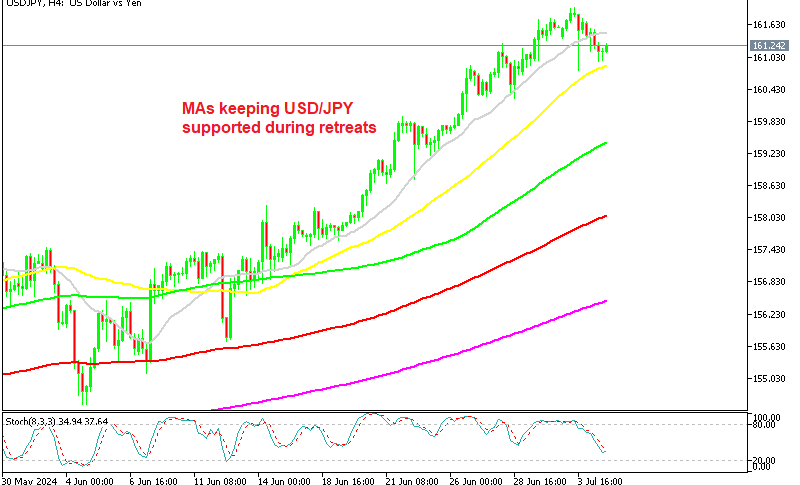

AUD USD was stuck in a 1-cent range for more than two months, but we got a bullish break yesterday, after the soft ISM services from the US which sent the USD 60 pips lower. The RBA continues to maintain the hawkish bias, while markets expect the FED rate cut odds to increase as the US economy keeps showing increasing weakness.

The strong retail sales in May from Australia which showed a 0.6% increase yesterday also helped keep the sentiment positive for the AUD. Retail sales in Australia rose by 0.6% month-over-month in May 2024, surpassing the expected increase of 0.2%. This follows a modest gain of 0.1% in April.

The Australian Bureau of Statistics highlighted that the strong results were primarily driven by cautious shoppers taking advantage of early end-of-financial-year promotions and sales events. They noted that retail businesses are heavily relying on discounts and sales to stimulate discretionary spending, which had been subdued in recent months.

However, the jump above the top of the range came after the release of the US ISM services, which showed that activity fell in contraction in June, dipping to the lowest level since the pandemic times in 2020. markets are getting worried for another dip in the US economy, with several sectors showing weakness, so yesterday’s report had a strong impact.

AUD/USD was trading in a range between the 100 SMA (red0 at the bottom and the 200 SMA (purple) at the top since late April. But, yesterday the break finally came, which we predicted in an update yesterday, as the price was sticking to the top of the range too long recently. Today we had the Goods Trade Balance from Australia, which was expected to show a slowdown in June.