NZDUSD Holds Above 0.60 as NZ Services, Manufacturing Improve

The NZD is showing resilience despite the surprise RBNZ 25 bps rate cut, with NZDUSD consolidating above the 0.60 level, which is the upper range for this pair since 2022. The economic situation seems to be getting better, with manufacturing and services PMI showing an improvement in activity in July, however, it’s too early to tell. Besides that, we will also have to keep an eye on China, as it is increasing efforts to help boost its economy, which might be a big help the the Kiwi later on.

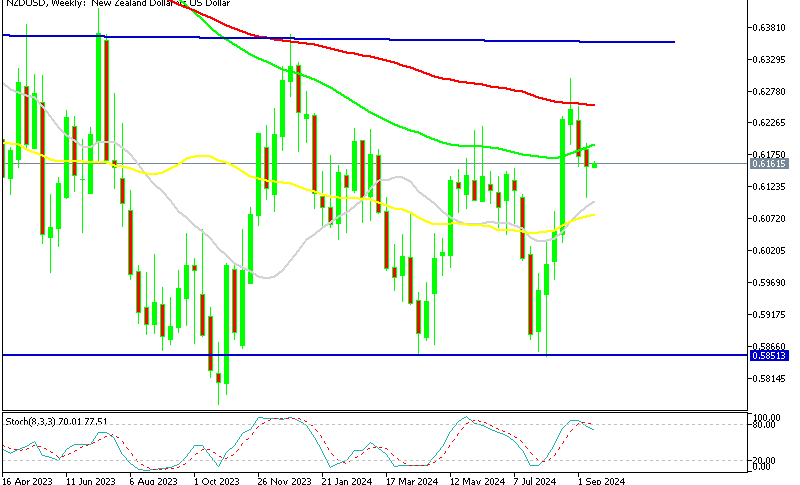

NZD/USD Chart Daily – The Return Above 0.60 Was Fast

On the daily chart, NZD/USD briefly rose above 0.60 but sharply reversed after Wednesday’s US CPI report, leading to a bearish engulfing candlestick pattern and a drop to 0.5974. However, buyers stepped in as USD selling resumed, pushing the price back into the higher range where it was consolidating by Friday.

New Zealand Services PMI for July via BusiznessNZ 2024

BNZ – BusinessNZ Performance of Services Index for July

- July Services PMI: The BNZ-BusinessNZ Performance of Services Index (PSI) for July rose to 44.6 points, showing improvement from June’s revised figure of 40.7 points. This indicates that the contraction in the services sector has slowed, although it remains below the 50-point threshold, signifying continued contraction.

- June Services PMI Revision: The services PMI for June was slightly revised upward from 40.2 points to 40.7 points, reflecting a marginally better performance than initially reported.

- Composite Services PMI: The composite services PMI, which combines the services and manufacturing sectors, increased to 44.3 points in July, up from 40.9 points in June. This also indicates ongoing contraction but at a slower pace.

- Sector Outlook: Despite the improvements in the July figures, the services sector in New Zealand continues to face challenges, with overall activity still in contraction territory. This ongoing weakness may signal underlying issues that need addressing for sustained recovery.

The report highlighted that New Zealand’s services sector showed signs of recovery in July after a particularly poor performance in June, with the activity index rising to 44.6 points. This is the best result since May, though still indicative of contraction. For 2024, the services index has averaged 46.5 points, a decline from the historical average of 53.2 points. BNZ Senior Economist Doug Steel emphasized that despite the recent improvement, the PSI remains below the levels seen during the 2009 Financial Crisis, underscoring the ongoing challenges faced by the service sector.

New Zealand Manufacturing PMI for July via BusiznessNZ 2024

- New Zealand July Manufacturing PMI 44.0 points

- July Manufacturing PMI was 41.1 points

BusinessNZ’s Director of Advocacy, Catherine Beard, mentioned that the industry continues to face challenges. BNZ Senior Economist Doug Steel added that manufacturing activity is likely to pick up once the broader economy strengthens. While easing financial conditions, such as a lower OCR, will help, it will take time for these changes to translate into increased sales.

NZD/USD Live Chart

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |