What to Expect from the ECB Meeting Today?

Today the main event is the ECB meeting, with expectations for no action this time, so attention will shift to the rhetoric regarding the future rate policy. EUR/USD has been bullish in July, approaching 1.10 mainly due to USD weakness, since the Euro doesn’t have anything going for itself, so today’s meeting might propel this pair above 1.10 if the ECB explicitly refuses to commit to further rate cuts.

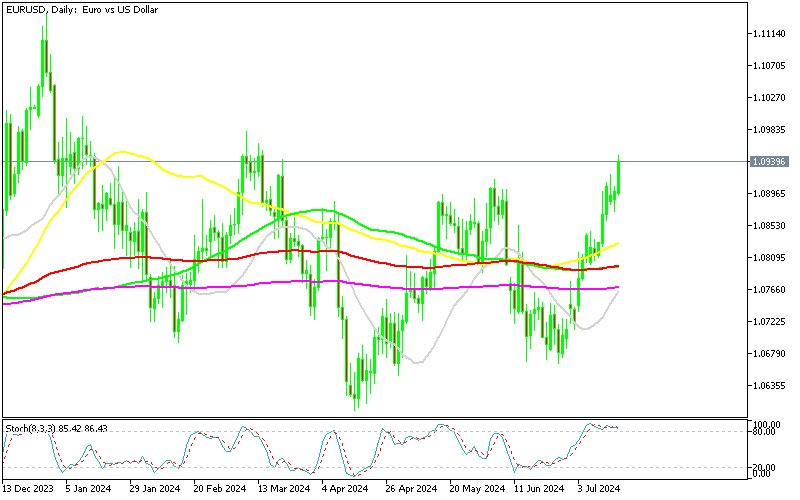

EUR/USD Chart Daily – Testing February Highs

The ECB recently delivered a 25 bps rate cut, but they have been non-committal about further rate reductions, even though market expectations suggest more are coming. The bullish momentum in the USD has supported the EUR/USD pair, but with the price now at the upper end of the range and a slowing Eurozone economy, as indicated by today’s ZEW economic sentiment, a bearish reversal seems imminent. The strong bullish momentum seen in July is likely to end as the Eurozone economy shows increasing signs of weakness.

ECB’s Stance and Future Rate Cuts

The market is projecting an additional 45 basis points of easing by the end of 2024. In the previous meeting, the ECB cut rates for the first time since 2019, stating that the “Governing Council is not pre-committing to a particular rate path.” Economists agree that the ECB will likely maintain current rates, with markets placing an 88% chance of such an outcome. The ECB is expected to keep interest rates unchanged at 3.75%. ECB members have repeatedly stated that they will not act in July, preferring to wait for more data, shifting the focus to policy cues for the September meeting.

Economic Indicators and Market Sentiment

Since the June announcement, headline HICP has ticked lower to 2.5% from 2.6% previously. Some analysts note that sticky services inflation at 4.1% has kept “core CPI too elevated for another imminent rate cut.” Q2 GDP data which will be out at the end of July, will provide further insights. Recent PMI indicators have shown a decline, with the Eurozone manufacturing print dipping to 45.8 points from 47.3 points, and services slipping to 52.8 points from 53.2 points, leaving the composite at 50.9 points vs. 52.2 points. The labor market remains strong, with the unemployment rate at a historical low of 6.4%.

Official Rhetoric and Market Pricing

Official statements suggest a rate cut this month is unlikely. President Lagarde has noted that officials are not in a hurry to cut rates again after June’s move, requiring additional reassurance that inflation is headed back towards 2% before making further cuts. Hawks on the Governing Council, like ECB’s Knot, have explicitly stated there is no reason to cut in July, adding that the next truly open meeting is in September. Therefore, the upcoming meeting is expected to be a non-event, with policymakers waiting to see how data plays out between now and September. Market pricing currently assigns a roughly 80% chance of a cut, with a total of 46 bps of easing expected by year-end.

EUR/USD Live Chart

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker |

| 🥈 |  | Visit Broker |

| 🥉 |  | Visit Broker |

| 4 |  | Visit Broker |

| 5 |  | Visit Broker |

| 6 |  | Visit Broker |

| 7 |  | Visit Broker |