usd-jpy

USDJPY Breaks Below 145 After BOJ Minutes

Skerdian Meta•Monday, August 5, 2024•2 min read

The Japanese Yen has significantly appreciated against major currencies, particularly against the USD, with USDJPY losing more than 15 cents in the last 4 weeks. On Friday the JPY closed right at the bottom, as monetary policies between the Bank of Japan and the Federal Reserve are diverging, with the BOJ delivering a 15 bps rate hike last week and perhaps followed by another hike as last night’s BOJ minutes showed, while markets are pricing in a 50 bps interest rate cut by the FED.

The Bank of Japan’s (BOJ) intervention earlier in July and the rate hike last week, have been the main reasons for the crash in this pair, adding here the negative risk sentiment after the softer Q2 earnings from multinationals in July. Otherwise, there is little fundamental support for the Yen’s rise. The USD/JPY reversed course last month after climbing close to 162. In less than a month, this pair has lost 10% of the value. Moving averages on lower timeframe charts have provided some support.

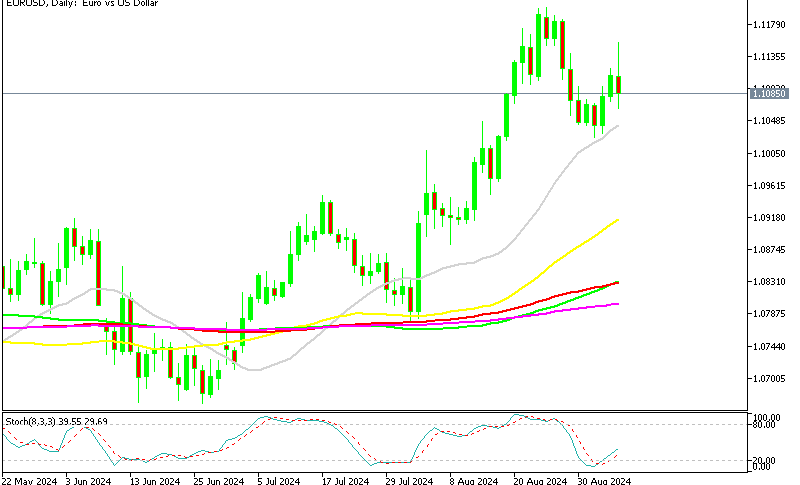

USD/JPY Chart Daily – Sellers Pushing Below 20 SMA at 146

The USD/JPY is also being pulled down by the drop in the stock market and US Treasury yields as well. This pair is approaching a critical swing area around 146, where the 20 SMA (gray) comes on the monthly chart, which has acted as support before. This level will test the sellers’ resolve. Can they push below this area and generate additional downward momentum? Or will buyers step in to defend support, preventing a drop below the swing area’s low point?

Bank of Japan June Meeting Minutes

- A few members said import prices rising due to recent yen fall, creating upside inflation risk

- One member said cost-push inflation could heighten underlying inflation if it leads to higher inflation expectations, wage increases

- One member said pass-through of higher labour costs accelerating, could appear in consumer inflation

- One member said BOJ might need to consider adjusting degree of monetary easing as inflation might overshoot due to renewed cost-push pressure

- One member said BOJ must raise rates at appropriate timing without delay

- One member said rate hike must be done only after inflation makes clear rebound, data confirms heightening in inflation expectations

- Members agreed recent weak yen pushes up inflation, warrants vigilance in guiding monetary policy

- One member said BOJ’s monetary policy should not be swayed by short-term fx moves

USD/JPY Live Chart

USD/JPY

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

3 hours ago

Save

Save

7 hours ago

Save

Save

8 hours ago

Save

Save