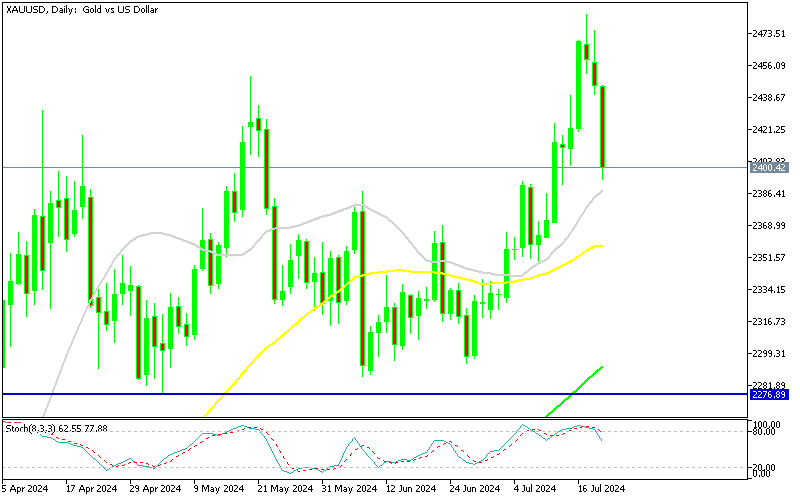

A Normal Pullback or Bearish Reversal As Gold Falls to $2.400?

Gold price accelerated the decline on Friday, printing a low of $2.393.77 and closing exactly at $2.400, after the massive rally in July.

Gold price accelerated the decline on Friday, printing a low of $2.393.77 and closing exactly at $2.400, after the massive rally earlier in July. Gold started to retreat slowly by midweek after putting a new record high at $2,483 but on Friday the decline accelerated, as XAU lost $40 and more than $80 from the highs.

Gold Chart Daily – Will MAs Hold As Support?

US Dollar Decline in July

The US dollar experienced a drop in July as investors anticipated that the Federal Reserve would start reducing rates in September. This expectation kept US Treasury bond yields near multi-month lows, leading the dollar to hit three-month lows by midweek and driving gold to new record highs. However, after a negative reversal in the latter part of the week, gold has become a new target for buyers.

Gold Price Movements

The gold price (XAU/USD) has been on a downward trend for three consecutive days, falling to around $2,400 during Friday’s American session. The US Dollar Index (DXY) rebounded to approximately 104.30 on Friday, as higher treasury yields increased the opportunity cost of investing in non-yielding assets like gold, making it a more expensive option for investors.

Profit-Taking for Gold Traders

The precious metal is facing profit-taking after hitting new all-time highs above $2,480 on Tuesday. Gold has also been pressured by a recovery in the US Dollar and bond yields amid growing speculation that the Republican Party will be victorious in the upcoming US Presidential elections. Gold rose by 3% in the first half of the week, surpassing its all-time highs set in May.

However, it subsequently retreated, selling off in the second part of the week and dropping further, forming an inverted hammer weekly candlestick that suggests possible further declines. Despite the recent downturn, there remains a possibility of a reversal and a push to new record highs for gold. Both scenarios are open for gold traders, and the upcoming week will provide more clarity on the market direction. FED Member Williams made some comments at the end of the day/week sounding slightly bullish, which might have contributed to the decline as well.

Comments from the NY FED Chair Williams

- Fed remains committed to reaching the 2% inflation target.

- Central banks must take responsibility for controlling inflation.

- Price stability is essential for financial stability.

- Long-term trends influencing the neutral interest rate (R-star) are still ongoing.

Gold Price Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account