USD Finds Some Grown As Philly FED Manufacturing Improves

It was quiet today as markets settled down after yesterday's volatility, awaiting the ECB meeting and the US Philly FED manufacturing index.

It was quiet early today as markets settled down after yesterday’s volatility, awaiting the ECB meeting and the US Philly FED manufacturing index. The JPY fell since BOJ data showed no signs of intervention, following yesterday’s tumble in USD/JPY , which has stabilized today.

Meanwhile, the pound softened as GBP/USD remained below 1.3000, despite UK labor market data indicating high wage pressures for the BOE. Overall, there was minimal action in the FX market, with other major currencies not performing well, partly due to today’s calmer stock market. Following yesterday’s tech selloff in US stock markets, futures are holding steady, but it is still early, and the overall tone may shift later in the US session. The ECB policy decision to hold rates steady and defer action until the September meeting, didn’t cause much concern among traders for now.

US July Philly Fed Manufacturing Report

Headline Manufacturing Index

- +13.9 (vs. +2.9 expected) – Significantly higher than anticipated, indicating robust manufacturing activity.

- Prior: +1.3

Six-Month Outlook

- +38.7 (vs. +13.8 prior) – Strong improvement, reflecting optimistic future expectations.

Capital Expenditures (Capex)

- +7.4 (vs. +12.1 prior) – Decrease, suggesting lower investment plans.

Employment

- +15.2 (vs. -2.5 prior) – Significant increase, indicating strong job growth in the sector.

New Orders

- +20.7 (vs. -2.2 prior) – Major increase, reflecting a surge in demand.

Prices Paid

- +19.8 (vs. +22.5 prior) – Slight decline, indicating easing input costs.

Prices Received

- +24.2 (vs. +13.7 prior) – Increase, suggesting higher selling prices.

Shipments

- +27.8 (vs. -7.2 prior) – Significant increase, indicating strong product delivery.

Unfilled Orders

- +9.1 (vs. +8.9 prior) – Slight increase, showing a modest rise in backlog.

Delivery Times

- +8.5 (vs. -9.4 prior) – Improvement, suggesting quicker delivery times.

Inventories

- -9.4 (vs. -6.4 prior) – Larger decline, indicating a drawdown in stock levels.

Average Employee Workweek Hours

- -1.6 (vs. +4.8 prior) – Decrease, suggesting reduced working hours.

Compared to previous months, the July Philly Fed manufacturing report presents a notably more optimistic picture, with activity rising across various metrics. The headline index surged to +13.9, significantly surpassing the expected +2.9, and reflecting robust manufacturing activity. Particularly, new orders jumped to +20.7 from -2.2, and shipments rose dramatically to +27.8 from -7.2, highlighting a strong demand and delivery performance.

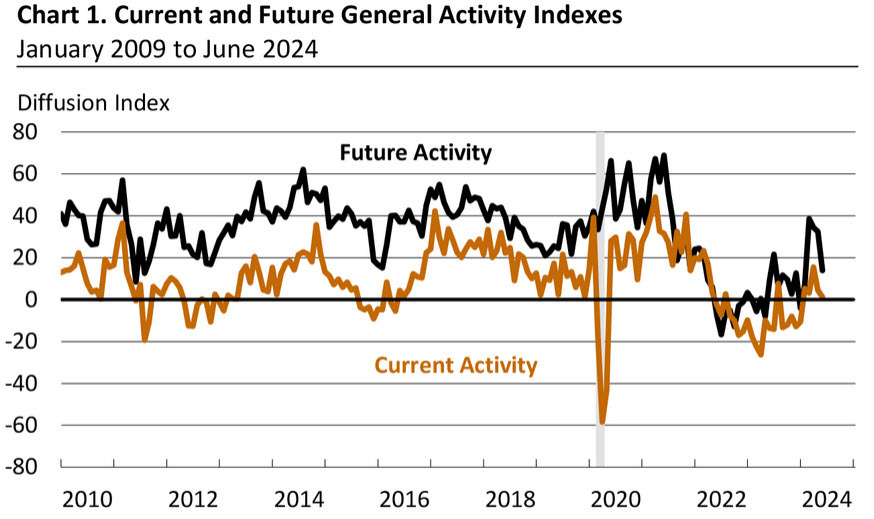

The increase in the future activity index to +38.7, up from +13.8, indicates that manufacturers are increasingly optimistic about growth prospects. This optimism persists despite ongoing inflation pressures, as evidenced by the prices received index climbing to +24.2 from +13.7. While prices paid slightly eased to +19.8 from +22.5, suggesting some moderation in input costs, inflation remains a concern. Employment metrics also show significant improvement, with the employment index rising to +15.2 from -2.5, reflecting strong job growth in the sector.

However, there are mixed signals in the workforce data which was also highlighted by the higher US Unemployment claims which were released at the same time. The average employee workweek decreased to -1.6 from +4.8, suggesting reduced working hours despite the increase in employment. Overall, the report underscores a resurgence in manufacturing activity and a cautiously optimistic outlook among manufacturers, even as they navigate persistent inflationary pressures.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account