Consumer Confidence Stabilizing, but US Consumers Still Cautious

The US consumer who has been a strong force behind the resilience of the US economy, was weakening in Q1, but in Q2 the consumer...

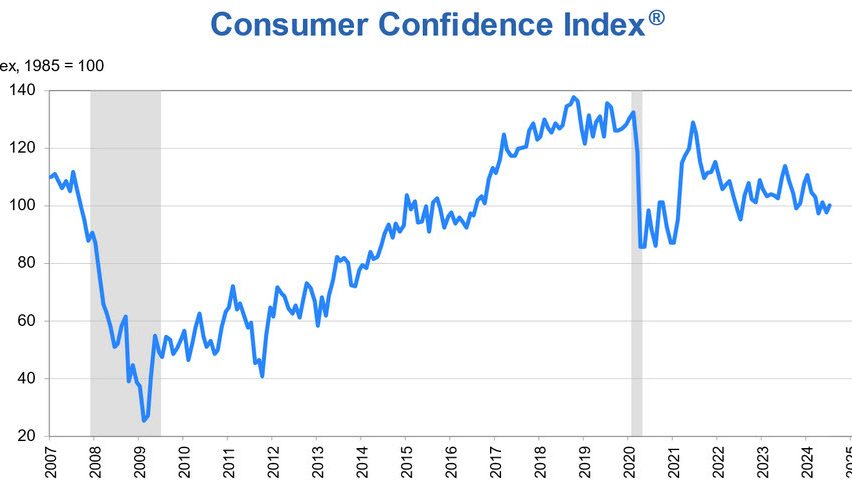

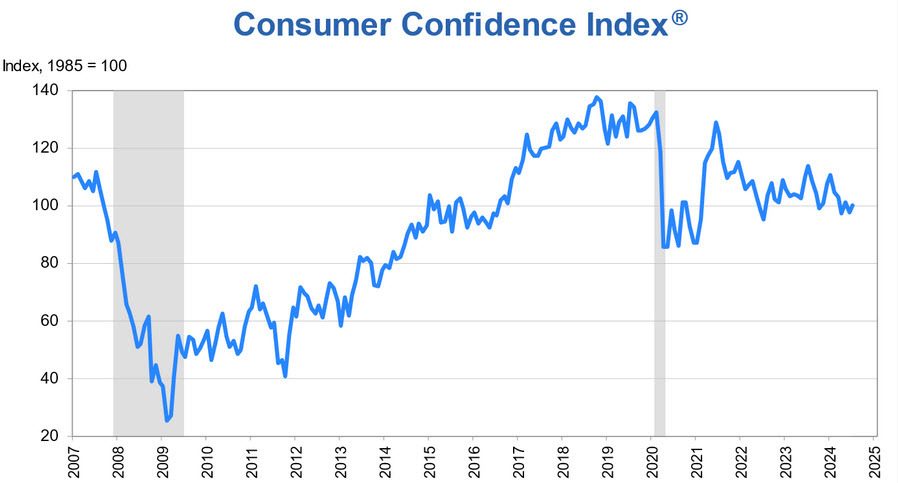

The US consumers who have been a strong force behind the resilience of the US economy in the last four years, were increasingly showing weakness in Q1 of 2024, but in Q2 the sentiment has stabilized. The CB Consumer Confidence indicator went through a steep decline in the first three months of this year, however, it has been stabilizing above 100 points, which is positive for the US dollar.

US Consumer Confidence for July 2024 (The Conference Board)

- July Consumer Confidence Index: 100.3 (higher than the expected 99.7)

- Previous Month’s Consumer Confidence: 100.4

- Expectations Index: 78.2 (up from 72.8 in the prior report)

- Present Situation Index: 133.6 (down from 135.3 previously)

- Percentage of Consumers Saying Jobs Are “Hard to Get”: 16.0% (up from 15.7%)

- 12-Month Inflation Expectations: 5.4% (unchanged from the previous month)

- Six-Month Moving Average for Home Purchasing Plans: Fell to a 12-year low

The Conference Board’s chief economist, Dana M. Peterson, noted that while consumer confidence did see a slight uptick in July, it remained within the narrow range established over the past two years. Although consumers generally still view the labor market favorably, they continue to be concerned about rising costs, interest rates, and future uncertainties, which are not expected to improve significantly until next year.

Consumers’ outlook for the future was somewhat less pessimistic compared to a month ago. While there was a slight improvement in expectations for future income, overall perceptions of business and employment conditions remained subdued. At the same time, opinions on the current state of labor and business conditions were slightly less positive. This may reflect the impact of slower monthly job gains, with consumer perceptions of the job market at their lowest since March 2021, despite still being relatively optimistic.

The ‘current situation’ index hit a three-year low, indicating clear signs of an economic slowdown and reduced consumer spending. There is a notable declining trend in spending on discretionary services: An additional survey question revealed that anticipated spending on services was weaker in July 2024 compared to July 2023.

Consumers indicated plans to cut back on various luxuries over the next six months, including personal travel, gaming, and amusement parks. They also expressed a preference for less expensive services, such as streaming, over going to the movies. Despite these anticipated cuts in discretionary spending, consumers continued to prioritize non-discretionary expenses, such as healthcare and automotive services.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account