After ending the previous session mostly higher, stocks may give back ground in early trading on Wednesday. The major index futures are currently pointing to a slightly lower open for the markets, with the S&P 500 down by 0.1 percent.

Traders may look to cash in on yesterday’s gains, which lifted the Nasdaq and the S&P 500 to new record closing highs. The S&P 500 closed above 5,500 for the first time ever.

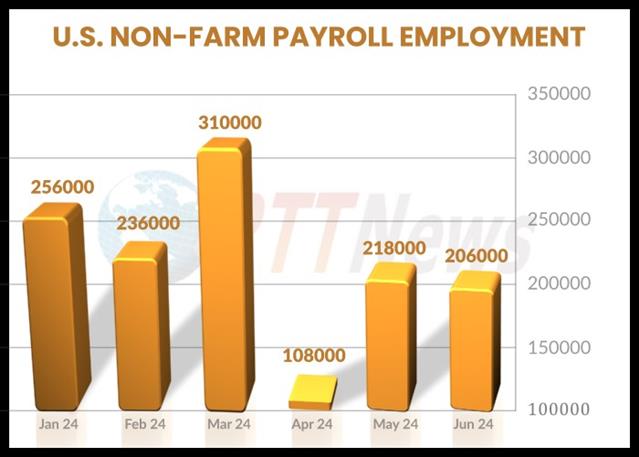

Concerns about the outlook for the economy may also weigh on the markets after payroll processor ADP released a report showing private sector employment in the U.S. increased by slightly less than expected in the month of June.

ADP said private sector employment climbed by 150,000 jobs in June after rising by an upwardly revised 157,000 jobs in May.

Economists had expected private sector employment to increase by 160,000 jobs compared to the addition of 152,000 jobs originally reported for the previous month.

“Job growth has been solid, but not broad-based,” said ADP chief economist Nela Richardson. “Had it not been for a rebound in hiring in leisure and hospitality, June would have been a downbeat month.”

With the more closely watched monthly jobs report looming, the Labor Department also released a report showing a modest increase by first-time claims for U.S. unemployment benefits in the week ended June 29th.

The report said initial jobless claims rose to 238,000, an increase of 4,000 from the previous week’s revised level of 234,000.

Economists had expected jobless claims to inch up to 235,000 from the 233,000 originally reported for the previous week.

Not long after the start of trading, the Institute for Supply Management is scheduled to release its report on service sector activity in the month of June.

The ISM’s services PMI is expected to slip to 52.5 in June from 53.8 in May, but a reading above 50 would still indicate growth.

The Commerce Department is also due to release its report on factory orders in the month of May. Factory orders are expected to rise by 0.2 percent in May after climbing by 0.7 percent in April.

After struggling for direction until a little past noon on Tuesday, stocks began climbing higher and continued to gain in strength to eventually end the day’s session a firm note.

Concerns about the outlook for interest rates rendered the mood cautious early on in the session, with investors digesting Federal Reserve Chair Jerome Powell’s remarks at the ECB Forum and the JOLTS report that showed a slight increase in job openings in the country.

Stocks moved higher after bond yields drifted down. The major averages all ended on a firm note, with the Nasdaq outperforming the Dow and S&P 500.

The Dow ended with a gain of 162.33 points or 0.4 percent at 39,331.85. The S&P 500 settled at 5,509.01, gaining 33.92 points or 0.6 percent, while the Nasdaq advanced 149.46 points or 0.8 percent, to 18,028.76.

In overseas trading, stock markets across the Asia-Pacific region moved mostly higher during trading on Wednesday. Japan’s Nikkei 225 Index surged by 1.3 percent, while Hong Kong’s Hang Seng Index jumped by 1.2 percent.

The major European markets have also moved to the upside on the day. While the French CAC 40 Index has shot up by 1.3 percent, the German DAX Index is up by 0.8 percent and the U.K.’s FTSE 100 Index is up by 0.4 percent.

In commodities trading, crude oil futures are inching up $0.16 to $82.97 a barrel after falling $0.57 to $82.81 a barrel on Tuesday. Meanwhile, an ounce of gold is trading at $2,362.80, up $29.40 compared to the previous session’s close of $2,333.40. On Tuesday, gold slipped $5.50.

On the currency front, the U.S. dollar is trading at 161.80 yen compared to the 161.44 yen it fetched at the close of New York trading on Tuesday. Against the euro, the dollar is trading at $1.0774 compared to yesterday’s $1.0745.