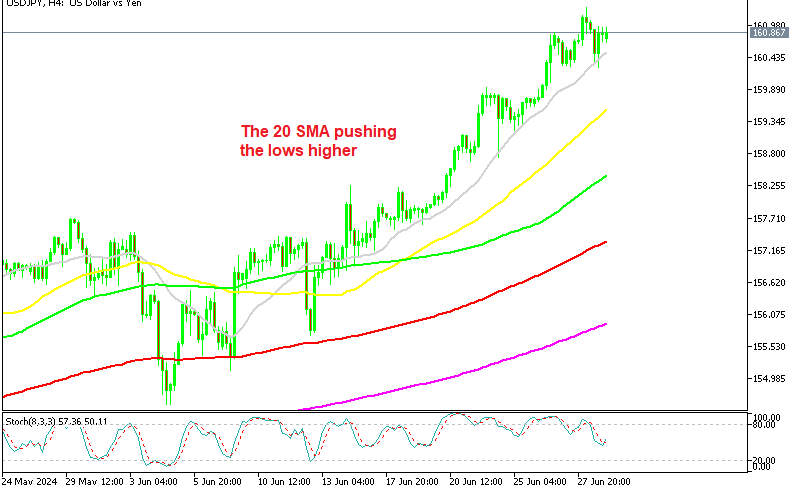

usd-jpy

USDJPY Remains Above 160 After Tokyo Core CPI Inflation

Skerdian Meta•Friday, June 28, 2024•2 min read

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments