holds

August 2024 Official Chinese Manufacturing and Services PMI (National Bureau of Statistics)

- Manufacturing PMI: Recorded at 49.1 points, below expectations of 49.5 points, and down from the previous reading of 49.4 points. This marks continued contraction in the manufacturing sector.

- Services PMI: Came in at 50.3 points, slightly above the expected 50.0 points, and an improvement from the prior 50.2 points, indicating modest expansion in the services sector.

- Composite PMI: Stood at 50.1 points, marginally down from the previous 50.2 points, suggesting overall economic activity is just above the expansion threshold but showing signs of slowing momentum.

- Manufacturing Sector Concerns: The drop in manufacturing PMI highlights ongoing struggles with demand and potential impacts from external trade tensions and internal structural challenges.

- Services Sector Resilience: Despite a slight decline, the services sector remains in expansion territory, which could be a positive sign for domestic consumption and economic diversification.

- Overall Economic Outlook: The marginal decrease in the composite PMI suggests that while there are areas of growth, the overall pace of economic recovery remains fragile, with risks still present from both domestic and global factors.

Weak Spots for the Chinese Economy:

- Uncertain Property Sector Outlook: The property sector is struggling with high levels of debt, creating uncertainty about its future stability and growth.

- Subdued Consumer Confidence and Demand: Weak consumer confidence is leading to lower domestic demand, further slowing economic momentum.

- Manufacturing Overcapacity: Certain manufacturing sectors are experiencing overcapacity, which can lead to inefficiencies and downward pressure on prices.

- Below-Target Underlying Inflation: Inflation remains below the target, influenced by weak domestic demand and supply overcapacity, raising concerns about deflationary pressures.

- Potential for Higher Tariffs on Chinese Exports: Future trade tensions could result in increased tariffs on Chinese exports, which would further strain economic growth and complicate trade relationships.

- Regulatory Uncertainty: Ongoing changes in regulations and policies are adding to the uncertainty, making it difficult for businesses to plan long-term investments.

- Global Economic Slowdown: A potential slowdown in the global economy could impact China’s export-driven sectors, exacerbating the challenges faced by the domestic economy.

AUD/USD Live Chart

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |