A significantly worse-than-expected jobs report for July fueled fears that the economy might hit a recession, sending stocks plunging sharply down on Friday. The broad market index ended the day down 1.84 percent, at 5,346.56 index points

The tech-heavy Nasdaq Composite closed at 16,776.16 index points with a 2.43% loss, increasing its decline from its most recent all-time high to nearly 10%. The Dow Jones Industrial Average fell 610.71 points, or 1.51%, to settle at 39,737.26 index points. The 30-stock index was down 989 points at its daily low point,

The Nasdaq with a decline of almost 10% from its peak is the first of the three major indexes to enter a correction zone. The Dow was 3.9% behind its all-time high and the S&P 500 was 5.7% below its peak.

After July’s unexpected slowdown in job growth in the United States and an increase in the unemployment rate to its highest level since October 2021, stocks plunged.

According to the Labor Department, nonfarm payrolls increased by just 114,000 last month, less than the 185,000 economists surveyed by Dow Jones had predicted, and a slowdown from the 179,000 jobs added in June. The rate of unemployment rose to 4.3%.

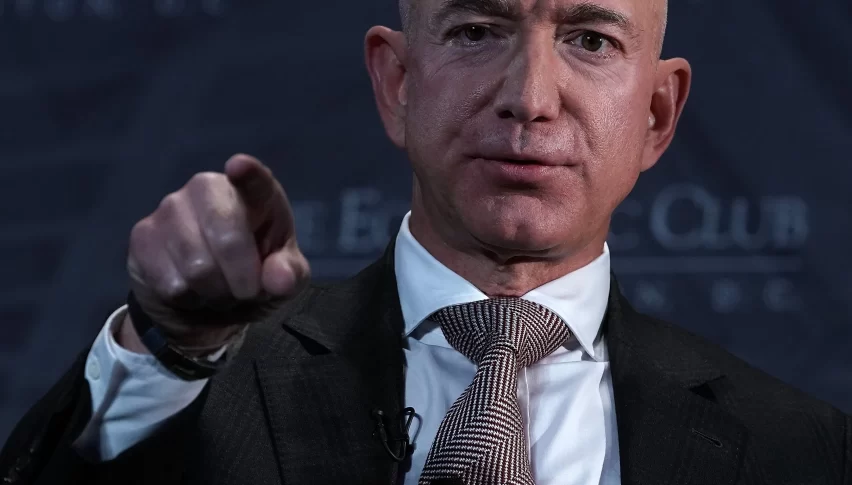

Amazon’s second-quarter results aroused investor concerns regarding Big Tech’s high capital expenditure on artificial intelligence. The massive online retailer dropped 8.8% after releasing a dismal forecast and missing Street revenue projections. Meanwhile, Intel plummeted 26% with the announcement of a poor outlook and layoffs. Nvidia saw a 1.8% decline after dropping 6% the day before.

The S&P 500 has moved more than 1% in the last three trading sessions, indicating that this week has been extremely volatile. When the Fed strongly hinted that rates might be cut at its upcoming meeting in September, the stock market responded positively on Wednesday. Many investors are beginning to feel that the central bank will take action on Wednesday in light of Friday’s dismal job data.