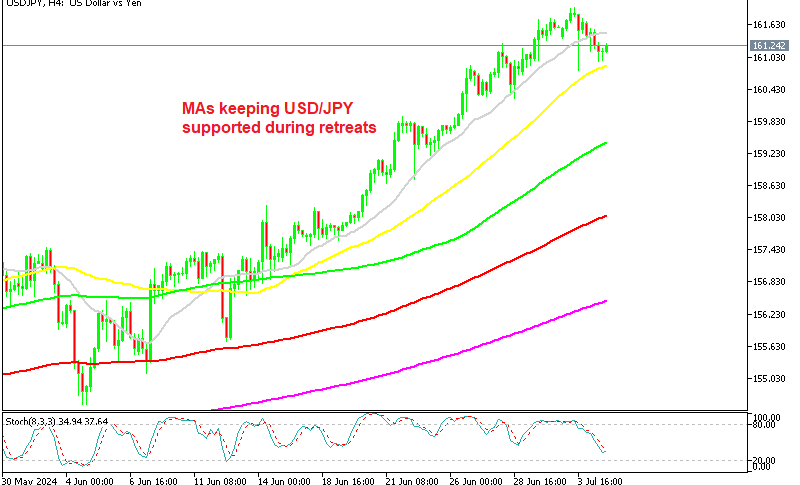

Today the European session was sluggish, with major currencies underperforming, but it kicked off after the US ISM services report and the unemployment claims. USD/JPY remains in the spotlight, continuing its upward movement and edging closer to the 162.00 level. The dollar dived lower after the softer services figures, but it recuperated after the European markets closed.

European and US stock markets rebounded strongly today, following gains on Wall Street yesterday as risk sentiment improved due to softer ISM services, which increase the odds of more rate cuts by the FED. The USD dipped around 60 pips lower after that report, but recuperated half the losses, as both employment reports today showed a stable labour market, calming fears after some soft jobs reports.

The weekly US initial and continuing jobless claims

- This Week:

- Initial Jobless Claims: 238K vs. 235K estimated

- Prior Week: Revised from 233K to 234K

- 4-Week Moving Average of Initial Claims:

- Current: 238.5K

- Previous: 236.25K

- Continuing Jobless Claims:

- Current: 1.858M vs. 1.840M estimated

- Prior Week: Revised from 1.839M to 1.832M

- 4-Week Moving Average of Continuing Claims:

- Current: 1.831M

- Previous: 1.814M

- Highest Level Since: December 4, 2021

The initial jobless claims came in slightly higher than expected, indicating a slight increase in the number of people filing for unemployment benefits for the first time. The 4-week moving average, which smooths out volatility, also rose, reflecting a consistent upward trend.

Continuing jobless claims, representing those still receiving benefits after an initial week of aid, also increased, surpassing estimates. The 4-week moving average for continuing claims reached its highest level since December 2021, suggesting a more prolonged impact on the labor market.

ADP National Employment Data for June 2024

- Headline Figures:

- June Employment: 150K vs. 160K estimated

- Prior Month: Revised from 152K to 157K

- Sector Breakdown:

- Goods-producing Sector: +14K

- Services Sector: +138K

- Company Size:

- Small Firms: +5K

- Medium Firms: +88K

- Large Companies: +58K

- Industry Highlights:

- Leisure and Hospitality: +63K

- Construction: +27K

- Professional and Business Services: +25K

- Trade, Transportation, and Utilities: +15K

- Natural Resources/Mining: -8K

- Wage Growth:

- Job Stayers: 4.9% YoY (previous month: 5.0%)

- Job Changers: 7.7% YoY (previous month: 7.8%)

This data indicates a modest increase in employment, with revisions to previous months showing slightly higher job gains than initially reported. The services sector continues to be the primary driver of job growth, while the goods-producing sector shows a smaller increase. Wage growth for both job stayers and job changers has slightly moderated compared to the previous month.

USD/JPY Live Chart

USD/JPY