USD Down, Silver Up As US Manufacturing Falls in Contraction

Silver crashed lower last week, but the support zone below $28 held and today buyers remain in control as USD dips following the soft manufacturing PMI. However, the climb has been slow, indicating that buyers are weak and considering that in the next two days we have the Q2 US GDP and the PCE price index, which is the main inflation report for the FED, then it’s understandable that buyers are not running away with anything.

Silver Chart H4 – MAs Are Turning Into Support

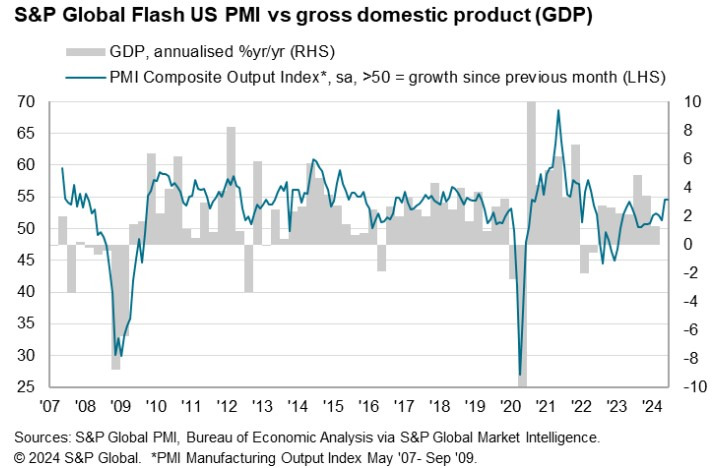

Besides that, the services report was quite impressive, showing a decent jump. The Services sector demonstrated strong growth, reaching a 28-month high, the Manufacturing sector showed signs of contraction, hitting a 7-month low. The overall Composite PMI indicates steady economic expansion, but the divergence between the robust services sector and the weakening manufacturing sector suggests underlying challenges in the economy. This mixed performance may influence market expectations and economic policy decisions moving forward.

US Manufacturing and Services PMI Report – 24 July 2024

-

July Flash Services PMI:

- Actual: 56.0 points

- Expected: 55.0 points

- Previous: 55.3 points

-

July Flash Manufacturing PMI:

- Actual: 49.5 points

- Expected: 51.7 points

- Previous: 51.6 points

-

July Flash Composite PMI:

- Actual: 55.0 points

- Previous: 54.8 points

Key Findings in US Manufacturing and Services Data

- Composite Output Index: Reached 55.0 points, a 27-month high (June: 54.8 points).

- Services Business Activity Index: Rose to 56.0 points, a 28-month high (June: 55.3 points).

- Manufacturing Output Index: Fell to 49.5 points, marking a 6-month low (June: 52.1 points).

- Manufacturing PMI: Declined to 49.5 points, a 7-month low (June: 51.6 points).

US Composite PMI for July

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, provided insights on the latest PMI data:

“The preliminary PMI figures suggest a ‘Goldilocks’ scenario as the third quarter begins, with the economy expanding at a strong pace while inflation continues to moderate.”

“July has seen the fastest growth in output across manufacturing and services in over two years, with the survey data pointing to an annualized GDP increase of 2.5%, following a 2.0% rise indicated for the second quarter.”

“The average price increase for goods and services has also slowed, aligning with the Federal Reserve’s 2% inflation target.”

“However, there are some concerning aspects in both the growth and inflation outlooks that need close monitoring in the coming months.”

“On the growth front, the expansion appears uneven, with manufacturing slipping back into contraction while the service sector strengthens. Some of this decline in production is attributed to staff shortages, which may be temporary, as indicated by improved confidence in future growth prospects within the sector. Nevertheless, both manufacturers and service providers are expressing heightened uncertainty due to the upcoming election, impacting investment and hiring.”

“Regarding inflation, the survey noted an increase in input costs, driven by rising expenses for raw materials, shipping, and labor. If these higher costs persist, they could lead to higher selling prices or squeeze profit margins.”

Silver Live Chart

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |