aud-usd

AUDUSD Set for Bullish Break, Knocking on the Top Too Often

Skerdian Meta•Wednesday, July 3, 2024•1 min read

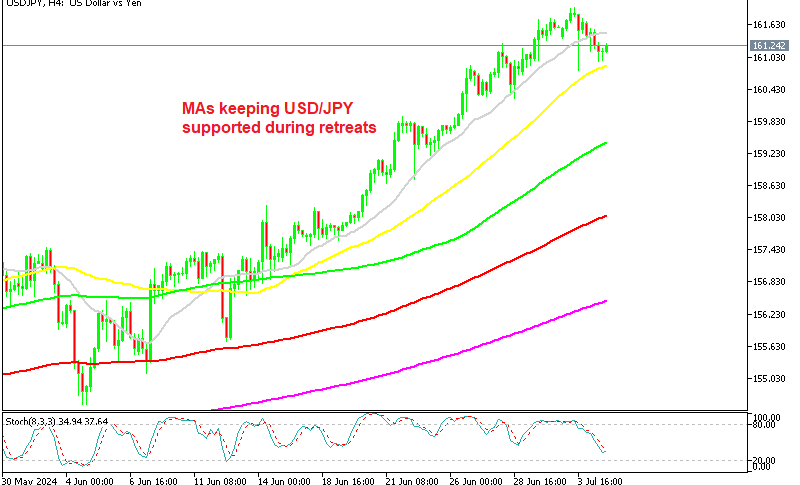

The USD to AUD rate continues to remain confined between MAs, but recently buyers have been pushing AUD/USD to the top of the range, which signals a possible break higher soon. This pair has been stuck in a 1-cent range for more than two months, but we might get a bullish break soon, as the RBA continues to maintain the hawkish bias, while markets expect the FED to deliver 2 rate cuts this year.

The Australian dollar gained momentum last week as the monthly CPI data showed solid growth, boosting the prospect of a rate hike. While a rate increase is uncertain, the positive data is still favorable for the AUD. The Fed’s anticipated easing, in contrast to the RBA’s expected prolonged restrictive stance, may strengthen the AUD/USD in the coming months. However, concerns about the Chinese economy’s slowdown could impede a sustained rebound of the Australian dollar, as China continues to face post-pandemic challenges.

AUD/USD Chart Daily – Sticking to the Top of the Range Lately

The RBA recently released the minutes of its latest hawkish hold, highlighting uncertainty over consumption data and significant evidence of financial hardship among many Australians. This set the stage for today’s release of May Retail Sales in Australia, which could either bolster or weaken the case for a rate hike.

Australia June Retail Sales Report

Australia Retail Sales Data for May 2024

- Retail Sales: +0.6% m/m vs. +0.2% expected

- April Retail Sales: +0.1% m/m

Comments from the Australian Bureau of Statistics:

- Boost from Promotions:

- “Retail turnover was lifted this month by watchful shoppers capitalizing on early end-of-financial-year promotions and sales events.”

- Reliance on Discounts:

AUD/USD Live Chart

AUD/USD

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

5 hours ago

Save

Save

10 hours ago

Save

Save

11 hours ago

Save

Save