Today is election day in the UK, however, the GBP and FTSE 100 index haven’t shown much worry, remaining on a steady path. However, the volatility can kick off in the evening as the first exit polls and results start to come out, so we’ll keep an eye on the exit polls as the day progresses.

Market Reactions Post-Announcement

The market has remained notably calm since Prime Minister Rishi Sunak’s unexpected announcement of a short and fast campaign. Surprisingly, the announcement caused hardly a ripple in the markets, and this trend has persisted as election day nears. Several factors may be contributing to this market stability, which we will explore shortly. Despite recent changes in the UK political landscape, it is understandable that market participants have maintained their composure. In contrast, the UK population has faced soaring prices and numerous political challenges over the past decade.

GBP/USD Price Action

As election day approaches, the GBP has rebounded against the US Dollar, with GBP/USD surging approximately 100 pips higher yesterday. While polls indicate a significant political shift, many doubt that the decision will have a major impact on the economy. Given the future government’s limited fiscal flexibility, monetary policy will bear the responsibility for stimulating growth.

Potential Volatility in GBP and FTSE 100

The potential for further advancement by Nigel Farage’s Reform Party may introduce some short-term volatility in the GBP and lead to notable gains. Economists have differing views on the likely trajectory of inflation following the election, which will determine the level of interest rates set by the Bank of England (BoE), subsequently affecting the Pound Sterling.

UK Economic Outlook

Overall, we anticipate slightly higher near-term growth and moderately higher inflation under a Labour majority compared to the current government’s promises. Specifically, we would expect a growth boost of roughly 0.1 percentage point in 2025 and 2026, likely resulting in modest increases in wage growth and inflation. The effects on the BoE would likely be minimal, though there is a risk of slower rate cuts if Labour achieves a significant increase in the Living Wage.

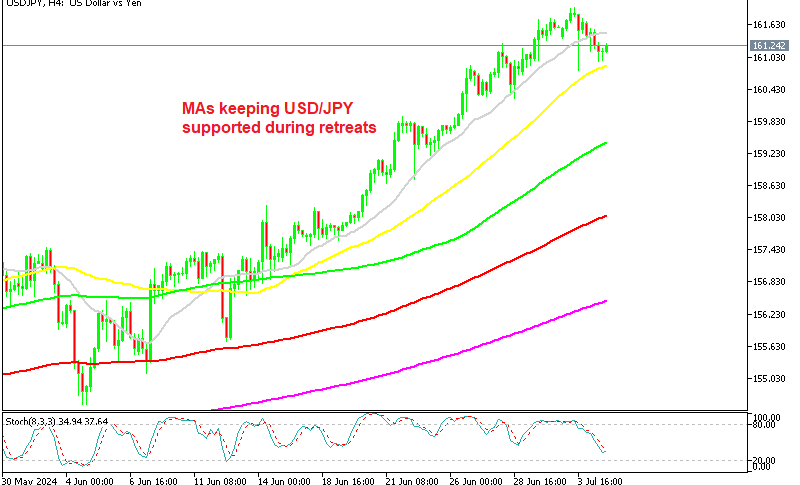

GBP/USD Technical Analysis

On the daily chart, GBP/USD bounced off the support at 1.2635. Buyers entered with a clear risk below this level, positioning for a rally towards the 1.28 handle. Sellers will aim to see the price break below the 1.2635 support.

GBP/USD Live Chart

GBP/USD