eur-gbp

EURGBP Resumes Decline After Touching 0.85 and Filling the Gap

Skerdian Meta•Wednesday, July 3, 2024•2 min read

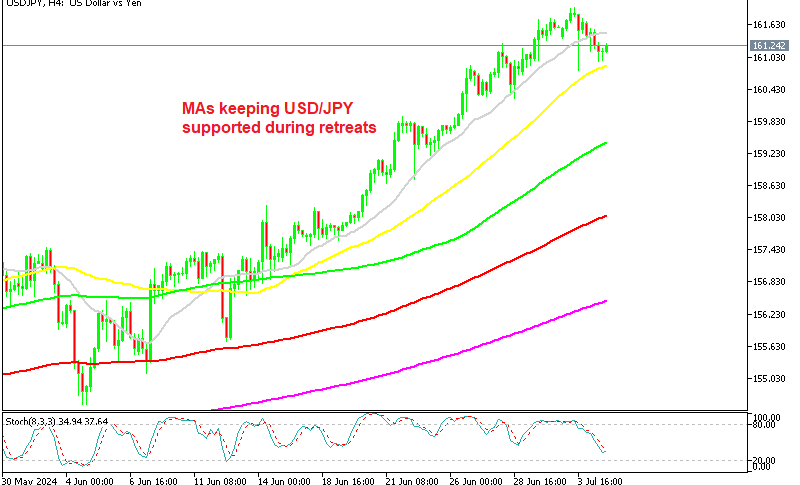

EURGBP was retracing higher in the last 2 weeks, climbing more than 1 cent and filling the bearish gap, but it has made a bearish reversal this week, indicating strong selling pressure just below 0.85. The ECB is much more dovish than the BOE, already having cut interest rates and thinking for more monetary easing, which should keep the pressure to the downside for this pair.

EUR/GBP Chart Daily – The 20 SMA Has Turned into Resistance Now

The GBP/EUR rate has been range-bound over the past year, but recently, EUR/GBP breached the crucial 0.85 support level due to a 30-pip downward gap sparked by political developments in Europe following the European Elections earlier this month. The price briefly dipped below 0.84, reaching as low as 0.8397 on June 14, aligning with the post-election volatility.

Since then, EUR/GBP has retraced some of its losses, closing the price gap on the charts. This suggests that the correction may be nearing completion. However, the currency pair is currently consolidating between two moving averages, indicating ongoing indecision in the market.

Eurozone June Final Services PMI

- Final Services PMI: 52.8 vs 52.6 prelim

- Prior: 53.2

- Final Composite PMI: 50.9 vs 50.8 prelim

- Prior: 52.2

Germany Final Services PMI

- Services PMI: 53.1 vs 53.5 prelim and 54.2 prior

- Final Composite PMI: 50.4 vs 50.6 prelim and 52.4 prior

Key Findings:

- HCOB Germany Services PMI Business Activity Index at 53.1 (May: 54.2). 3-month low.

- HCOB Germany Composite PMI Output Index at 50.4 (May: 52.4). 3-month low.

- Cost inflation lowest since March 2021.

France June Final Services PMI

- Final Services PMI: 49.6 vs 48.8 prelim

- Prior: 49.3

- Composite PMI: 48.8 vs 48.2 prelim

- Prior: 48.9

Italy Services PMI

- Services PMI: 53.7 vs 53.7 expected and 54.2 prior

- Composite PMI: 51.3 vs 52.3 prior

Key Findings:

- Growth of activity and new business ease, but remain solid overall.

- Cost pressures abate slightly.

- Strongest optimism towards the year-ahead outlook since early 2022.

The Eurozone’s final services PMI for June slightly surpassed preliminary figures but still showed a decline from the previous month. Germany’s services and composite PMIs hit three-month lows, highlighting slowing growth and reduced cost inflation since March 2021. France’s services sector remains in contraction, though slightly improved from the preliminary reading. Italy’s services sector continues to expand but at a slower pace than previously expected. Despite easing cost pressures, there is notable optimism in Italy regarding the year-ahead outlook, the highest since early 2022.

EUR/GBP Live Chart

EUR/GBP

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

12 hours ago

Save

Save

17 hours ago

Save

Save

19 hours ago

Save

Save