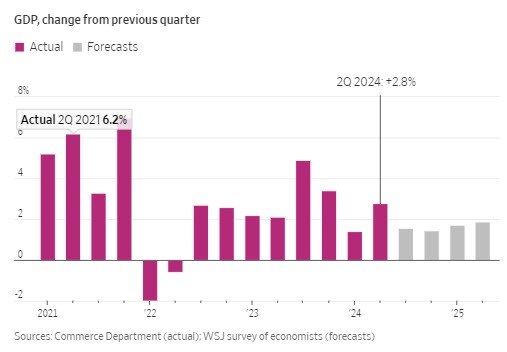

Q2 US GDP Not As Strong If You Disregard Inventories

Today we got the advanced GDP for Q2, with the headline coming in at 2.8%. However, if you strip out inventories which showed a jump in Q2, the numbers don’t look too hot, and that’s one of the reasons for the USD not surging higher after the report. The components were higher compared to Q1 for sure, which confirms the improving trend, but it’s not particularly strong, as the headline number would suggest.

US GDP Advance Estimate for Q2 2024

- GDP Growth: Q2 GDP grew by 2.8%, surpassing the estimated 2.0%. This follows a 1.4% growth in Q1 and a 3.4% rise in Q4 2023.

- Atlanta Fed GDPNow Estimate: The estimate was at 2.6% for Q2.

- GDP Sales: Increased by 2.0%, aligning with the estimated 1.9%, and consistent with the prior 2.0%.

- Consumer Spending: Rose by 2.3%, up from 1.5% in the previous quarter.

- GDP Deflator: Recorded at 2.3%, below the 2.6% estimate and prior 3.1%.

- Core PCE Prices: Increased by 2.9%, above the 2.7% estimate, but down from the prior 3.7%.

- PCE Prices: Rose by 2.6%, compared to 3.4% in the previous period.

- PCE Excluding Food, Energy, and Housing: Recorded at 2.5%, down from 3.3%.

- PCE Services Excluding Energy and Housing: Decreased to 3.3% from 5.1%.

- Inventories: Increased by 6.9%, contributing 0.8% to the quarterly GDP data.

- Business Investment: Rose by 5.2%, reflecting increased spending on equipment.

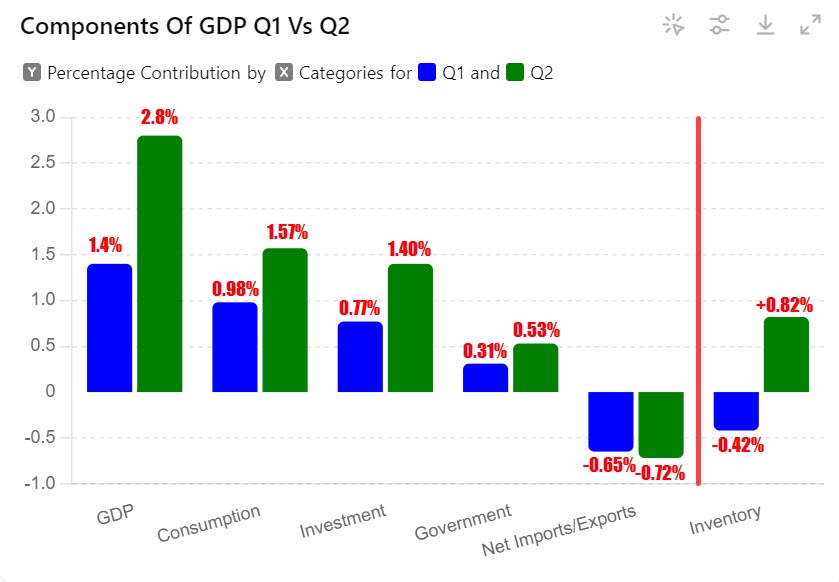

Contributors and Detractors to the 2.8% GDP Growth:

- Consumption: Added 1.57% (up from 0.98% last quarter)

- Investment: Contributed 1.46% (up from 0.77% last quarter)

- Government Spending: Added 0.53% (up from 0.31% last quarter)

- Net International Trade: Subtracted 0.72% (compared to a 0.65% subtraction last quarter)

Consumer spending increased mainly due to a rise in services and products, which grew by 2.3%. This growth was accompanied by a notable increase in inventory, which added 0.8% to the GDP compared to a subtraction of -0.4% in the previous quarter. The decline in PCE (Personal Consumption Expenditures) measures offers positive news for inflation trends. While the core PCE came in slightly higher than expected at 2.9% (versus 2.7%), it marked a significant decline from 3.7%.

The headline PCE also fell, decreasing from 3.4% to 2.6%. In terms of investment, inventories contributed an increase of 0.82%, a turnaround from the previous quarter’s -0.65%. Excluding the inventory fluctuation, the underlying growth rate for the month was around 2%. Similarly, if the inventory swing from the previous quarter is excluded, the 1.4% growth figure adjusts to approximately 2.0%, indicating a consistent trend of expansion. End-of-year Federal Reserve projections indicate a reduction of 69 basis points, compared to 72 basis points before the release of GDP and durable goods data.

Comparing Q1 and Q2 GDP Components

GDP growth for the first quarter was reported at 1.4%. Today, the advanced GDP figure for the second quarter was released, showing an increase of 2.8%. When examining the components contributing to or detracting from the overall GDP figure, it’s important to note that inventory changes are included in the investment component.

These inventories can fluctuate, as they did from a negative contribution of -0.42% in Q1 to a positive contribution of +0.82% in Q2. What if we adjusted the GDP figures for these inventory fluctuations? In the first quarter, inventories reduced GDP by -0.42%. Including this adjustment, the growth rate excluding inventory impacts was roughly 1.8% for Q1.

For Q2, if we exclude the inventory gain of 0.82% from the total 2.8% gain, the adjusted GDP growth would be just below 2.00%. Combining the two quarters and excluding the impact of inventories, the growth rate averages around 1.9%, which aligns with the overall trend. This could suggest that the U.S. economy is experiencing a soft landing, which the Federal Reserve may interpret as a positive sign, especially considering the stronger growth in the second quarter.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |